What Is Payroll Tax Cut

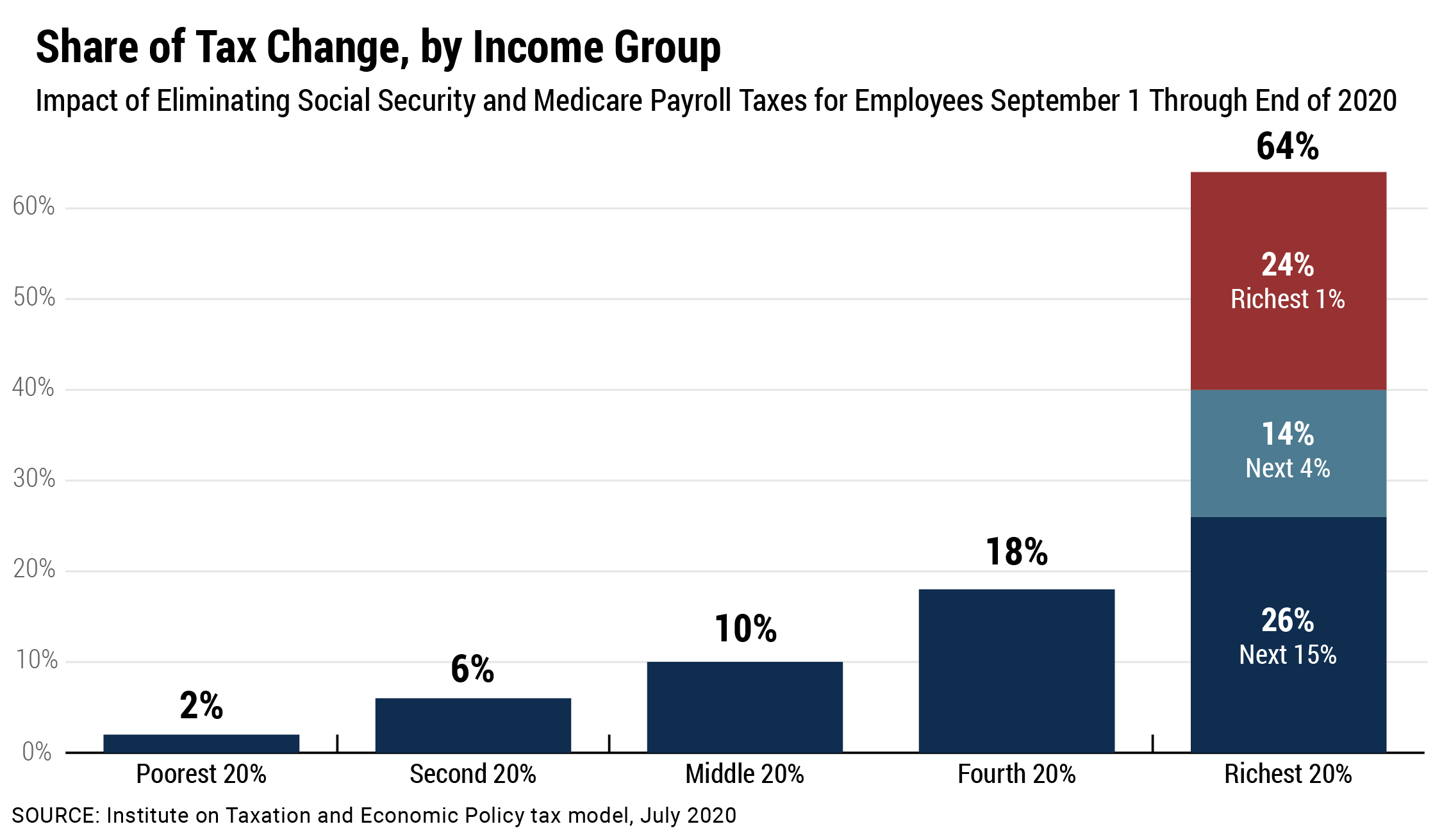

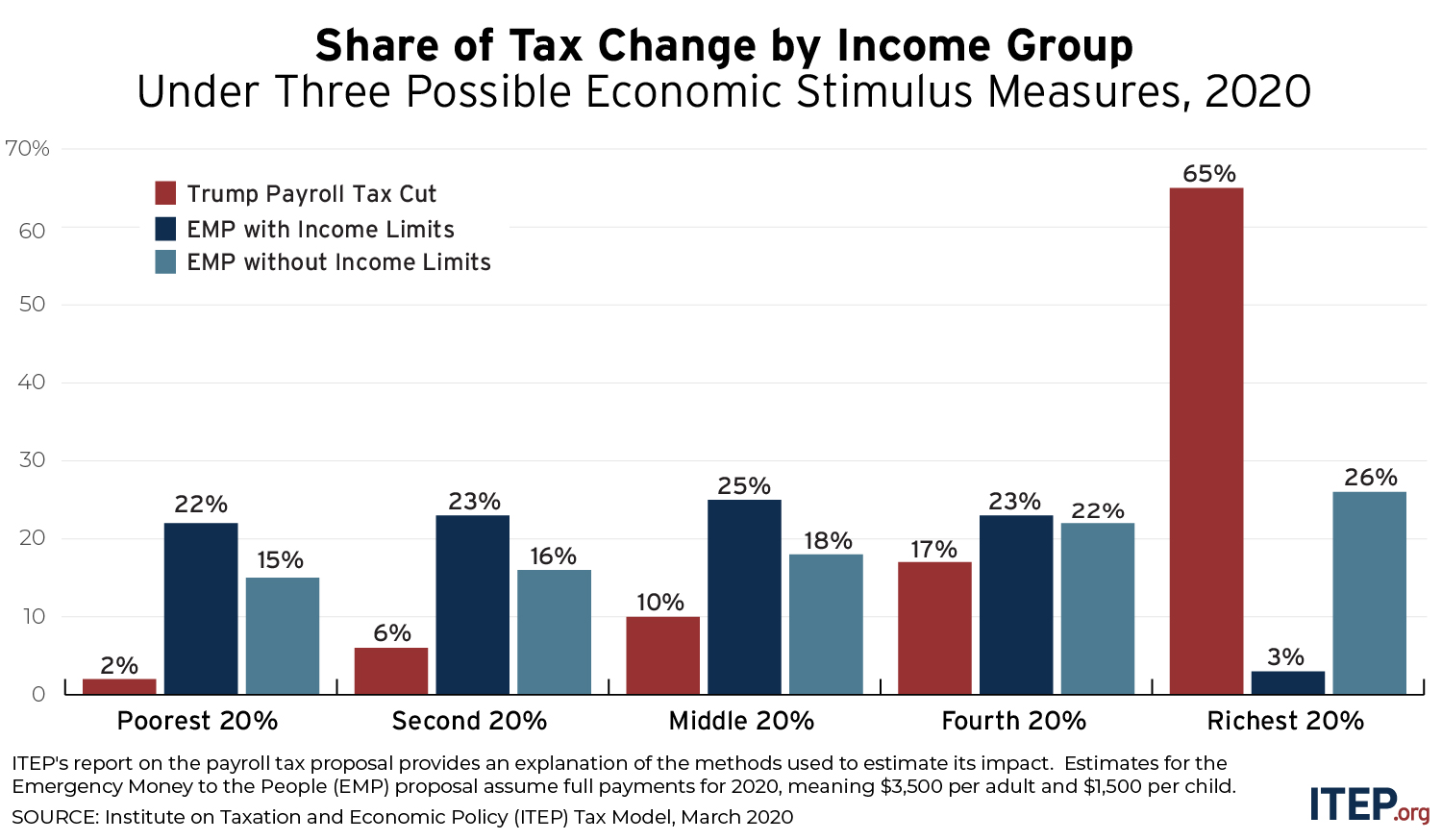

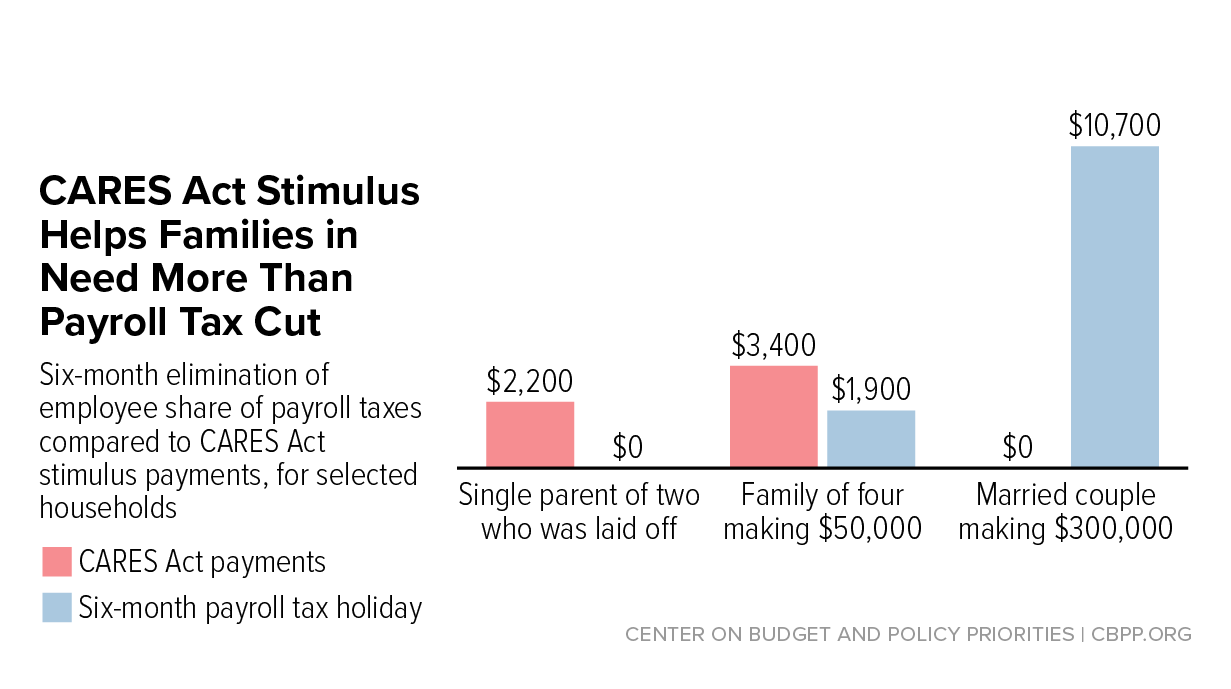

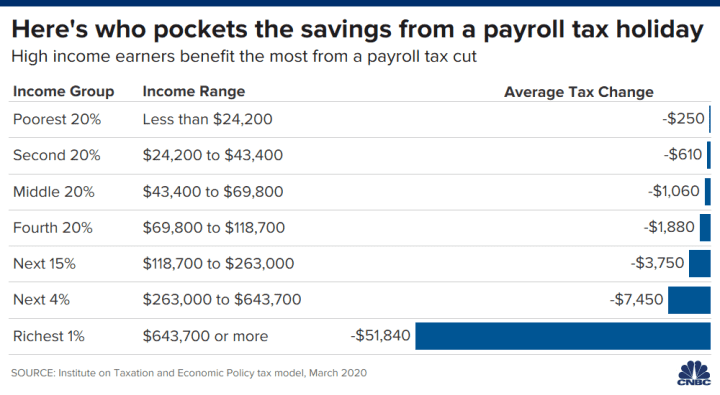

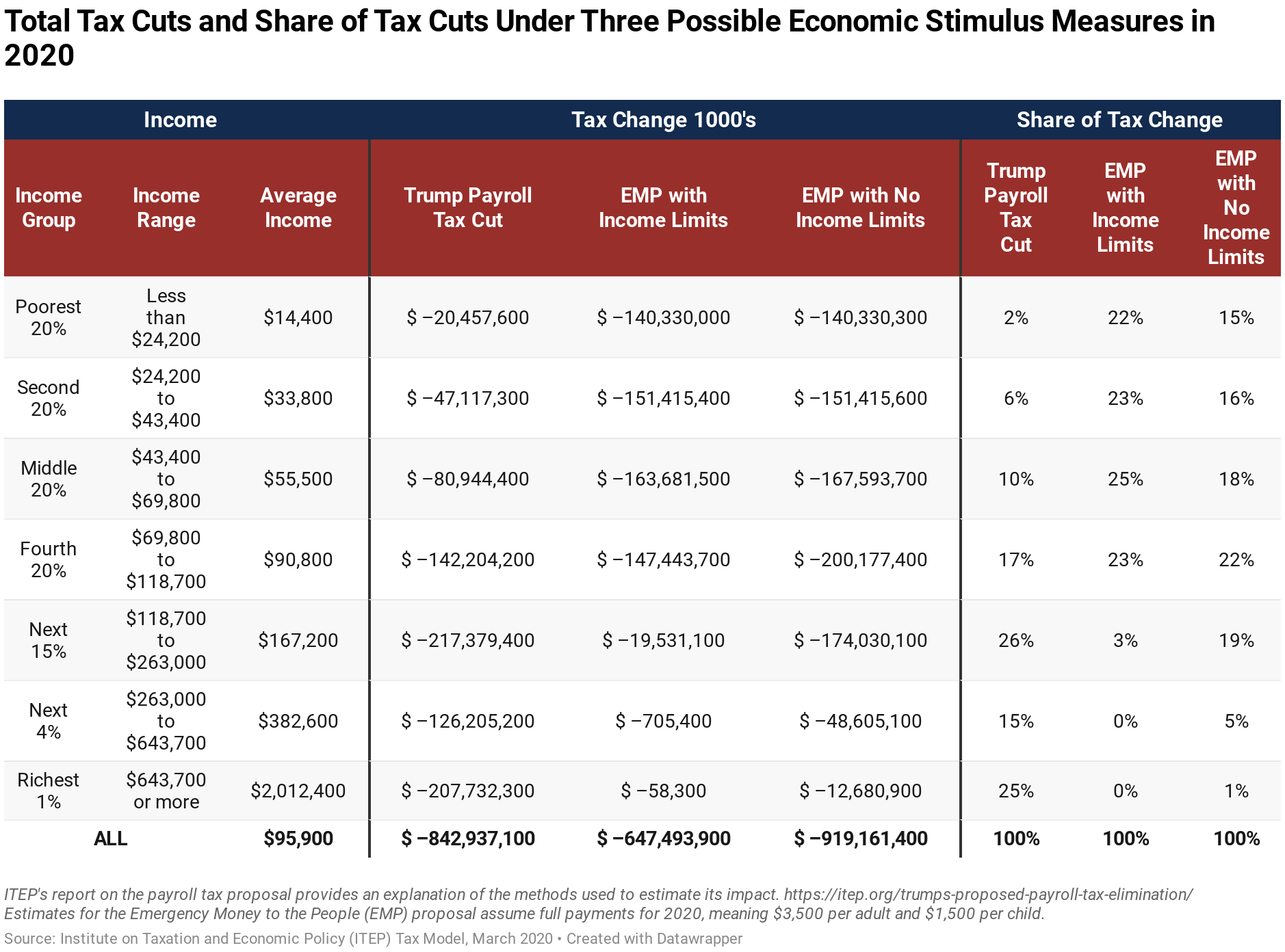

A payroll tax cut would mostly help people who are working and even more so the largest successful companies that have done fine before the pandemic and are still doing fine today.

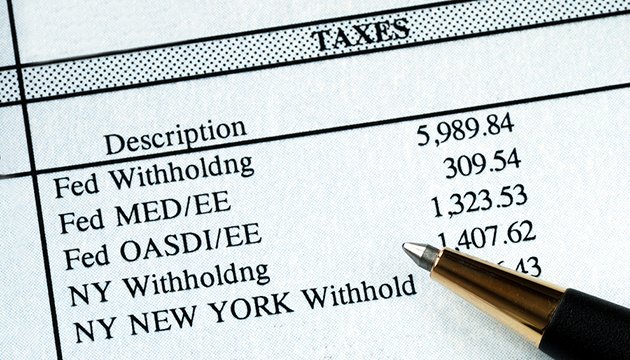

What is payroll tax cut. Deductions from an employee s wages and taxes paid by the employer based on the employee s wages. Experts say such a move would not necessarily be a magic. Payroll taxes generally fall into two categories.

A payroll tax cut if enacted for both employees and employers could give workers more money to spend and businesses more cash as they face a decline in consumer spending through the crisis. Traditionally democrats have favored payroll tax cuts because these cuts provide a direct tax cut that benefits workers over investors since payroll taxes are only paid on income from work and. If he were to make such a move he would not be the first.

Payroll taxes are taxes imposed on employers or employees and are usually calculated as a percentage of the salaries that employers pay their staff. If trump were to pass a payroll tax cut he would not be the first president to do so. It s not clear if trump is pressing for a 100 payroll tax cut i e no tax is taken out of your paycheck or only a partial cut.

Former president barack obama previously reduced the taxes paid by. Assuming it s a 100 cut then someone making 15 per hour and. Trump has not elaborated on how large a payroll tax cut would be.

/cloudfront-us-east-1.images.arcpublishing.com/tronc/6WLZLK7V3RGP7HPOETCBHRJUHY.jpg)