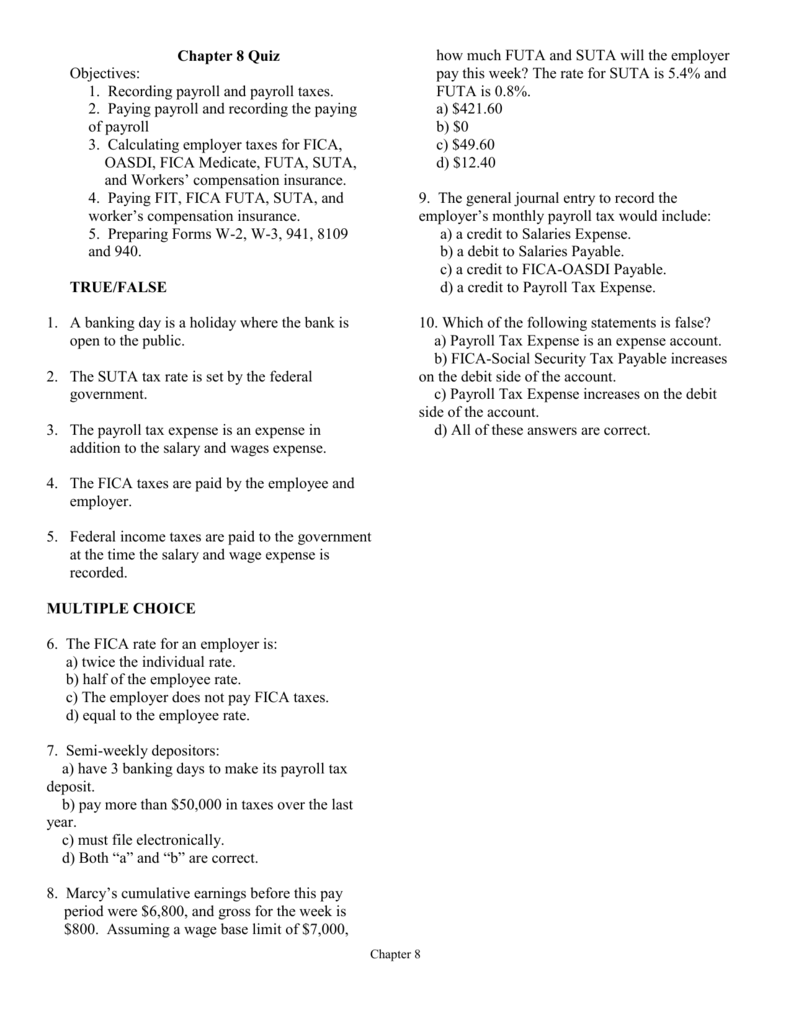

What Is Payroll Tax Expense

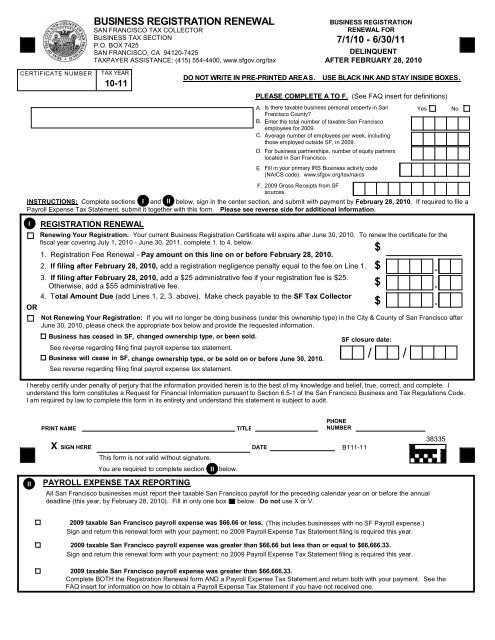

The term payroll expense is defined in section 902 1 of the business and tax regulations code and generally includes but not limited to the compensation paid to on behalf of or for the benefit of an individual including shareholders of a professional corporation or a limited liability company llc including.

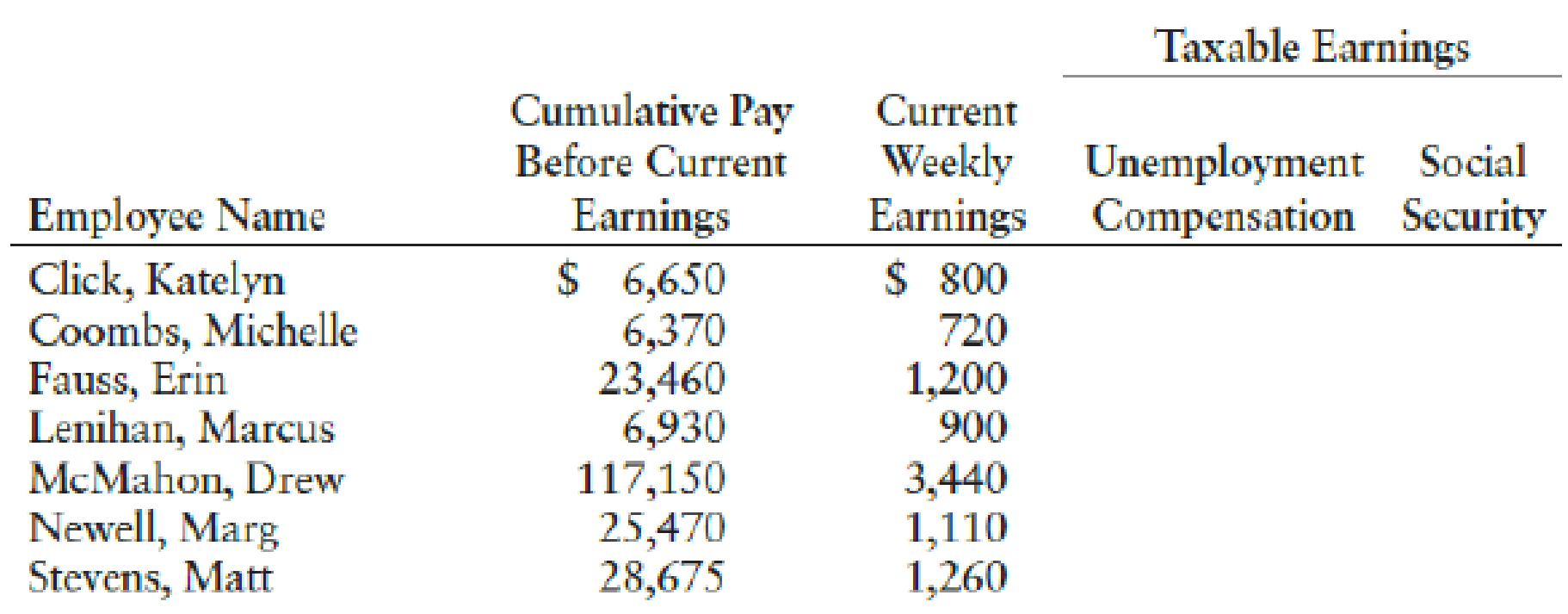

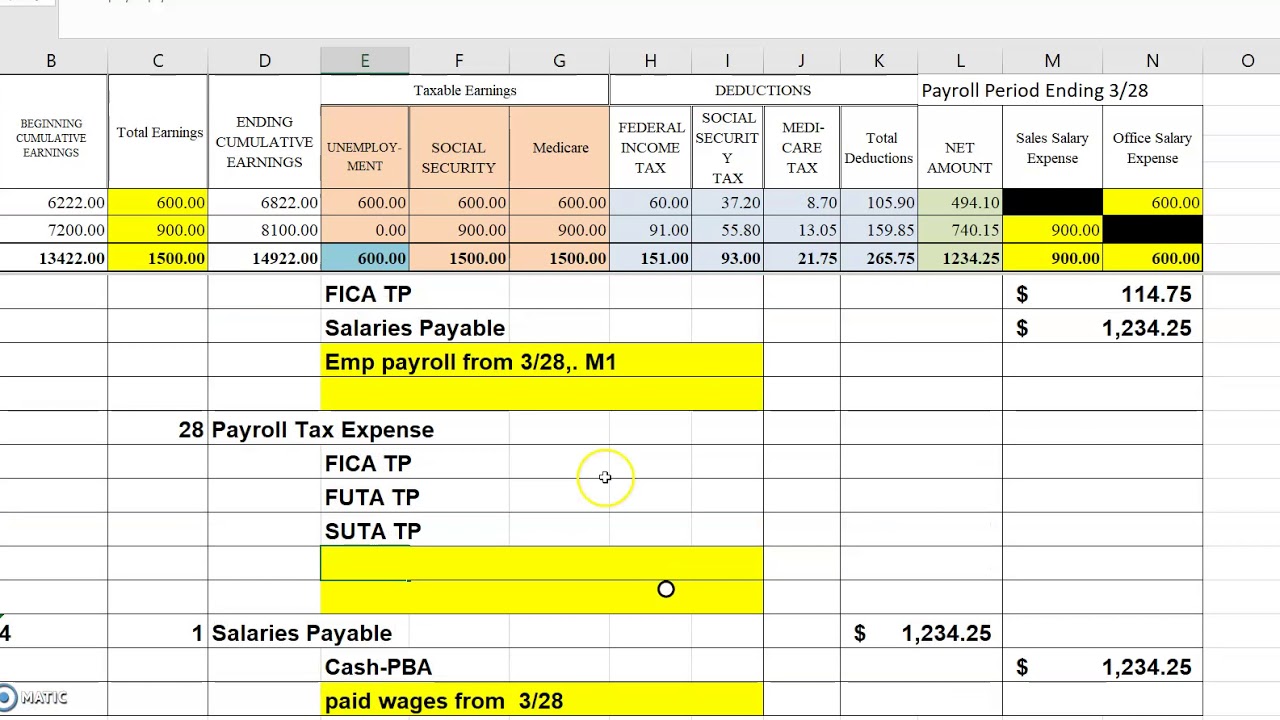

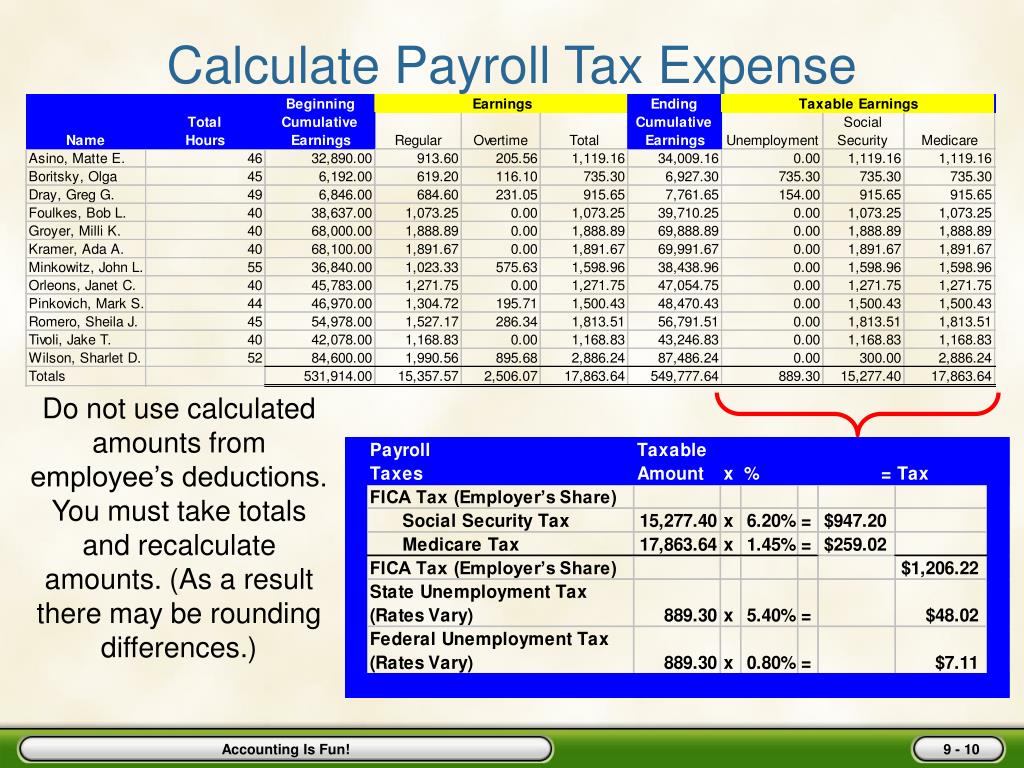

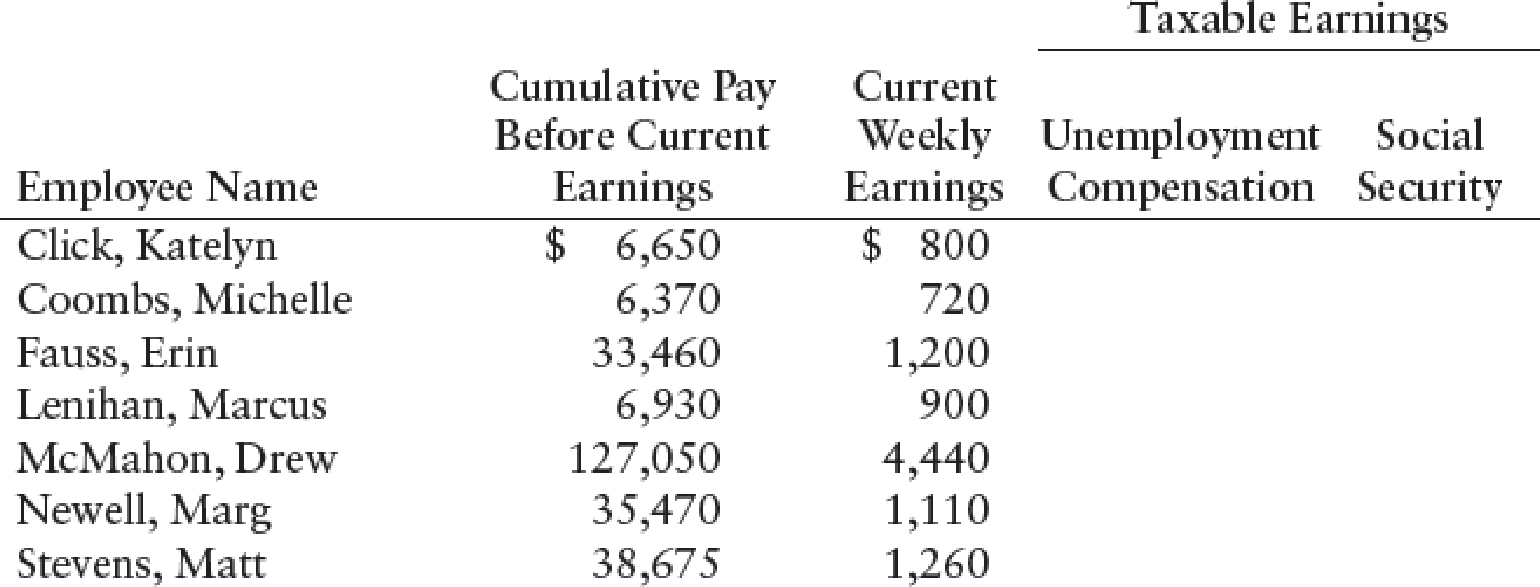

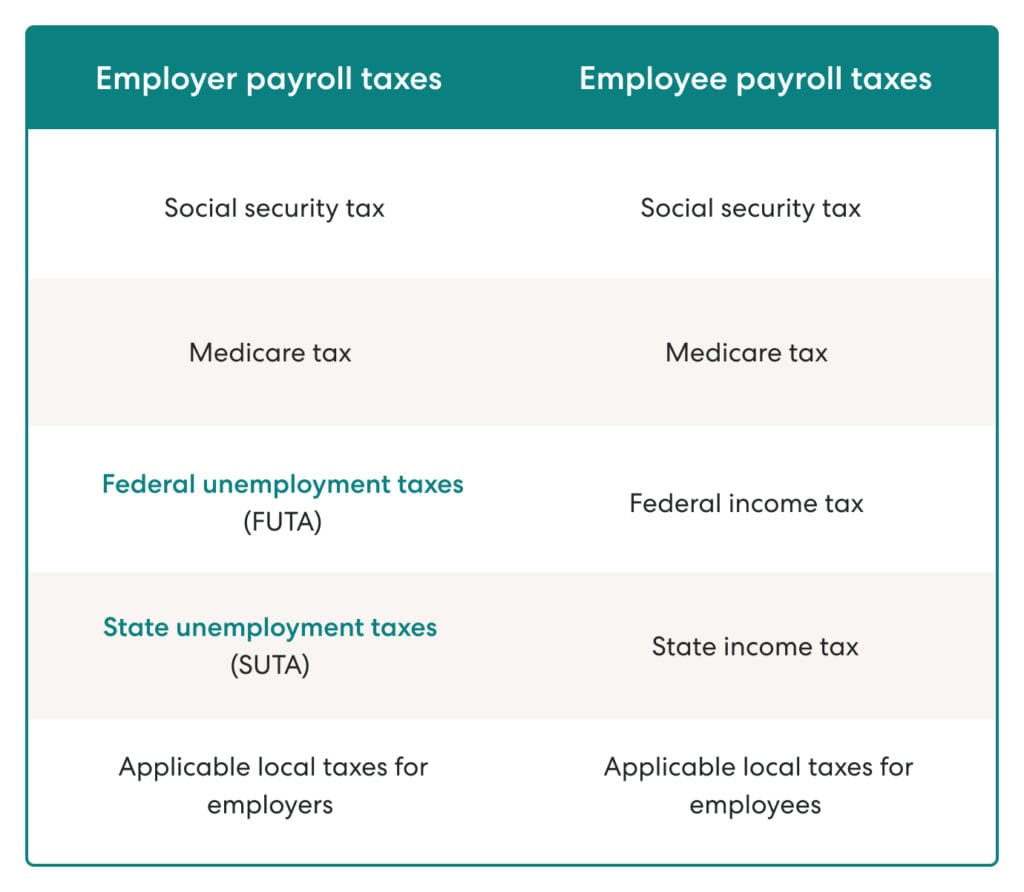

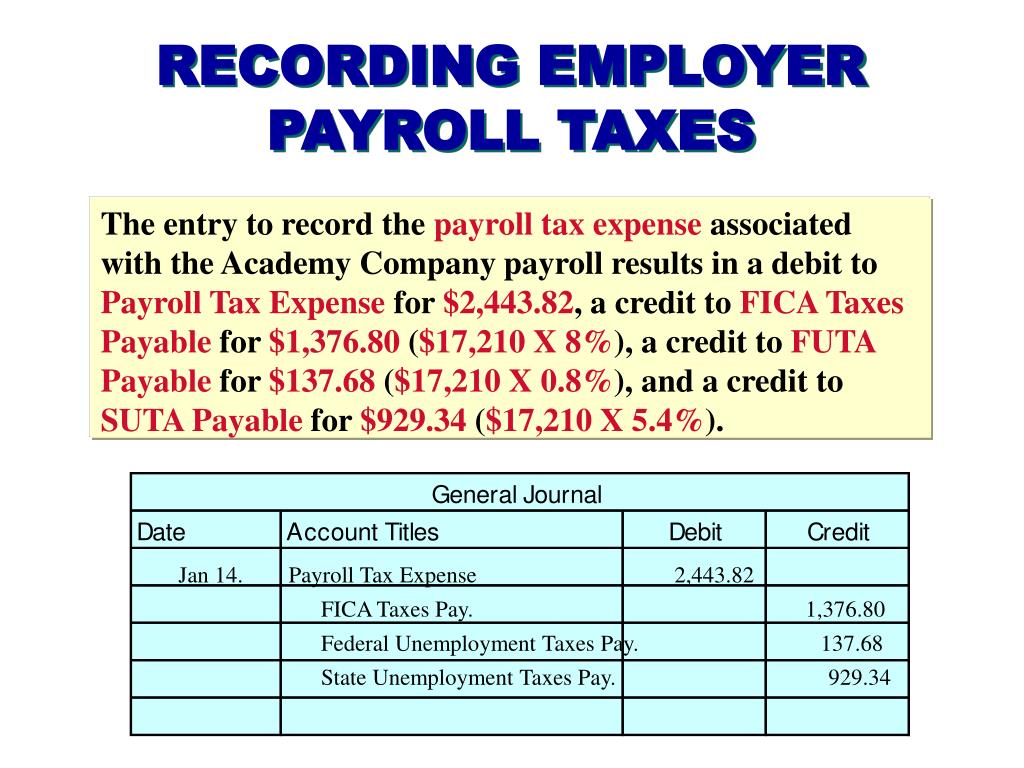

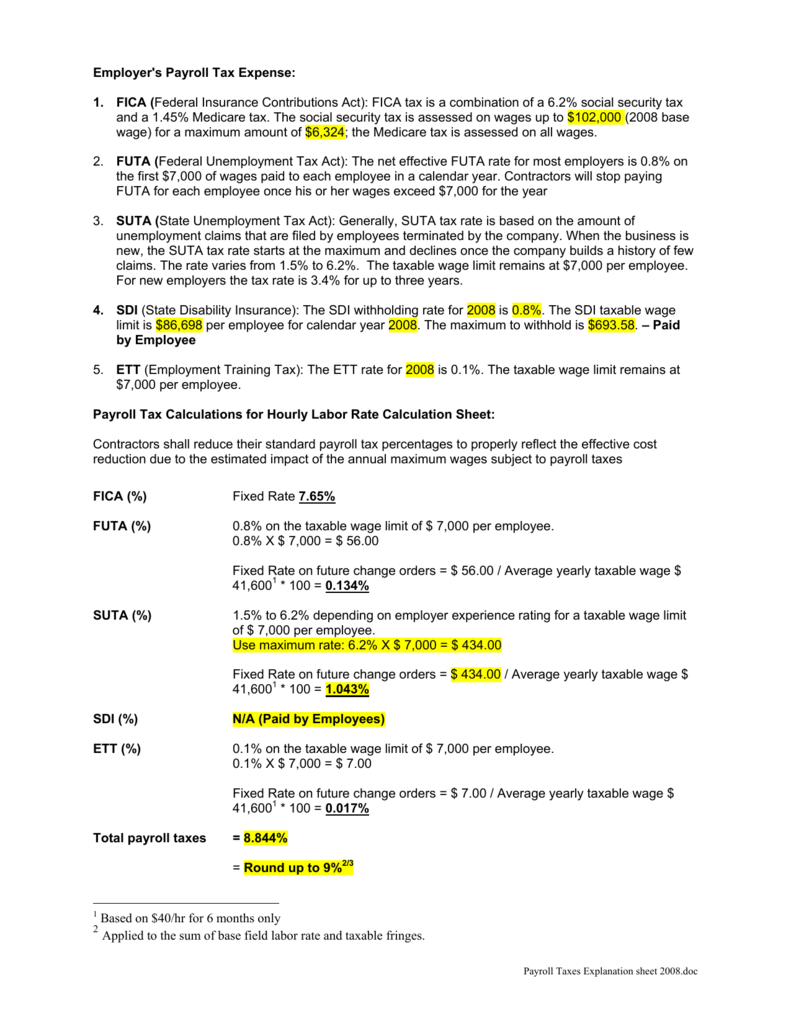

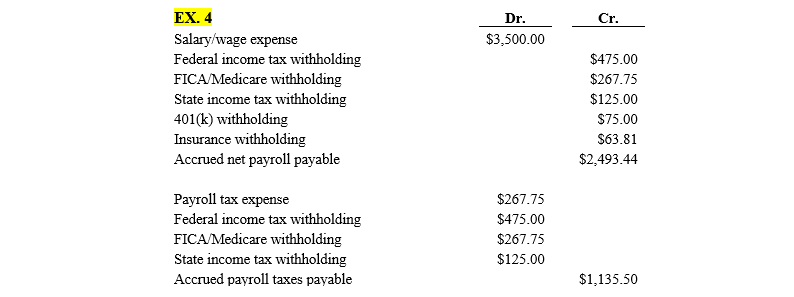

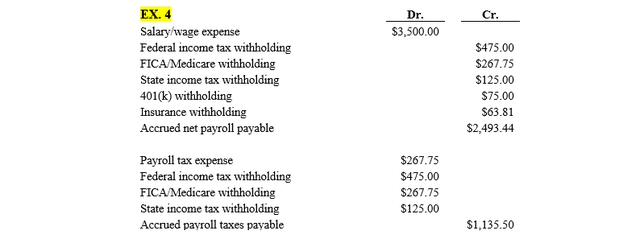

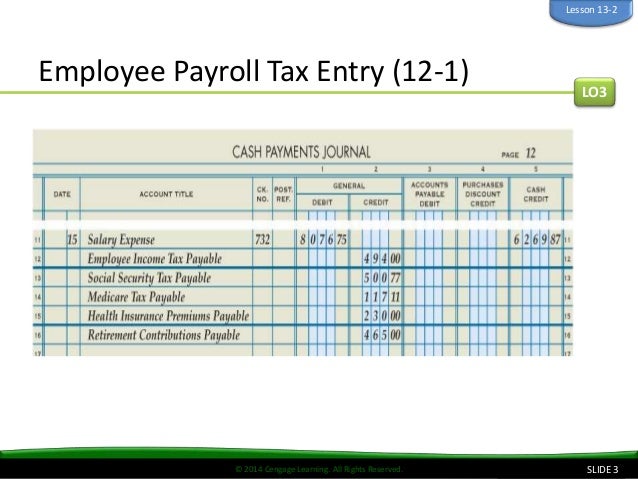

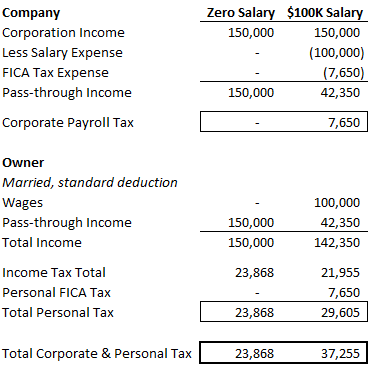

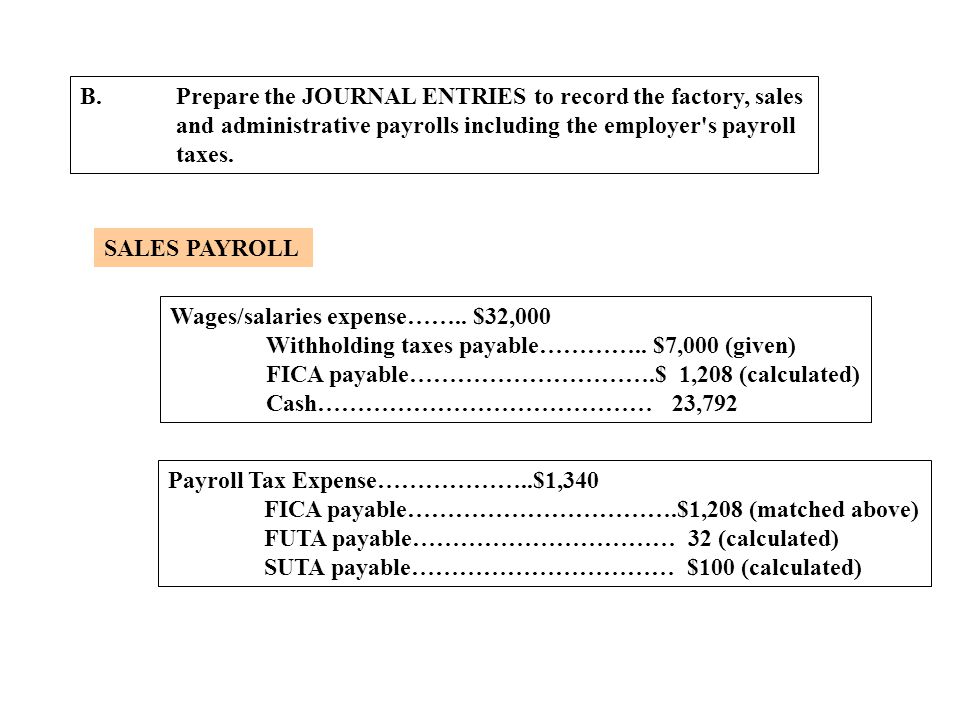

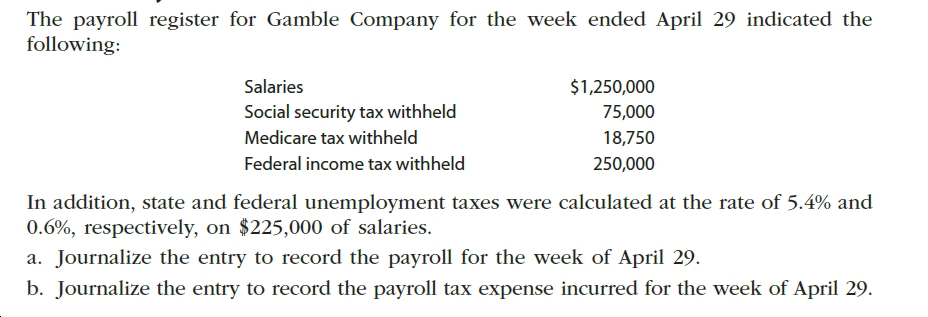

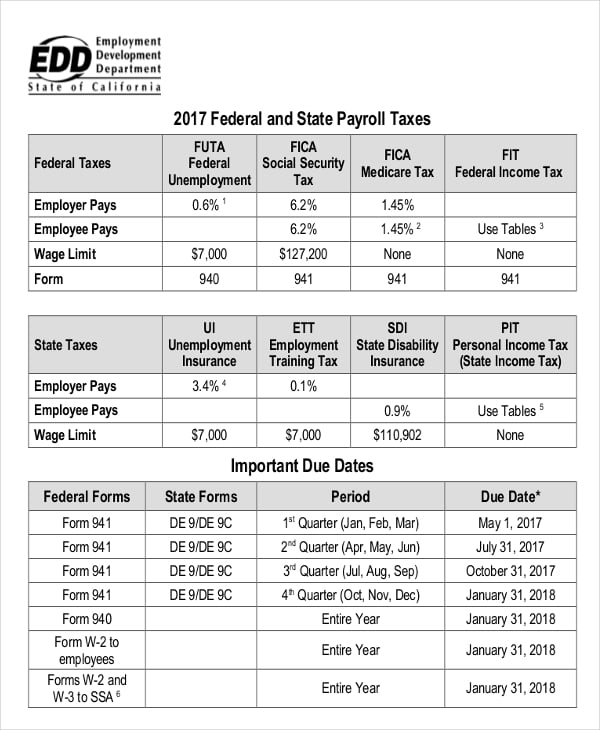

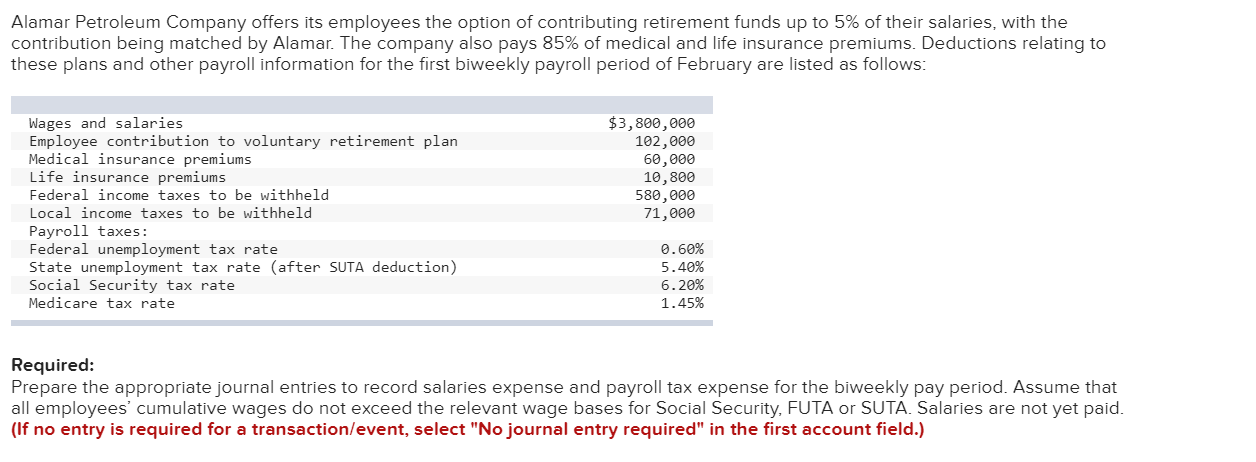

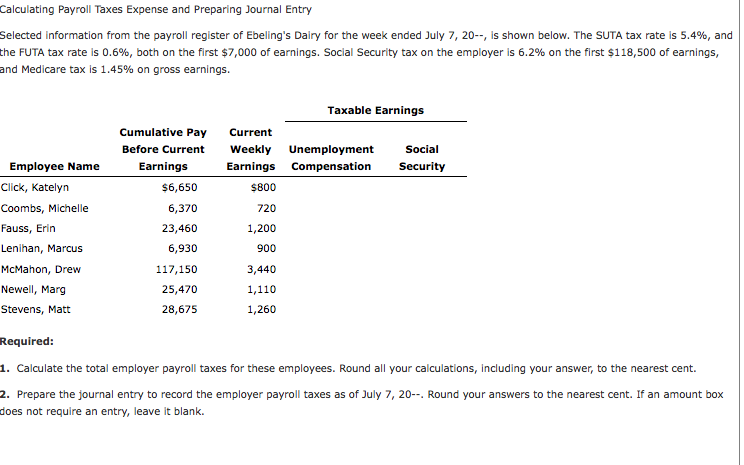

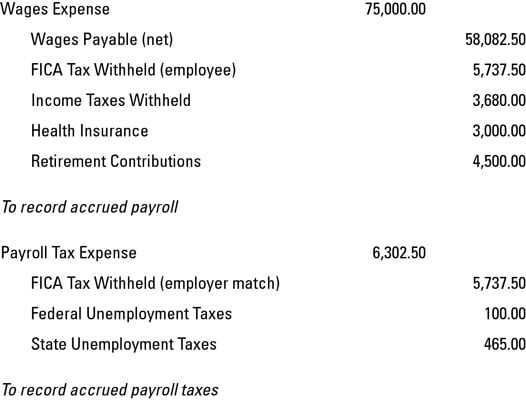

What is payroll tax expense. Employer payroll taxes. An employer s payroll is the gross amount of compensation paid to all employees but payroll expenses in the united states are generally at least 10 15 higher due to the inclusion of payroll taxes and other statutory fringe benefits such as unemployment insurance and disability. A payroll tax is a tax withheld from an employee s salary by an employer who remits it to the government on their behalf.

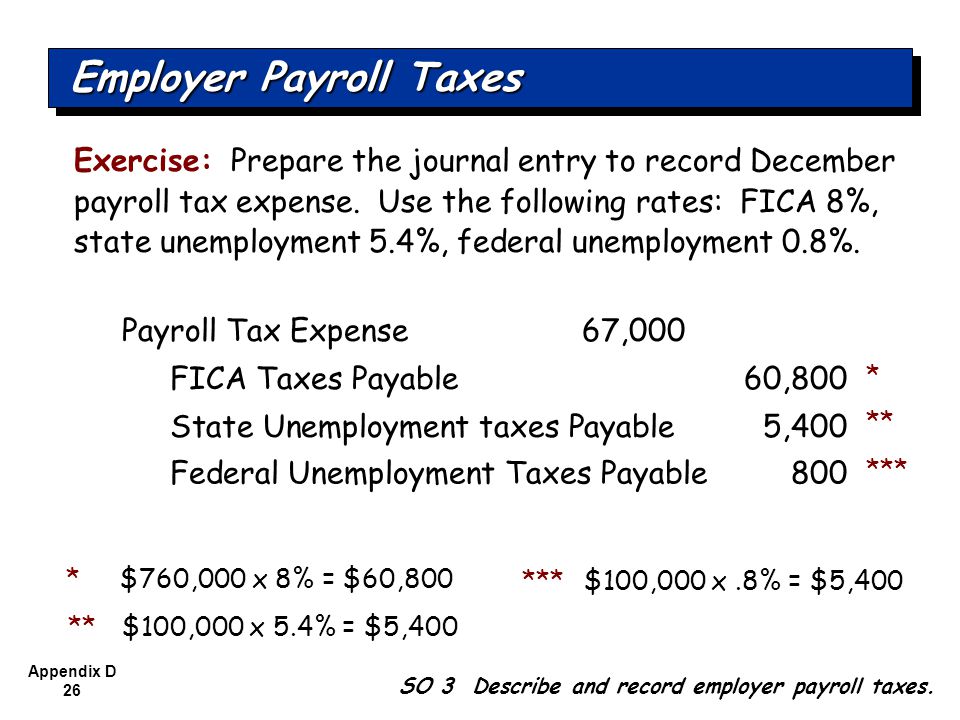

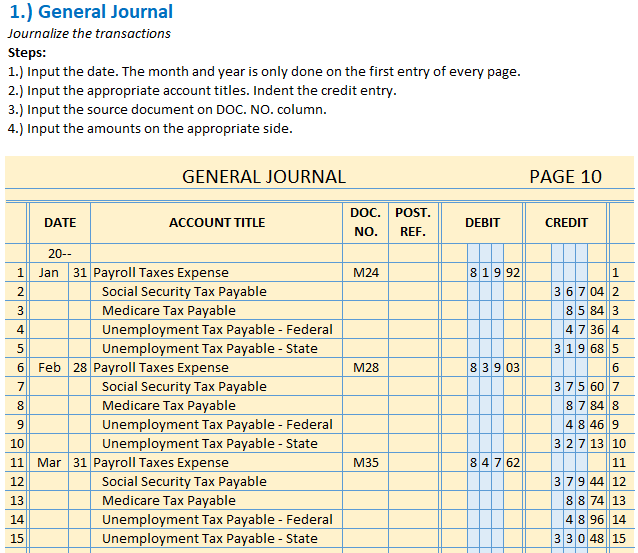

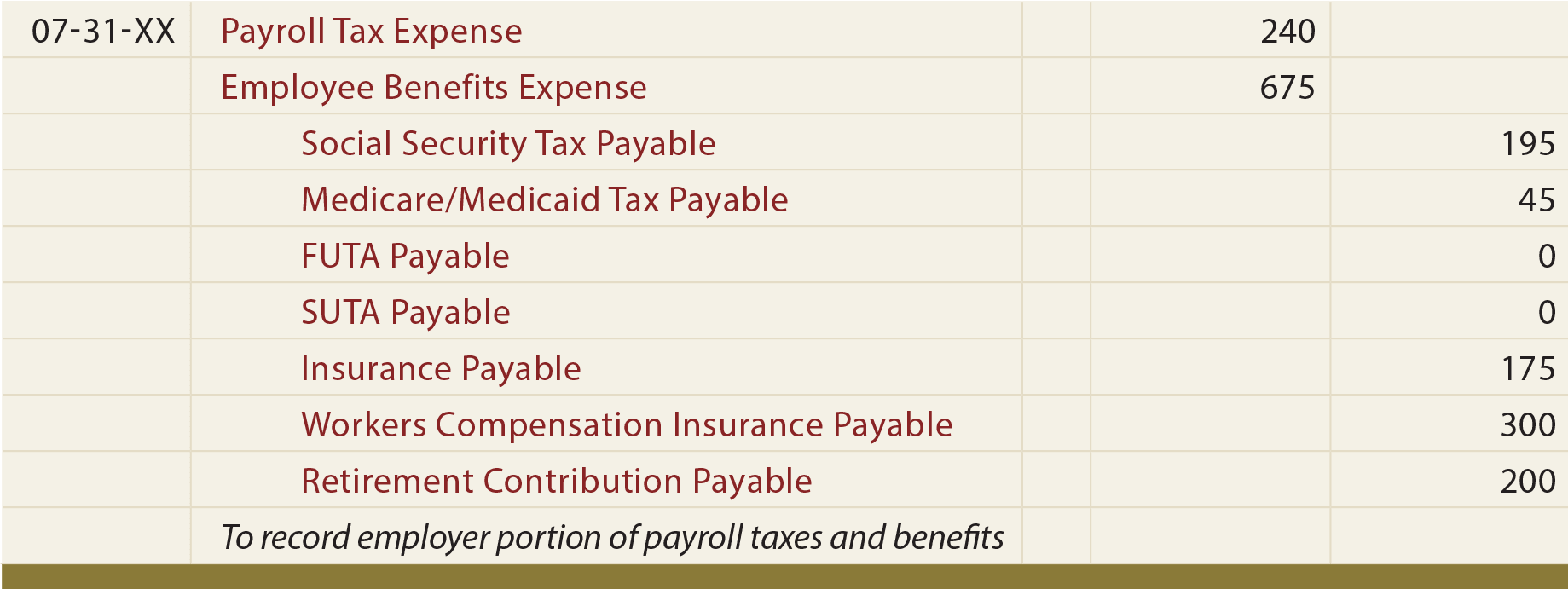

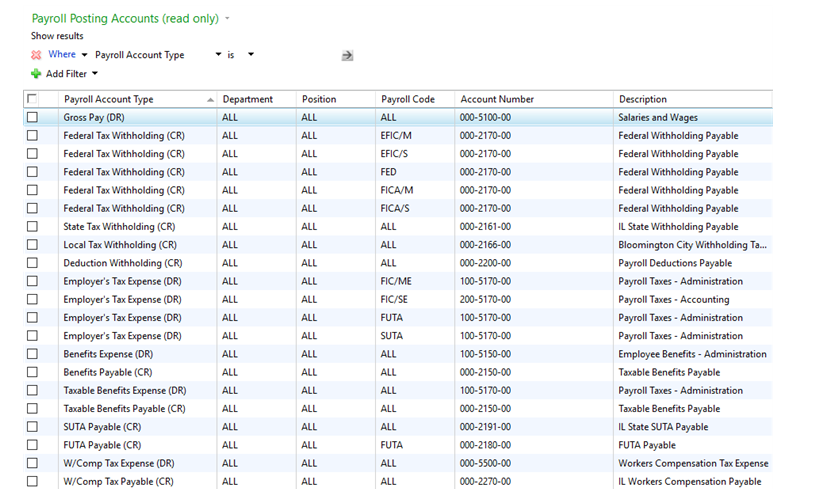

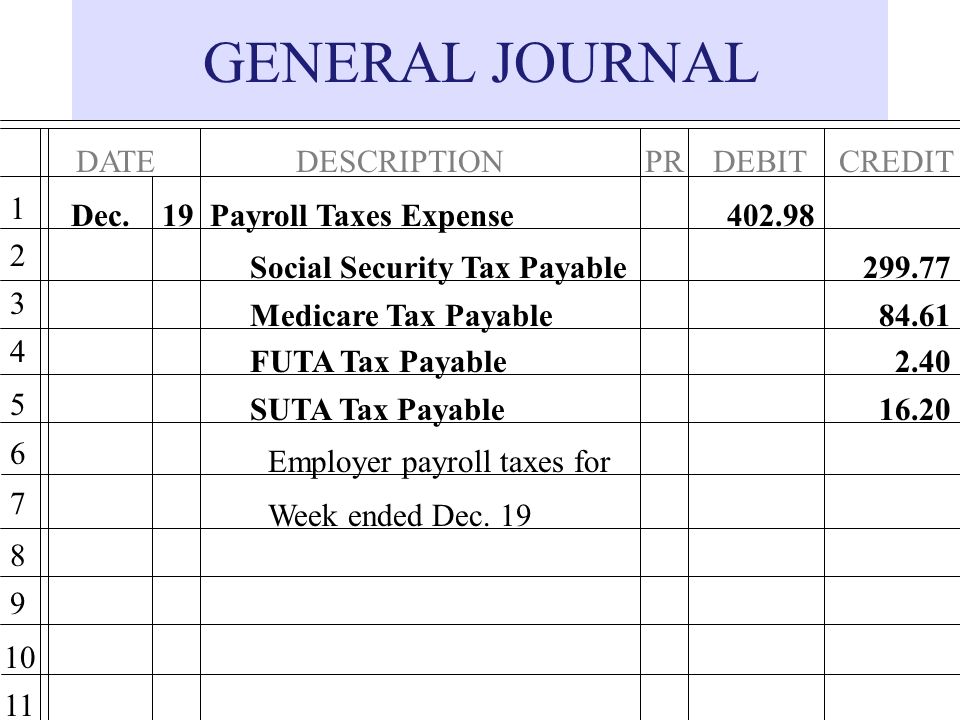

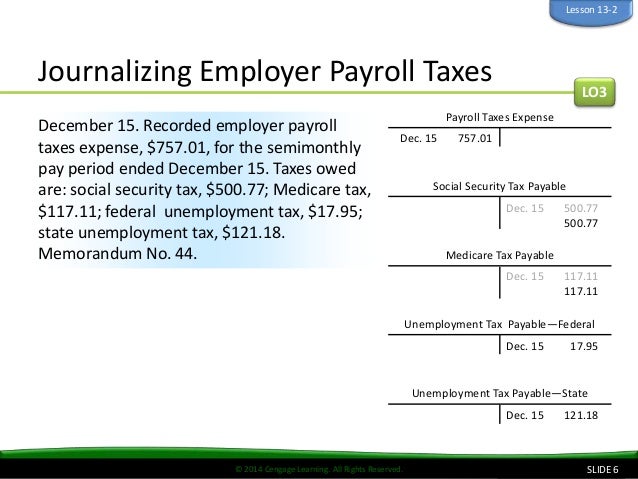

The employer portion of payroll taxes includes the following. In many industries payroll expense is the biggest expense category so it is critical for businesses to manage payroll expenditures shrewdly. Payroll and payroll expenses then are not the same.

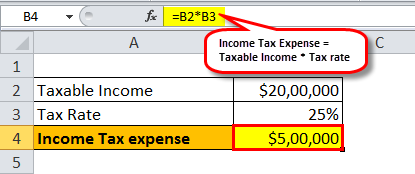

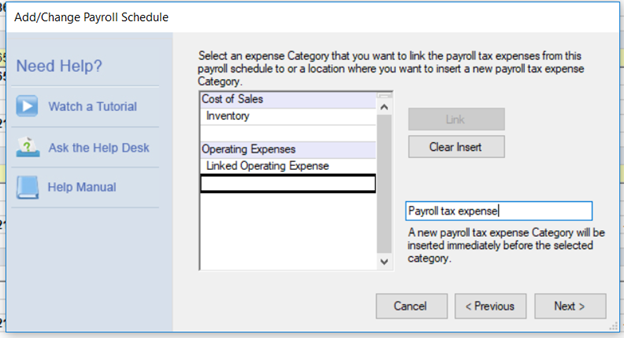

Payroll expense is the sum you pay to employees for their labor as well as associated expenses such as employee benefits and state and federal payroll taxes. Payroll expense is synonymous with the terms salary expense and wage expense. The payroll tax expense account is the holding account used to track the balance of the employer contributions to payroll taxes including social security medicare and.

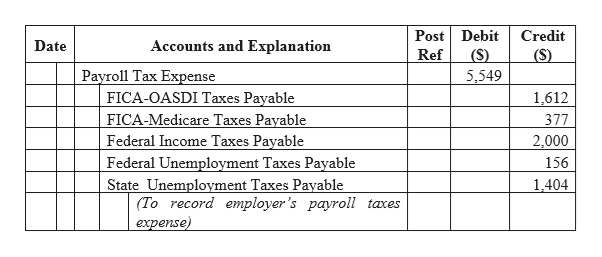

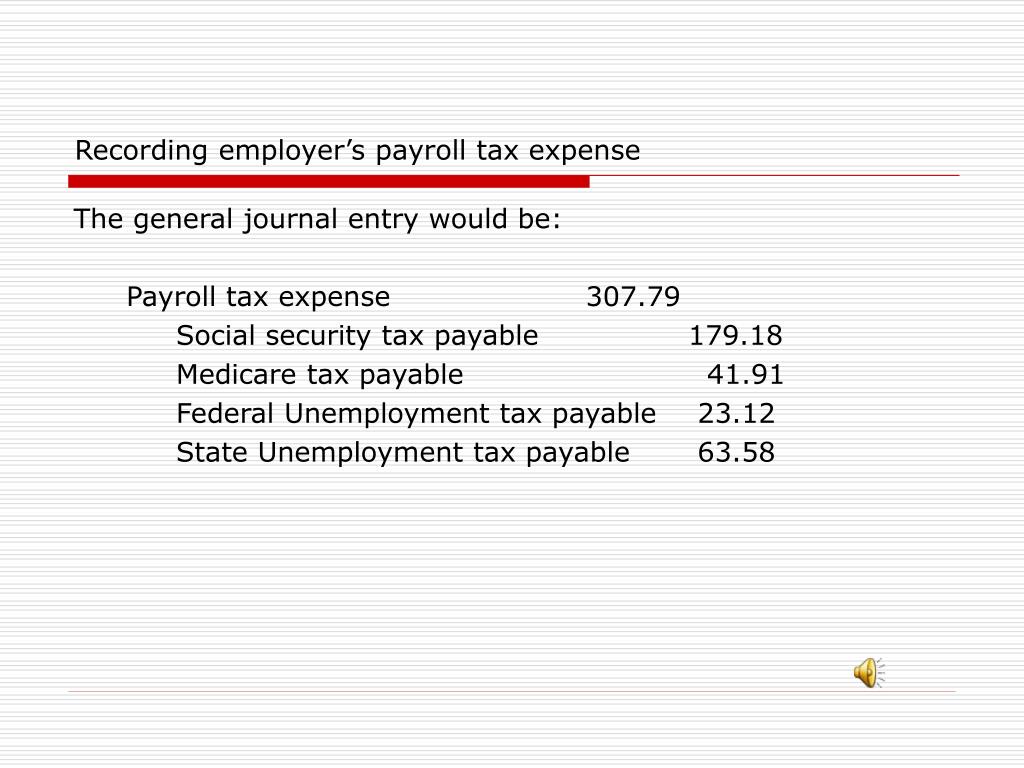

Companies are responsible for paying their portion of payroll taxes.

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)