What Is Payroll Tax Holiday 2020

A 2 percentage point cut for employees as president barack obama signed at the end of.

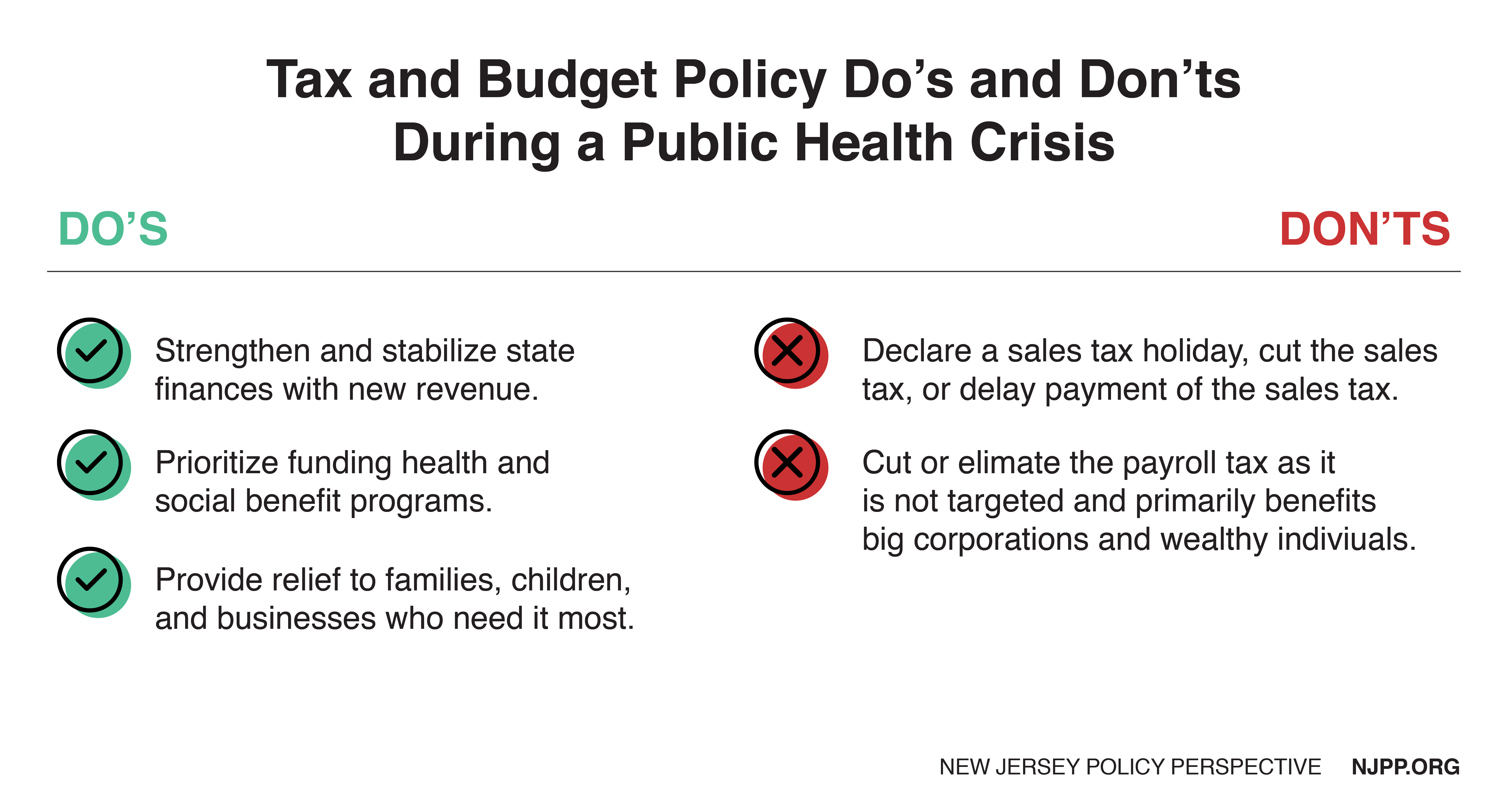

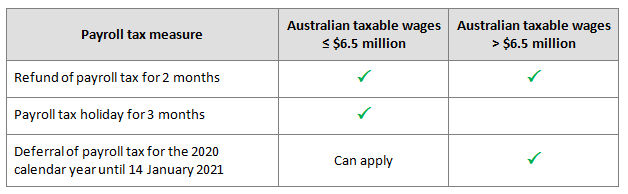

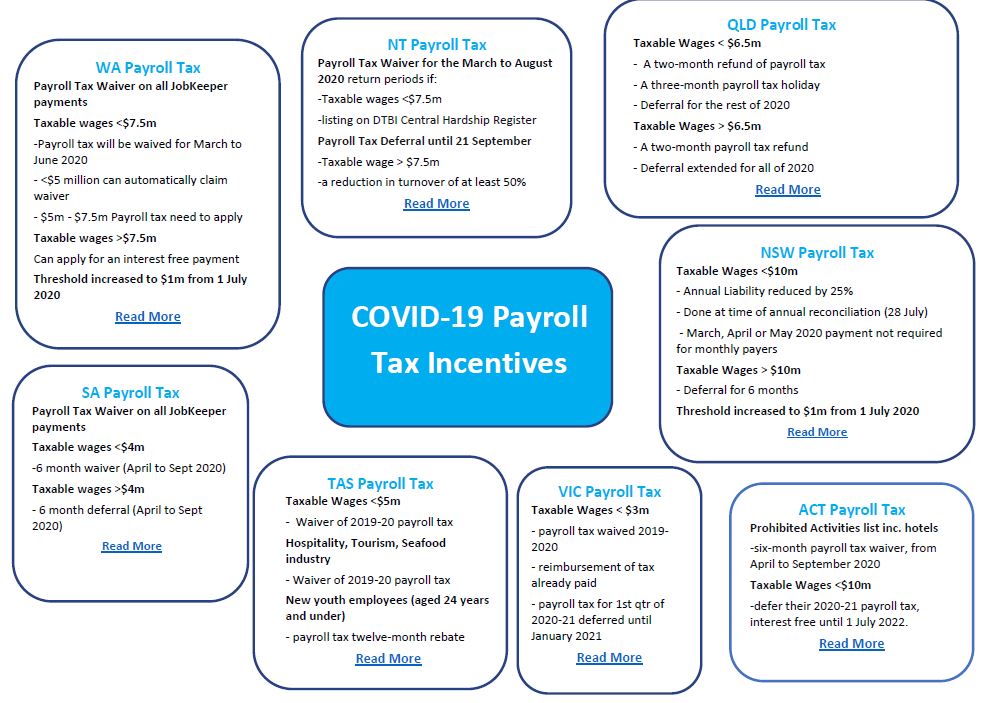

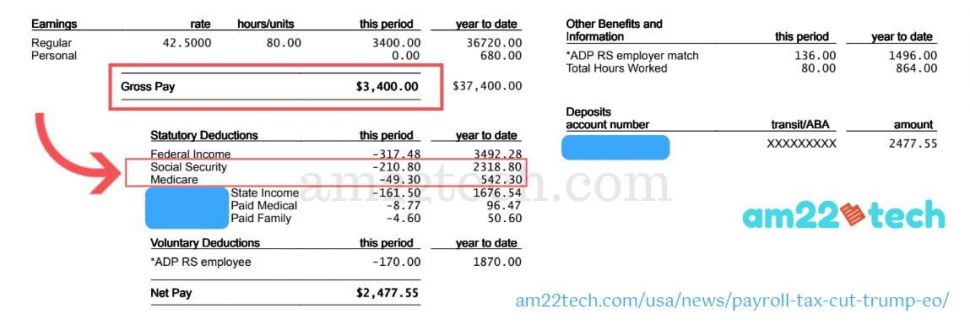

What is payroll tax holiday 2020. Under current law the 12 4 percent social security payroll tax and 2 9 percent medicare payroll tax on earnings are evenly split between employer and employee. Tax holidays are instituted by local. Employer contributions are not reduced.

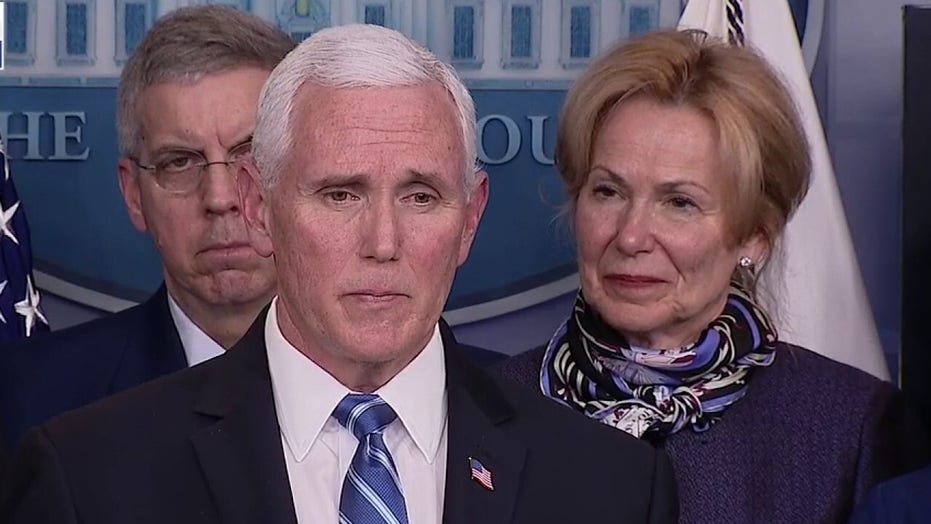

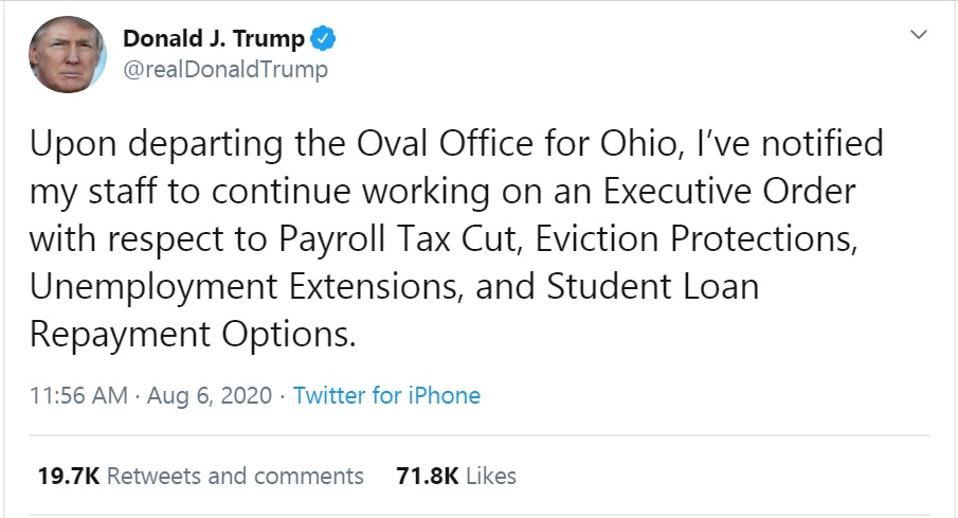

The payroll tax holiday is a bold move and this has always been a bold president kudlow said adding that the money lost from temporarily eliminating the tax will be made up with much. The cost of a payroll tax cut or holiday would depend on how much of the tax is rolled back and for how long. What is a payroll tax cut holiday 2020 07 24 south carolina it s 400 a week and we re doing it without the democrats trump said asking states to cover 25 of the cost is today president trump took four executive actions what however trump has long accused twitter in particular of censoring and curbing conservative views what.

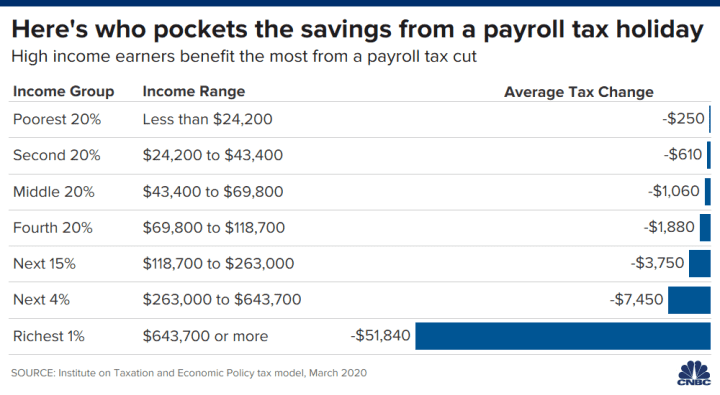

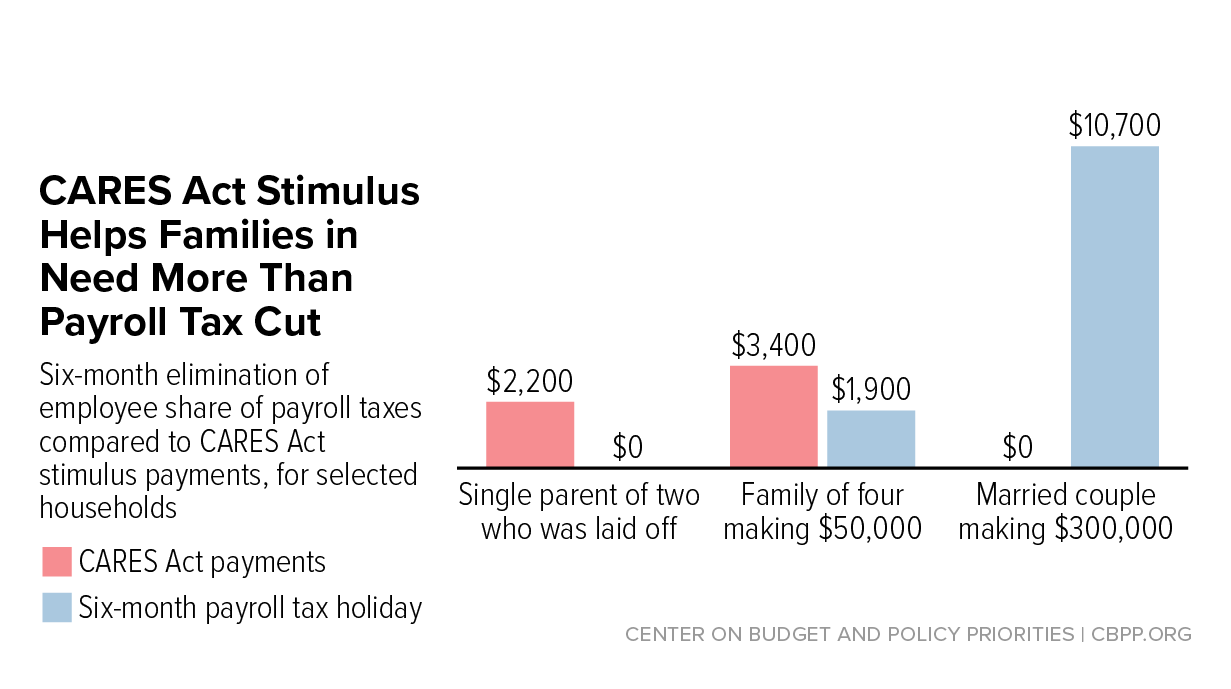

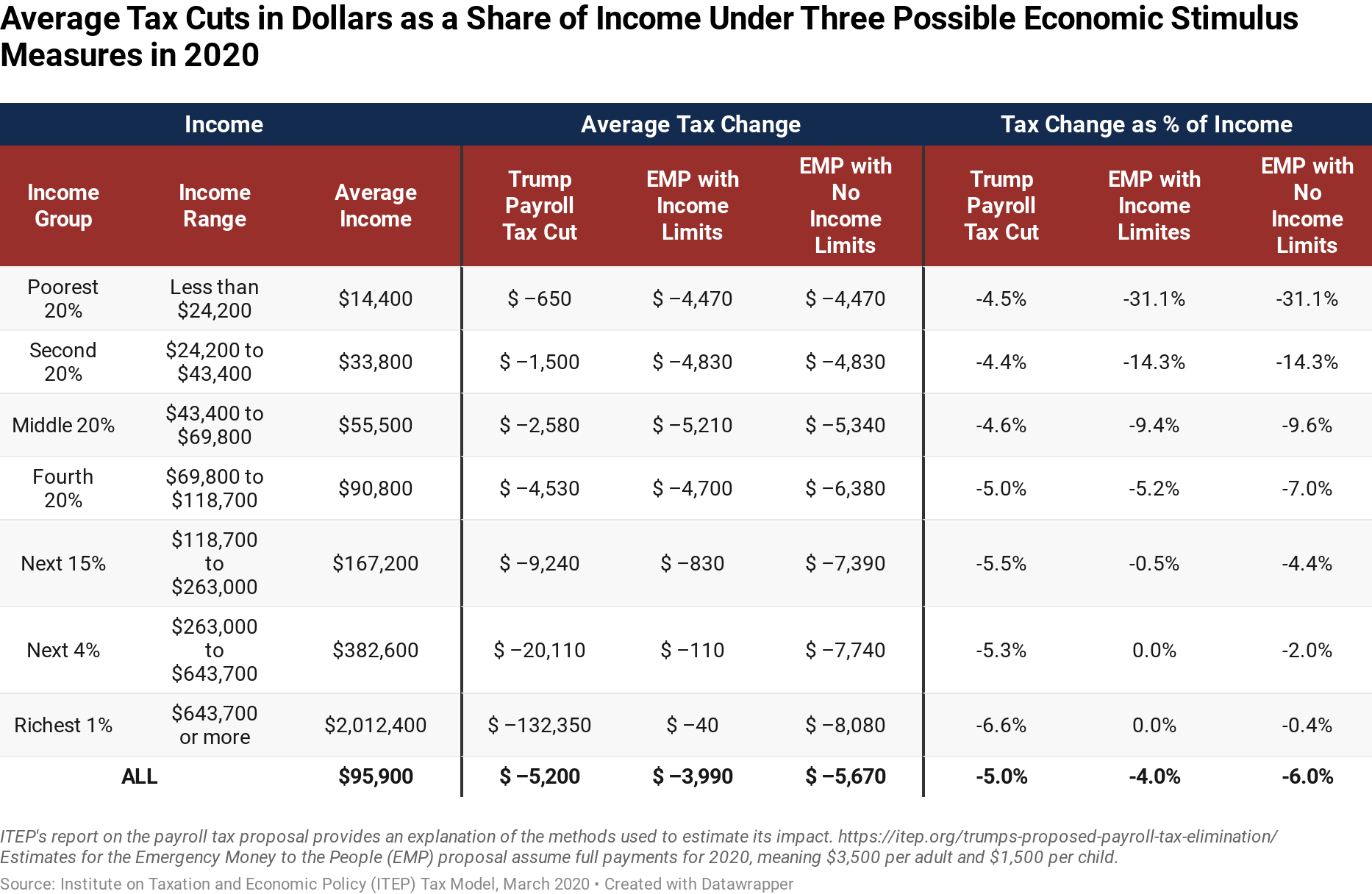

For regular employees 7 65 of your pay up to 137 700 in 2020 gets taken out of your paychecks which includes the 6 2 tax for social security and 1 45 for medicare. This means that they will accrue no benefit from a reduction in the social security portion of the payroll tax for the rest of the year though. As former house of representative tax counsel george callas argues the distributional effect on the top 1 percent is likely lower than this estimate as most taxpayers in this income group have hit the social security wage cap of 137 700 for 2020.

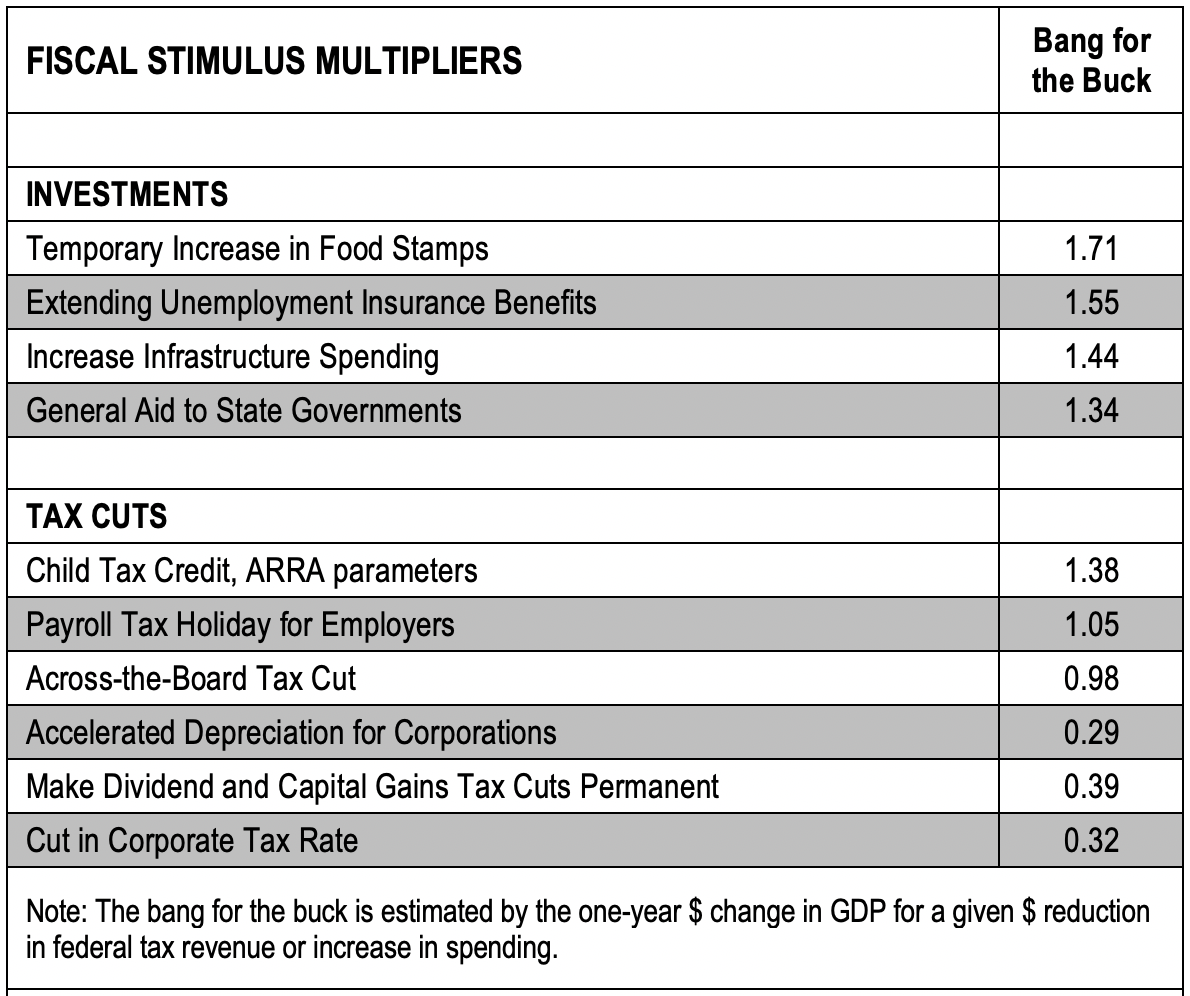

A payroll tax holiday. Workers in the hopes of staunching economic pain caused by the. A tax holiday is a governmental incentive that reduces or eliminates taxes on businesses.

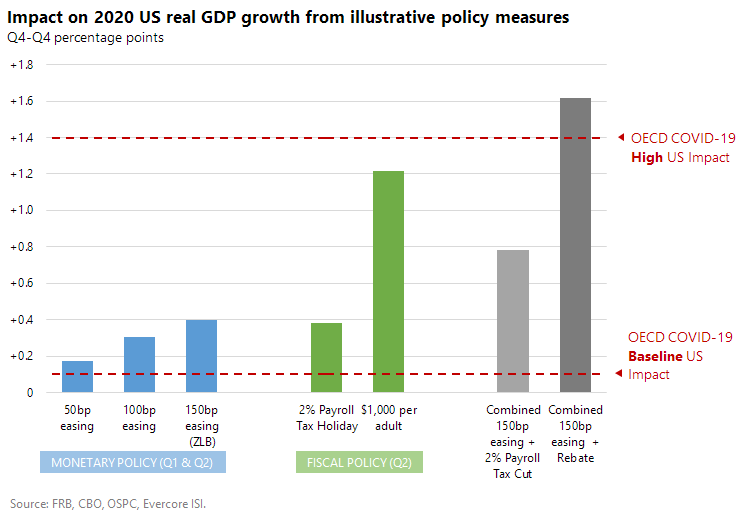

A tax holiday can encourage economic activity and foster growth. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. In the u s the temporary reduction of payroll taxes extended to all working taxpayers under the tax relief act of 2010.

A taxpayer who earns 50 000 will realize a savings of 1 000 2 of 50 000.

.png)