What Is Payroll Tax Relief Means

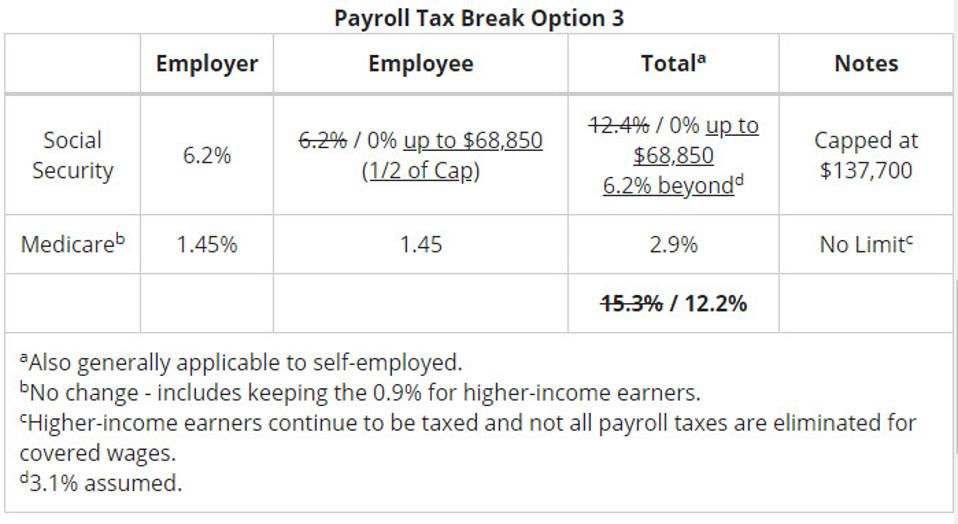

Right now an employee earning 50 000 per year would pay 3 100 in payroll tax.

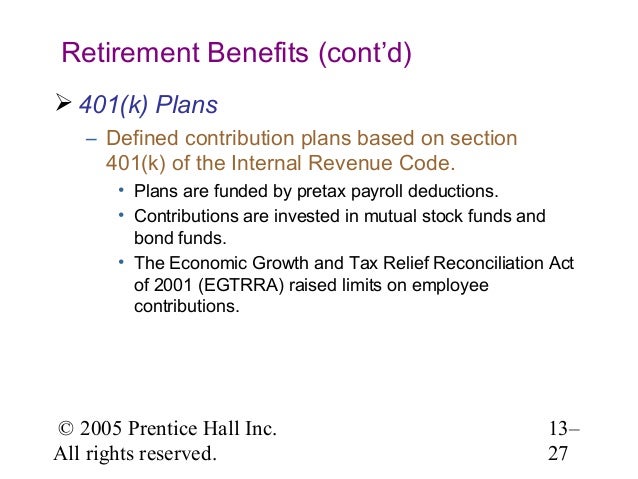

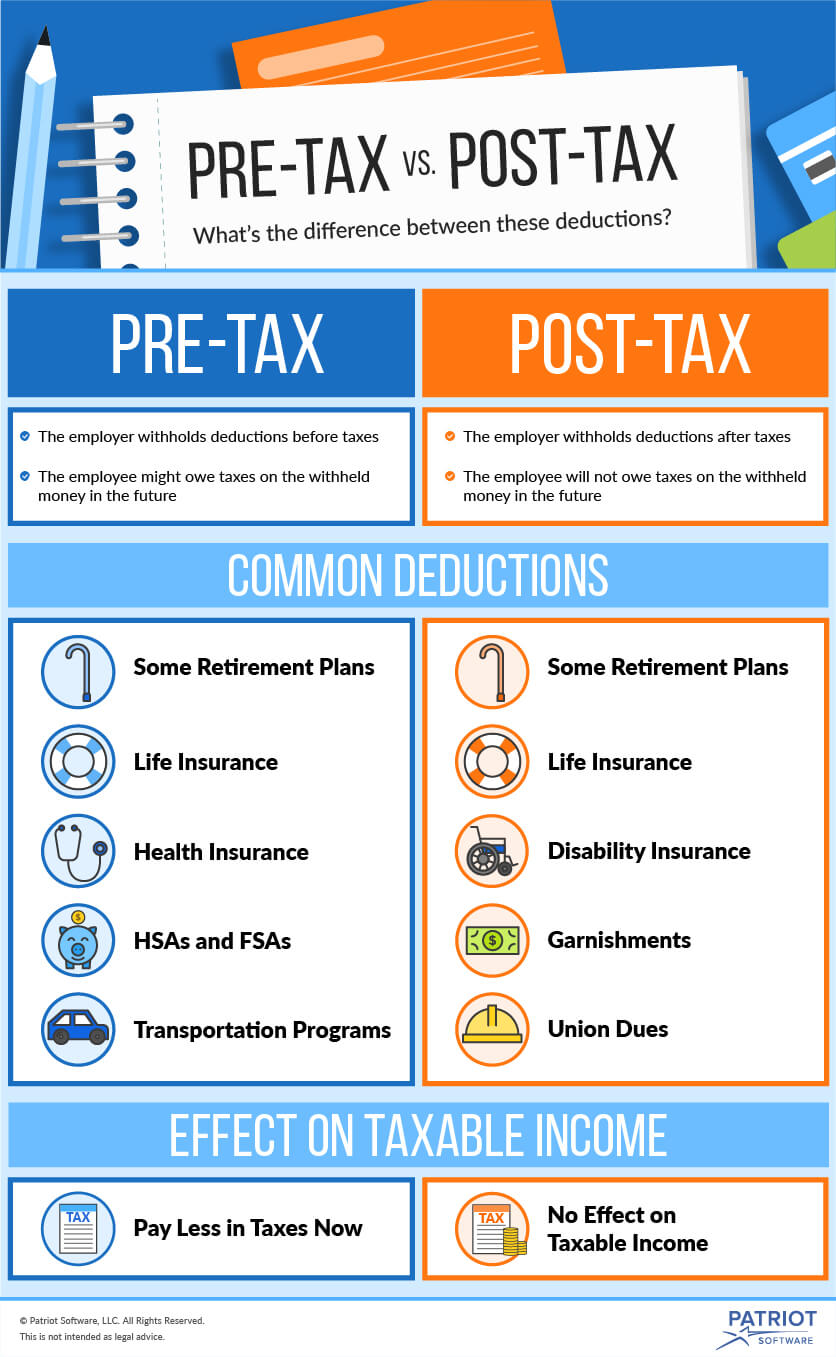

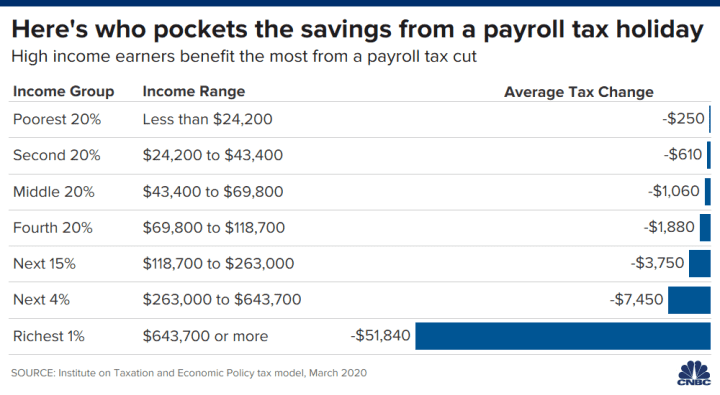

What is payroll tax relief means. President donald trump is pushing congress to include a payroll tax cut in the next economic relief package. In other words it is the percentage of income an employee must pay to the government for its programs. Payroll tax is a portion of an employee s wages that is withheld for the purpose of complying with tax laws and contributing to social security and medicare.

As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. We are to be meeting with house republicans mitch mcconnell and discussing a possible payroll tax cut or relief substantial relief very substantial relief trump said at a press briefing on. What you re paying now in payroll taxes.

A payroll tax is a tax withheld from an employee s salary by an employer who remits it to the government on their behalf. It s not clear if trump is pressing for a 100 payroll tax cut i e no tax is taken out of your paycheck or only a partial cut. The tax is based on wages salaries and tips paid to employees.

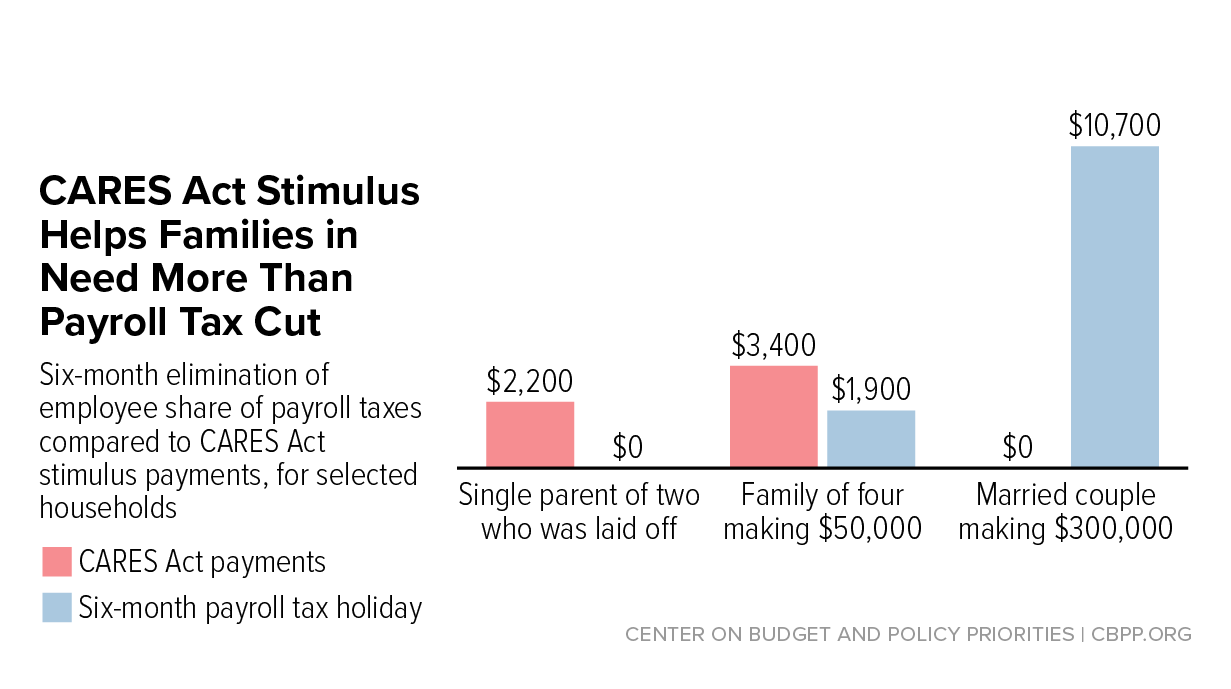

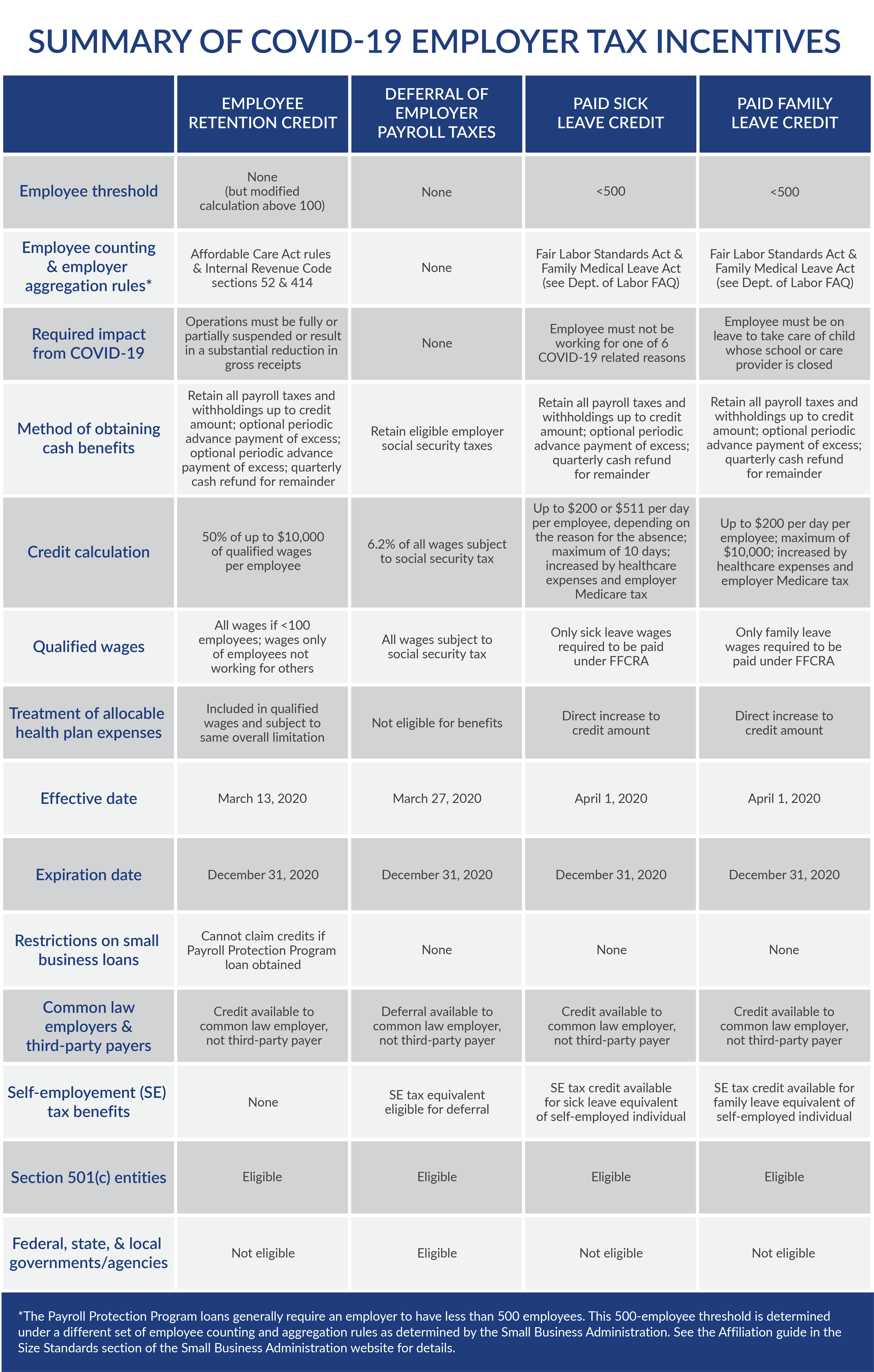

Since payroll taxes fund the two programs many people are worried about the long term effects of diverting money away from these two social safety nets. Payroll taxes are imposed on workers to provide revenue for social security and medicare. Joe biden s tax plans.

The current total rate of payroll taxes is 7 65. Currently all employees and employers pay a 6 2 percent payroll tax on wages capped out at 137 700. See more election 2020.

Payroll taxes generally fall into two categories.

/Netoftax-taxrates-464cac356d8c468c97eb98a8e92f4052.jpg)

/payroll-tax-concept--papers--calculator-and-money--1128492914-ea403a57dd164b3f830ab222c2d24ee7.jpg)

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-932532128-d846b02aba6341bf94d77298b92e9b7f.jpg)

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)