What Is A Payroll Tax Holiday

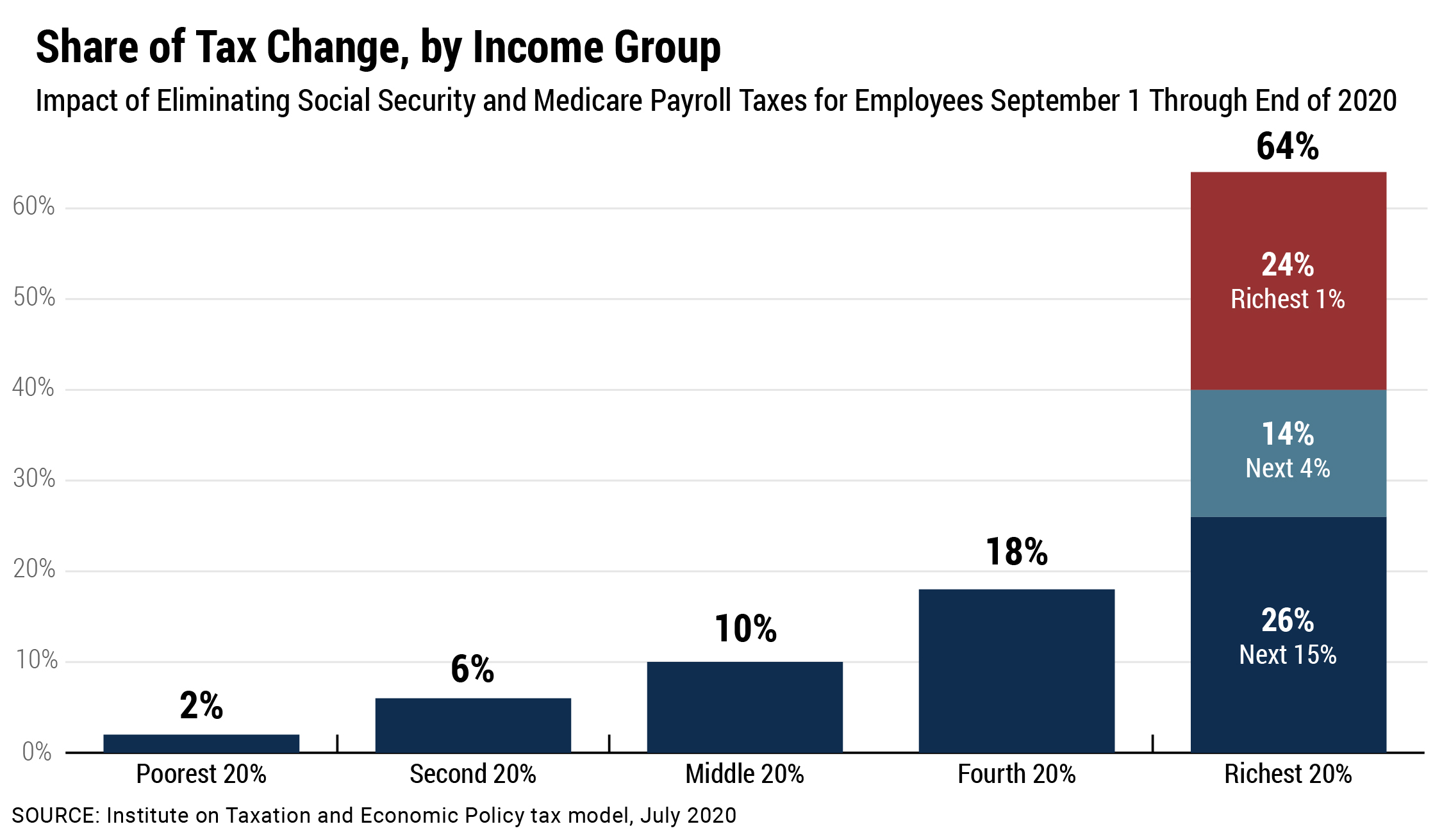

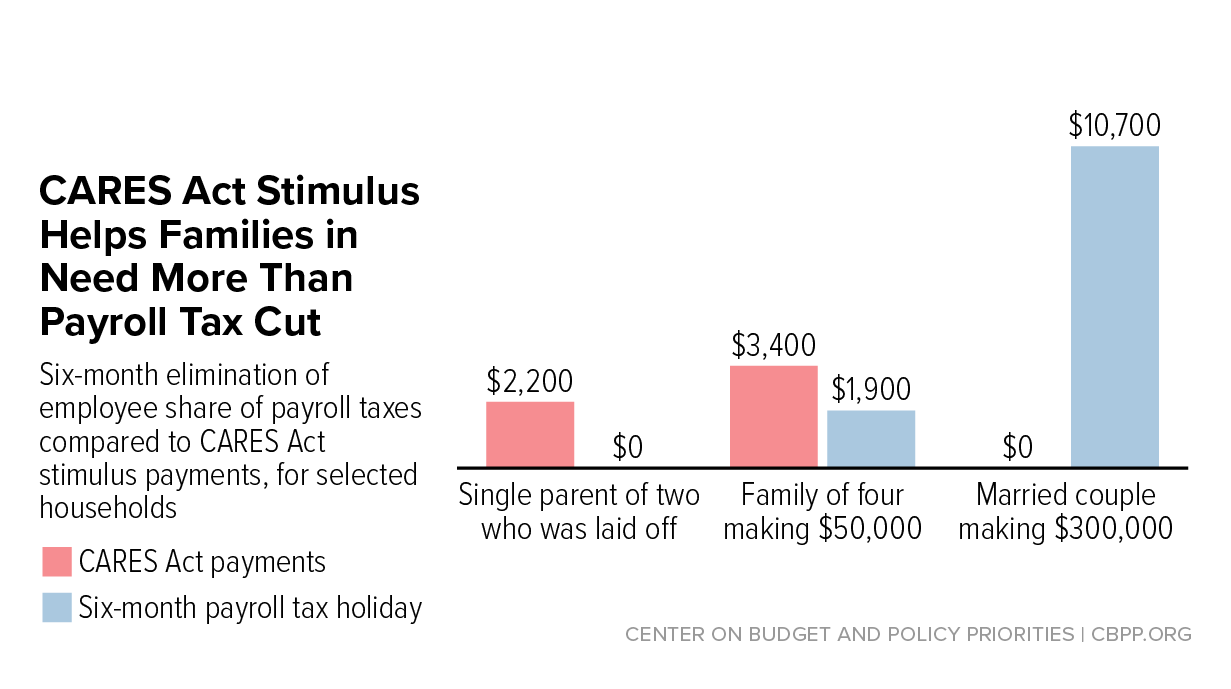

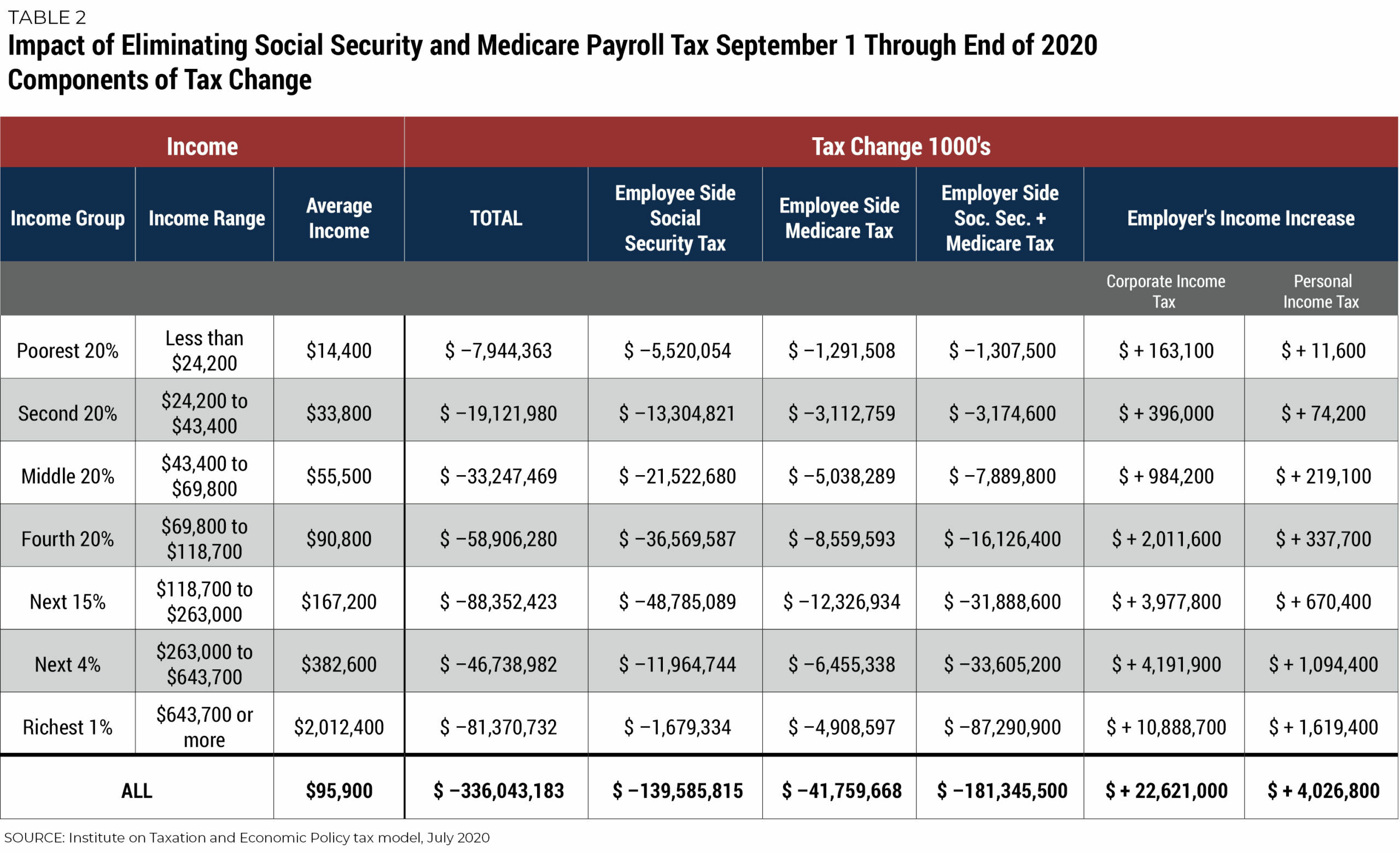

A holiday essentially a temporary tax cut generally benefits lower.

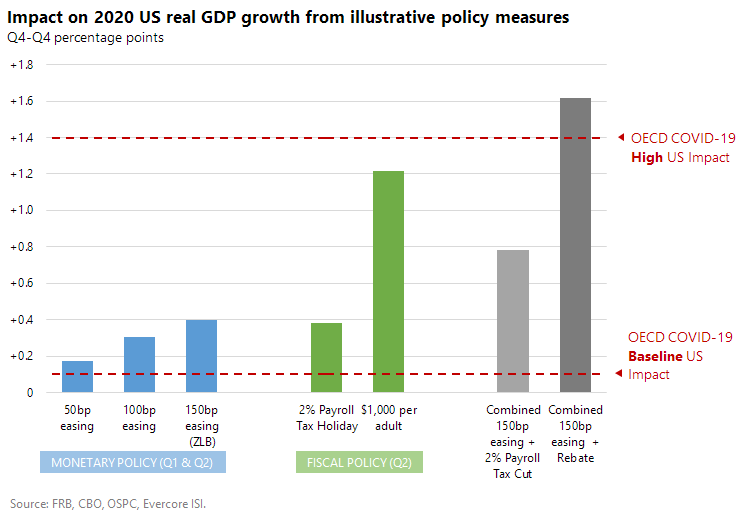

What is a payroll tax holiday. Continue reading below the president has proposed slashing the payroll. A tax holiday can encourage economic activity and foster growth. Employer contributions are not reduced.

A payroll tax holiday is not a new idea. A payroll tax holiday would be misguided now as it would have been last year. A taxpayer who earns 50 000 will realize a savings of 1 000 2 of 50 000.

Social security payroll taxes paid by employees were temporarily cut by 2 percentage points for calendar years 2011 and 2012. In the u s the temporary reduction of payroll taxes extended to all working taxpayers under the tax relief act of 2010. The payroll tax holiday is a bold move and this has always been a bold president kudlow said adding that the money lost from temporarily eliminating the tax will be made up with much.

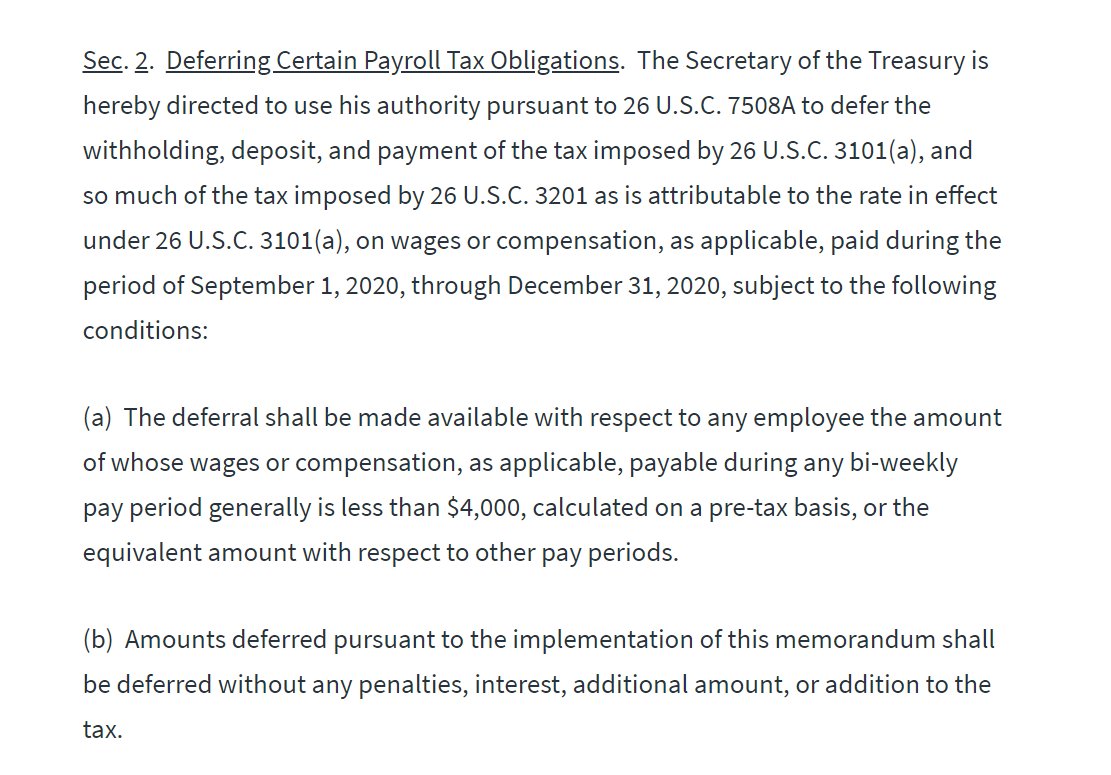

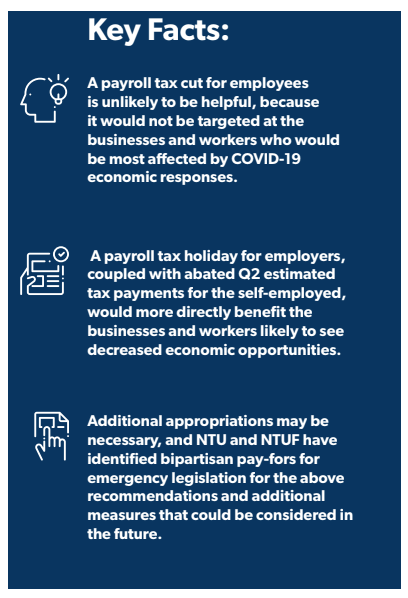

Tax holidays are instituted by local. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. There is still considerable disagreement in the empirical literature over the effectiveness of a payroll tax holiday.

As former council of economic advisers chairman jason furman and my colleague kyle pomerleau have observed a payroll. One policy measure that s repeatedly appeared on president trump s coronavirus stimulus wish list is a payroll tax holiday. A tax holiday is a governmental incentive that reduces or eliminates taxes on businesses.