What Is Payroll Tax Cut For Employees

Deductions from an employee s wages and taxes paid by the employer based on the employee s wages.

What is payroll tax cut for employees. The question is is it the right time to do that gleckman said given the health risks the coronavirus poses. Payroll taxes are taxes imposed on employers or employees and are usually calculated as a percentage of the salaries that employers pay their staff. That s because this economic slowdown is being driven by a fear of a disease rather than a.

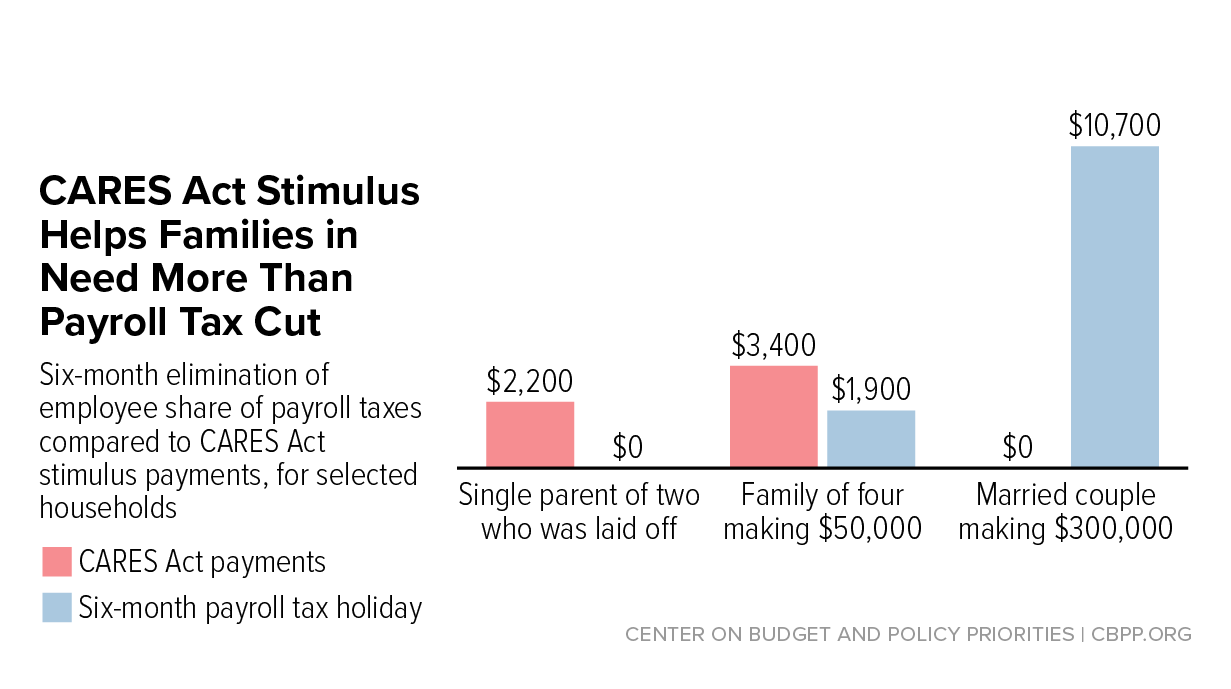

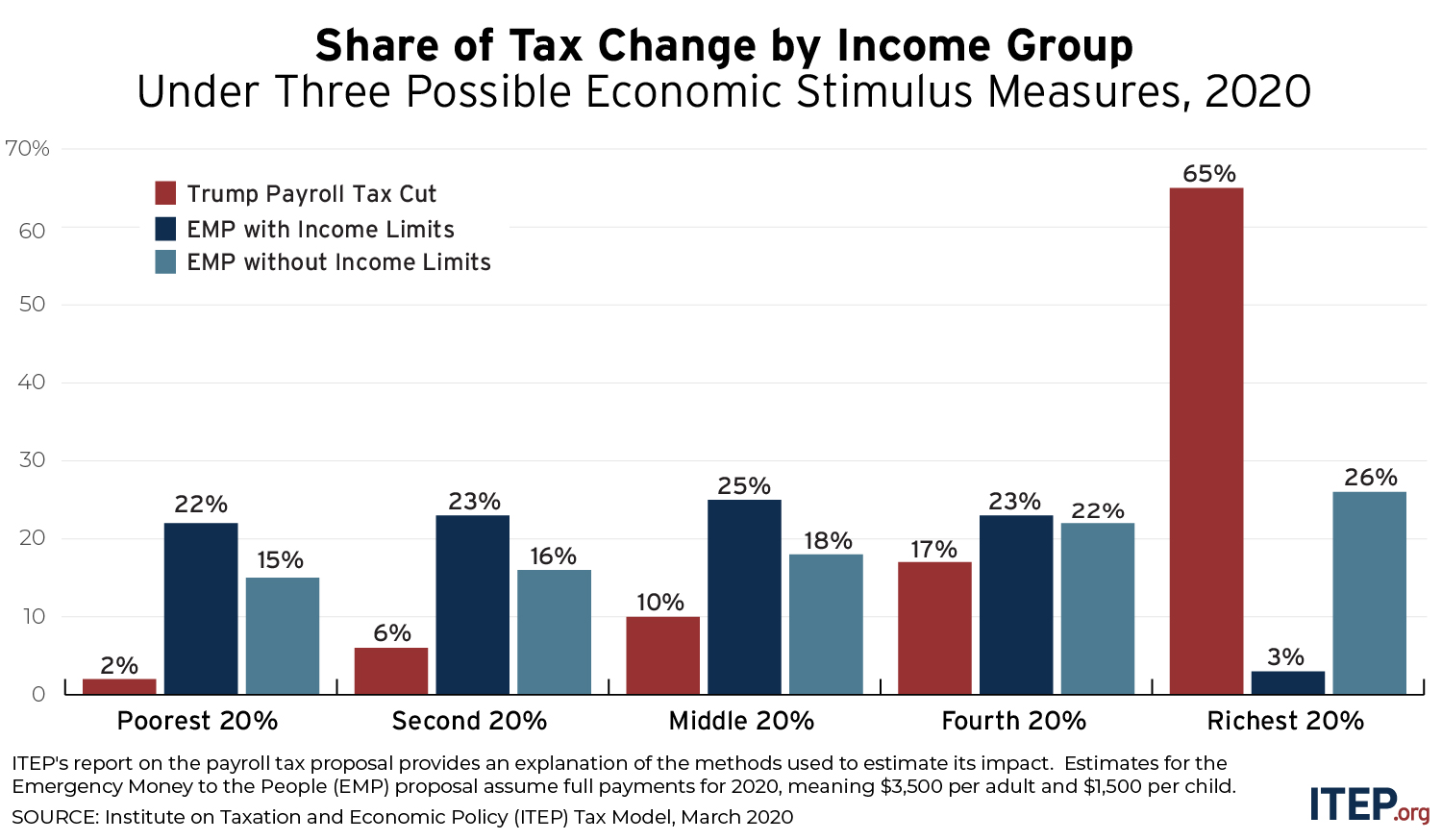

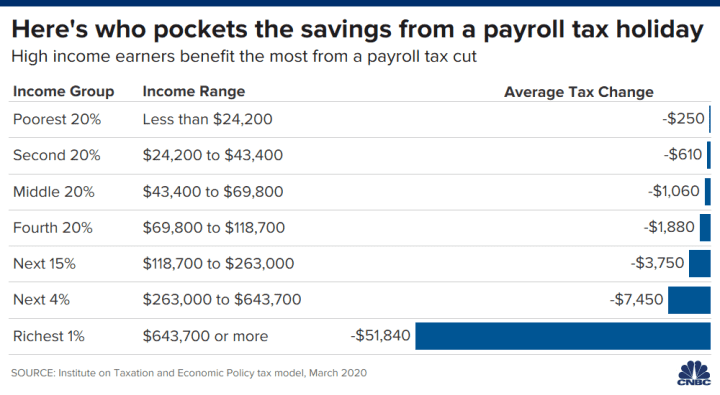

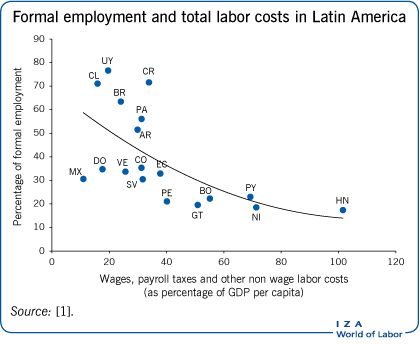

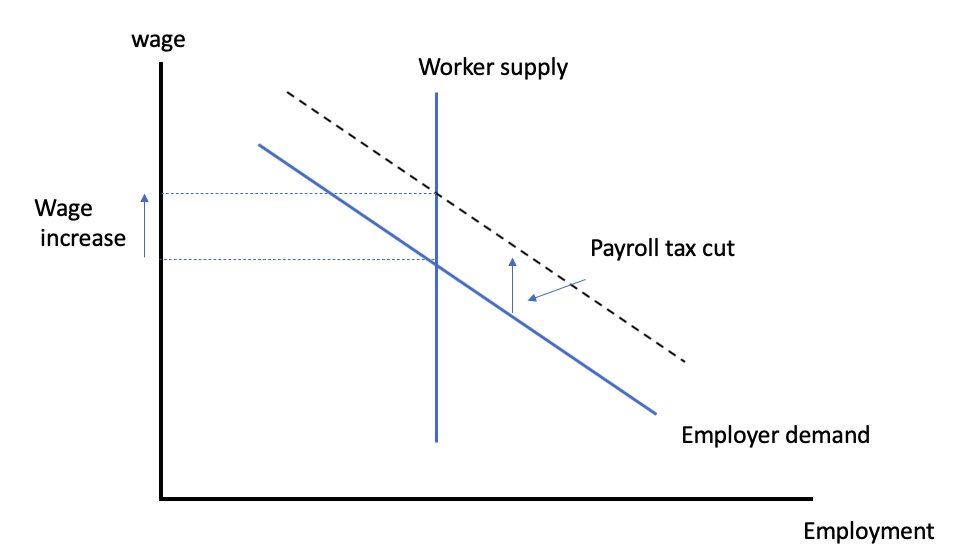

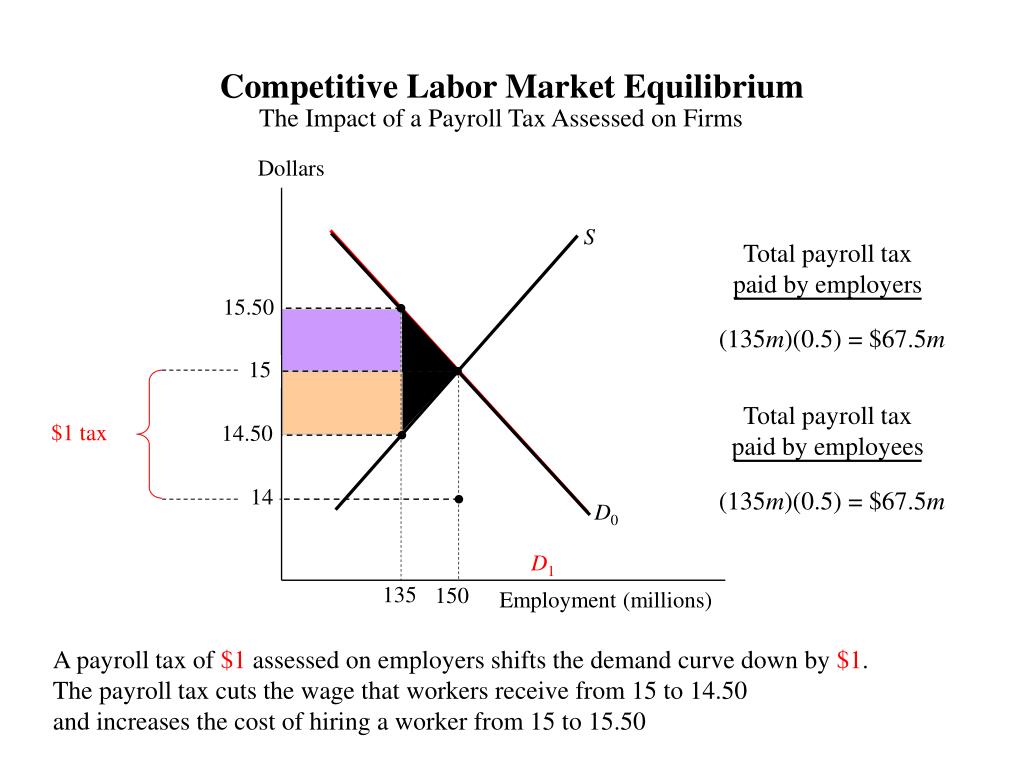

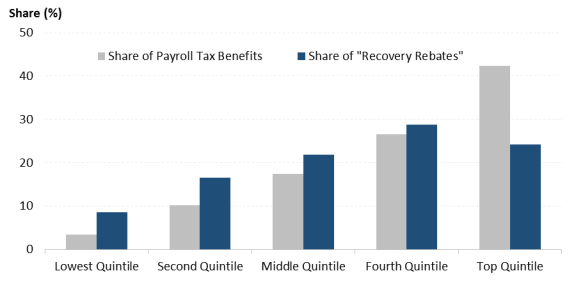

A payroll tax cut would mostly help people who are working and even more so the largest successful companies that have done fine before the pandemic and are still doing fine today. Today s payroll tax rate is 15 3 with 12 4 of that going to fund social security and 2 9 to fund medicare. Payroll tax cuts would also provide an incentive for employees to go back to work.

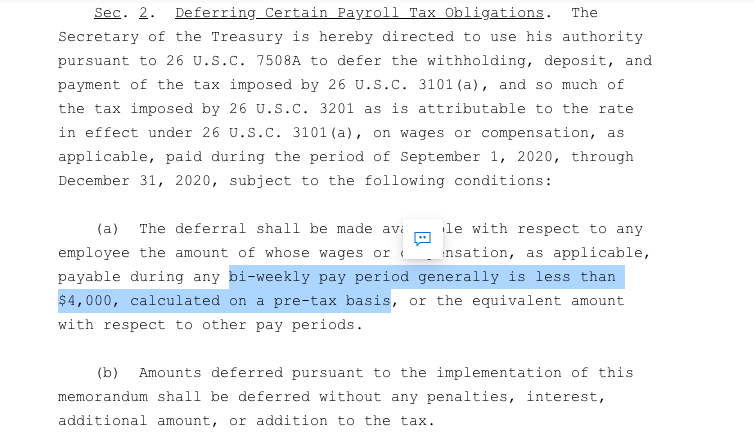

A payroll tax cut if enacted for both employees and employers could give workers more money to spend and businesses more cash as they face a decline in consumer spending through the crisis. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. President trump is hoping to include a payroll tax cut for employees as part of a phase 4 stimulus relief package amid the coronavirus crisis as the trump administration remains confident that a.

It s not clear if trump is pressing for a 100 payroll tax cut i e no tax is taken out of your paycheck or only a partial cut. Instead of paying in at 6 2 for social security taxes up to the cap which was at the time 106 800. Assuming it s a 100 cut then someone making 15 per hour and.

A payroll tax cut might not have the desired effect of inspiring consumers to spend more gleckman said.

/cloudfront-us-east-1.images.arcpublishing.com/tronc/6WLZLK7V3RGP7HPOETCBHRJUHY.jpg)