What Is Payroll Tax Cut Mean

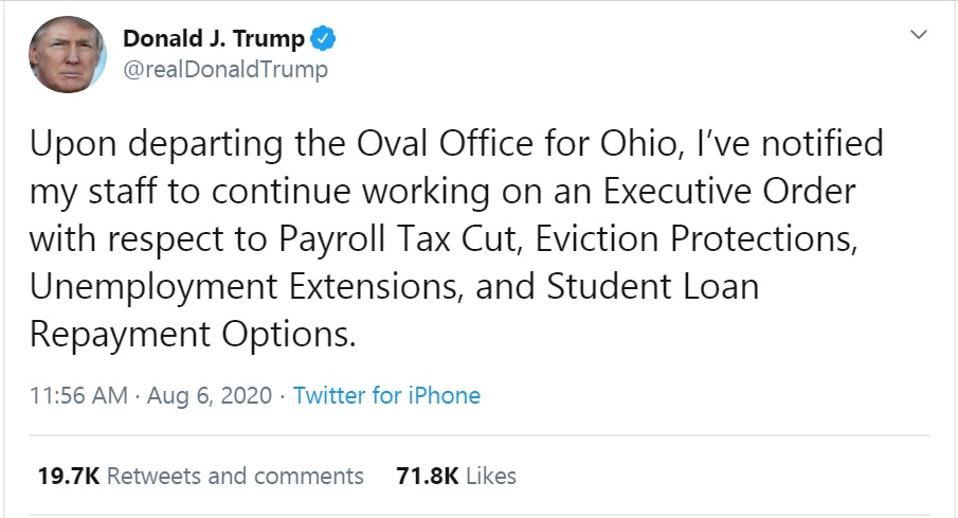

Trump hints at payroll tax cuts to mitigate coronavirus effects.

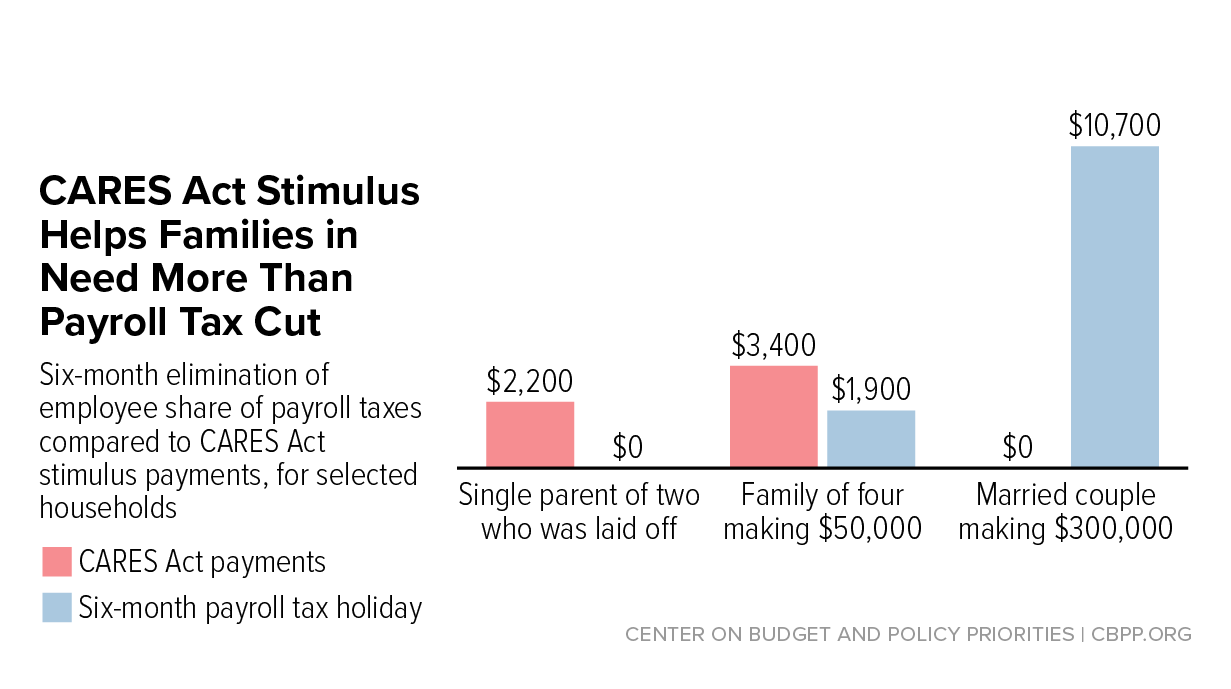

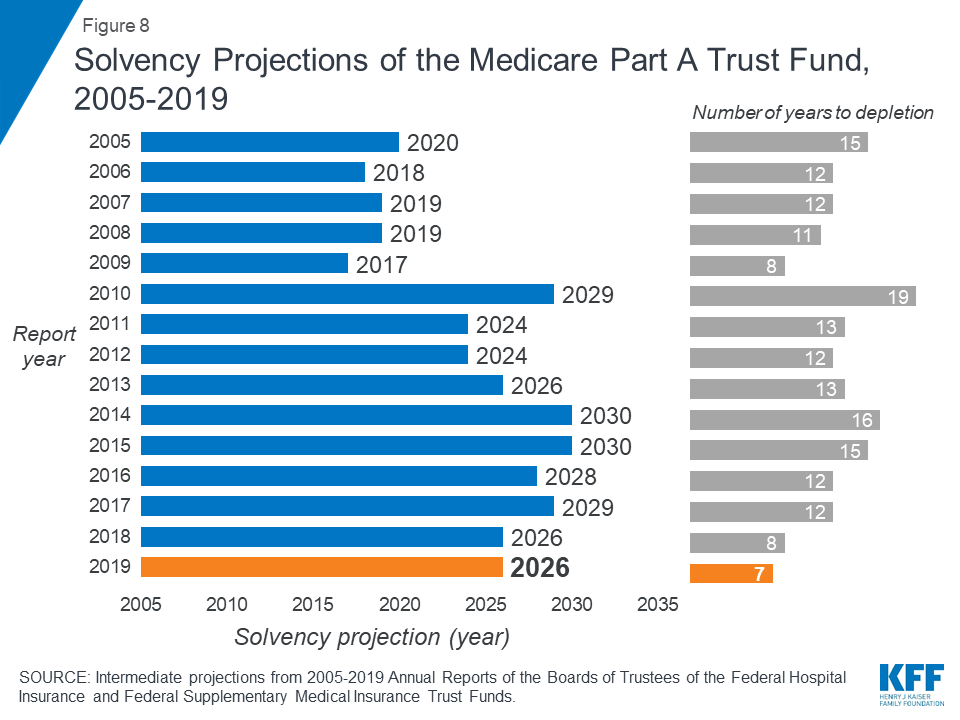

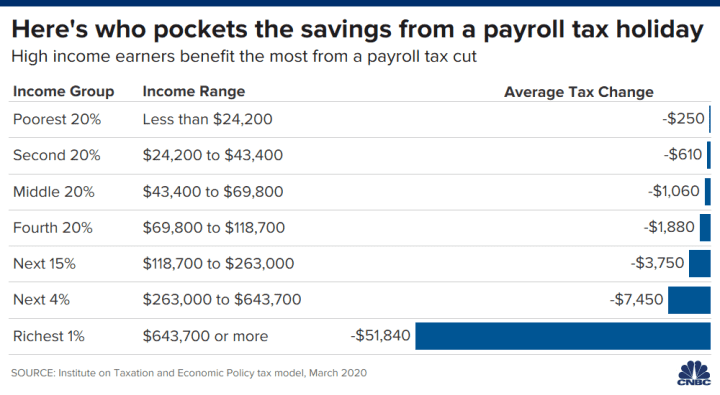

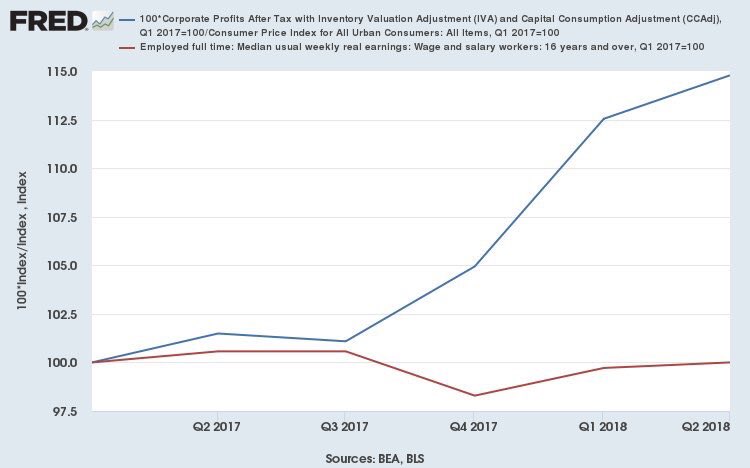

What is payroll tax cut mean. Most full time wage and salary workers would save in the neighborhood of 908 or about a week s wages. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. A payroll tax cut would mostly help people who are working and even more so the largest successful companies that have done fine before the pandemic and are still doing fine today.

Published wed aug 21 2019 1 22 pm edt updated tue mar 10 2020 5 07 pm edt. Trump has not specified how large a payroll tax cut would be. It s not clear if trump is pressing for a 100 payroll tax cut i e no tax is taken out of your paycheck or only a partial cut.

When tax laws change your payroll taxes could change. A similar payroll tax cut in 2019 could save top wage earners up to 2 658. Assuming it s a 100 cut then someone making 15 per hour and.

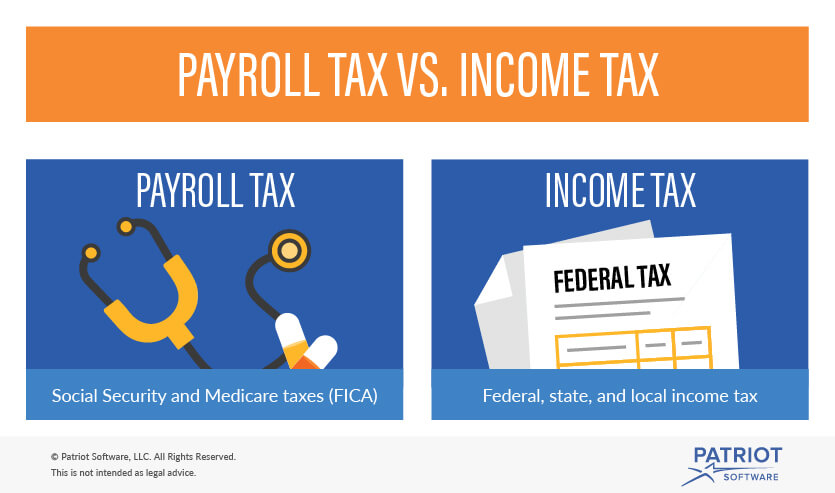

What a tax cut would mean trump has not elaborated on how large a payroll tax cut would be. If trump were to pass a payroll tax cut he would not be the first president to do so. Currently all employees and employers pay a 6 2 percent payroll tax on wages capped out at 137 700.

In 2011 and 2012 former president barack obama reduced the taxes paid by employees to 4 2 percent from 6 2. If you get an income tax cut or an income tax increase or if your personal tax situation changes you may need your employer to withhold a. A payroll tax cut might not have the desired effect of inspiring consumers to spend more gleckman said.

/posttv-thumbnails-prod.s3.amazonaws.com/03-06-2020/t_90fb0700157d4ddb94e953abe4f8ca4c_name_2ddb7286_5fdf_11ea_ac50_18701e14e06d_scaled.jpg)

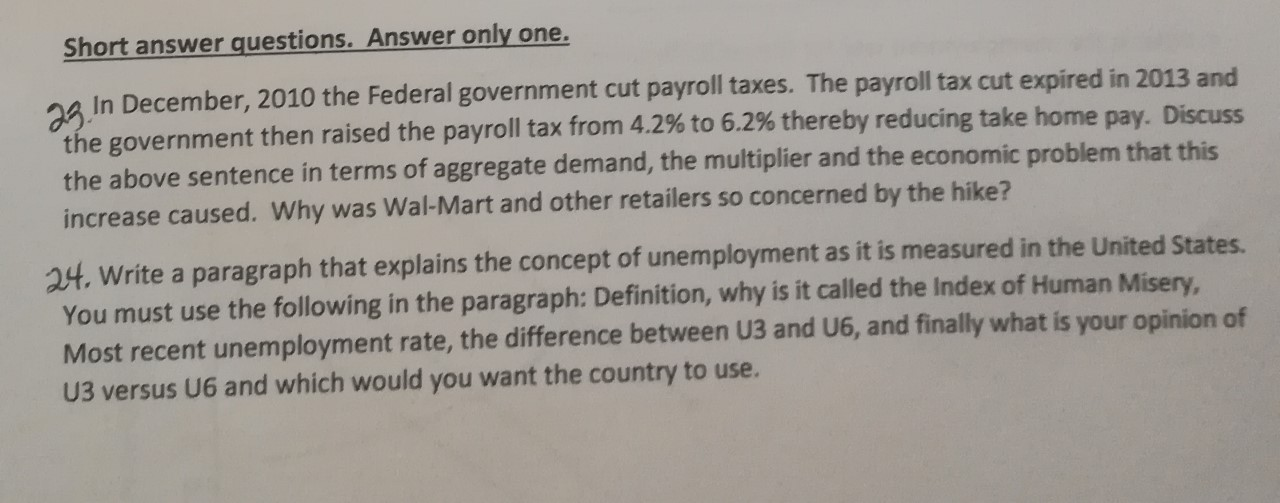

/cloudfront-us-east-1.images.arcpublishing.com/tronc/6WLZLK7V3RGP7HPOETCBHRJUHY.jpg)