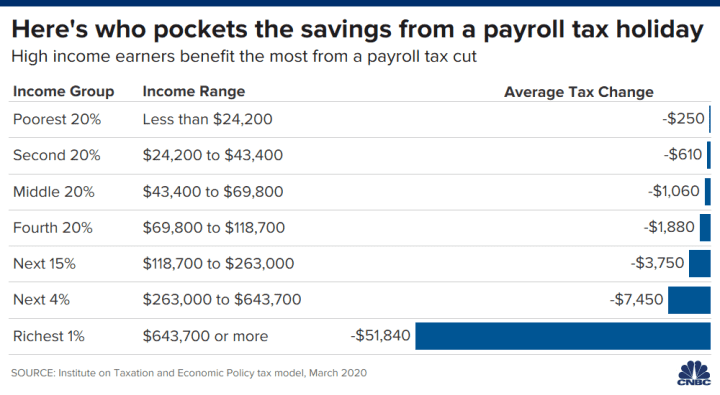

What Is Payroll Tax Relief

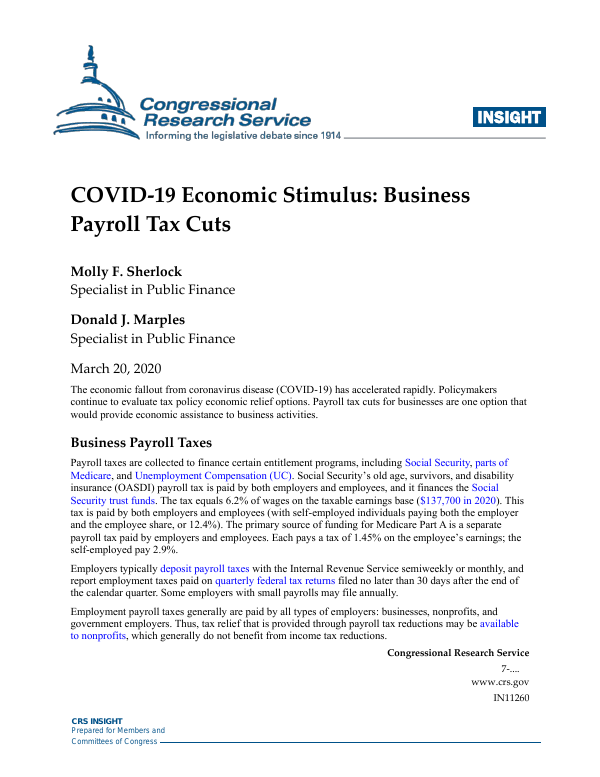

Payroll tax relief is meant to help businesses that owe payroll taxes or those that should have been withheld from employees paychecks.

What is payroll tax relief. Employers should quantify the amount of eligible tax credits including management of eligible wage computations each pay period. These employers did not have to pay payroll tax for the months of january february and march 2020. Review posted payroll and hours information to identify employees and wages that are eligible for credits.

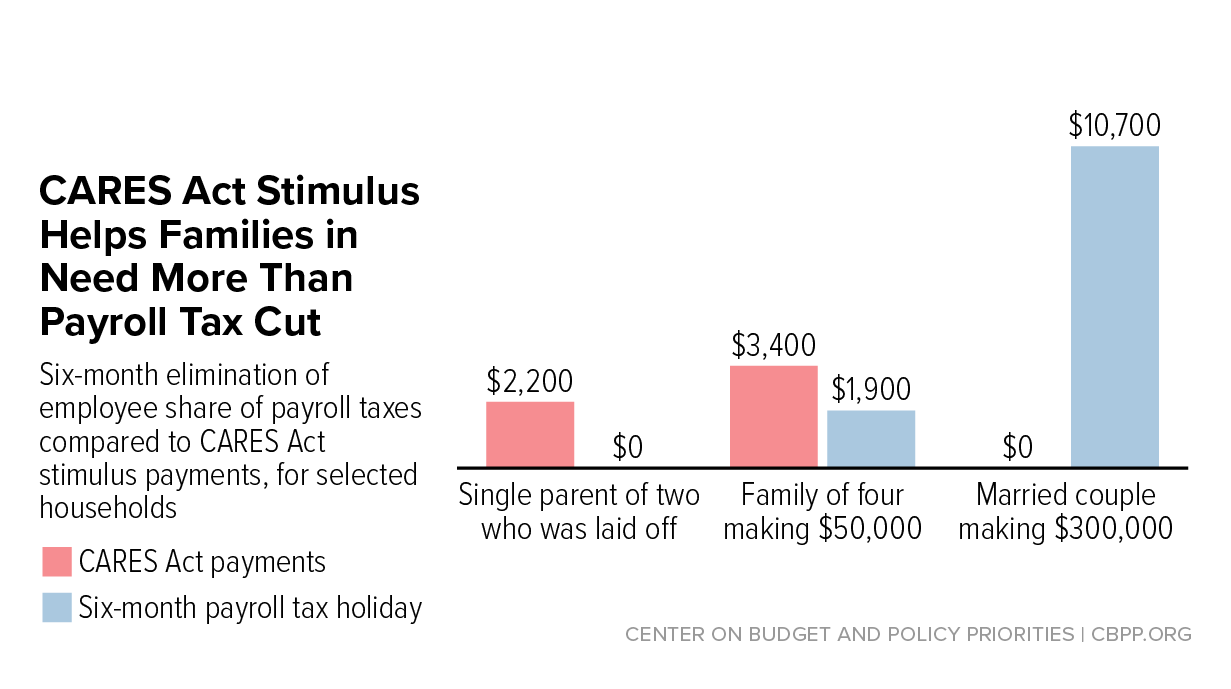

Here s what that means for workers published wed mar 25 2020 1 39 pm edt updated fri mar 27 2020 1 51 pm edt. Whether these taxes went unpaid due to an error inability to pay because of financial troubles or because the business closed down you still need to pay what you owe to the irs. As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers.

Companies get to defer payroll tax payments under coronavirus relief bill. The tax is based on wages salaries and tips paid to employees. 2 quantify tax relief.

This holiday relief does not have to be repaid.