What Is The Payroll Tax Rate In California

However each state specifies its own rates for income unemployment and other taxes.

What is the payroll tax rate in california. Let workyard handle payroll taxes. Self employed individuals pay the government self employment taxes which serve a similar function. A payroll tax is withheld by employers from each employee s salary and is paid to the government.

Below is a state by state map showing tax rates including supplemental taxes and workers compensation. And the state is not a credit reduction state. Payroll taxes generally fall into two categories.

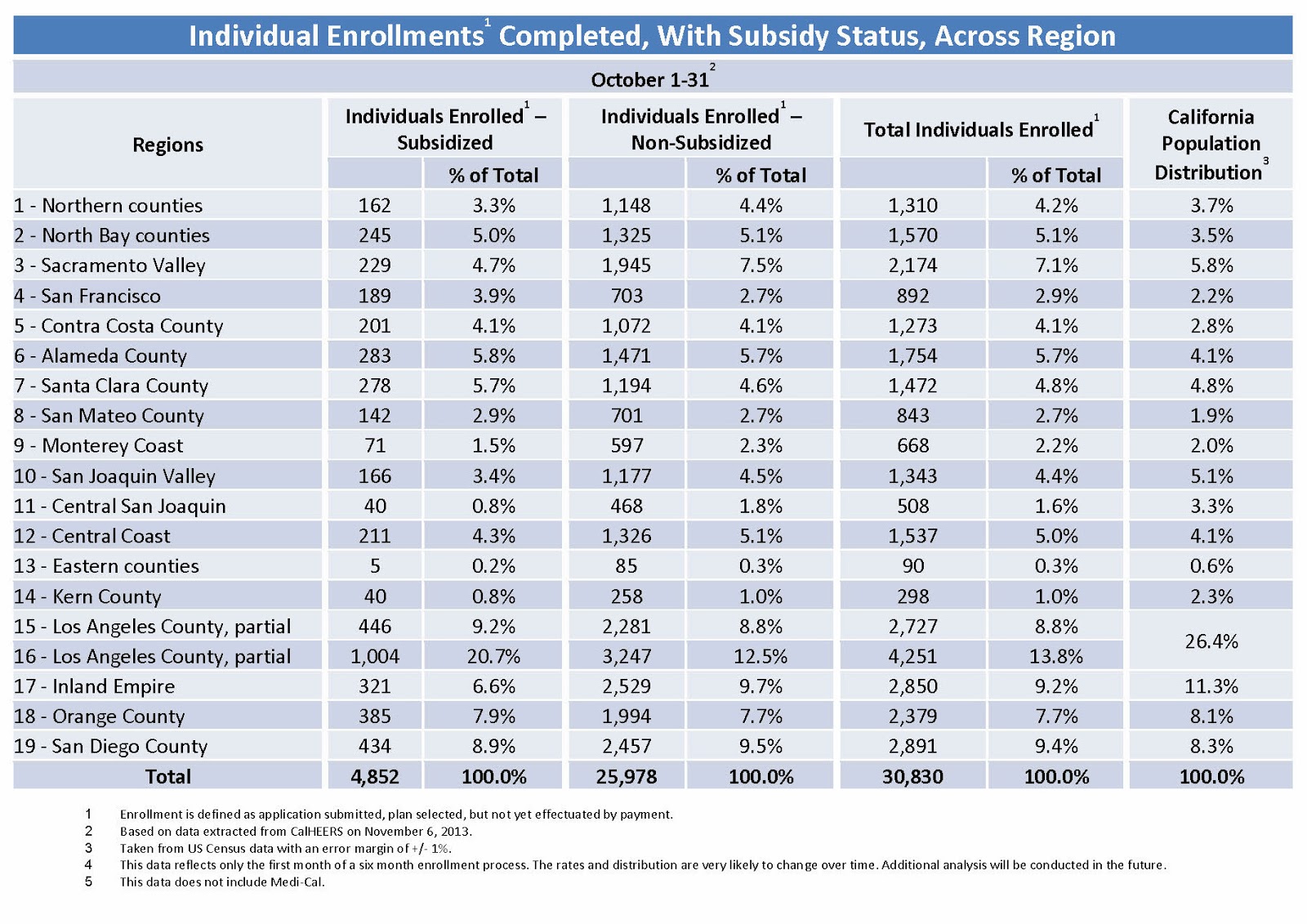

If it is a credit reduction state see instructions for form 940 and schedule a for form 940. Generally wages are subject to all four payroll taxes. Sdi and pfl are set by the california state legislature and may change yearly.

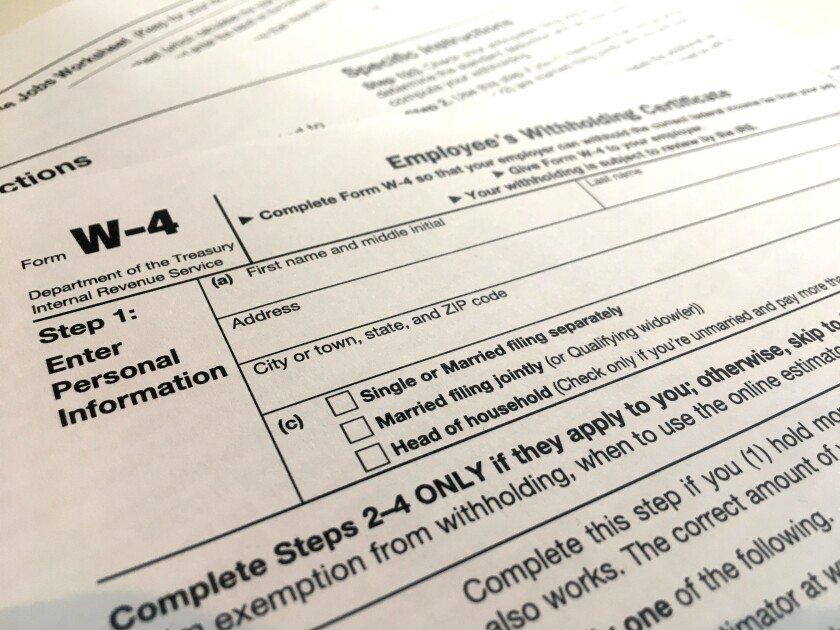

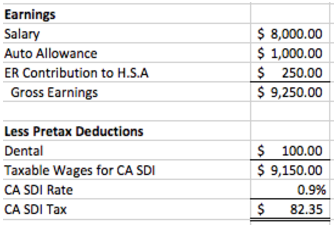

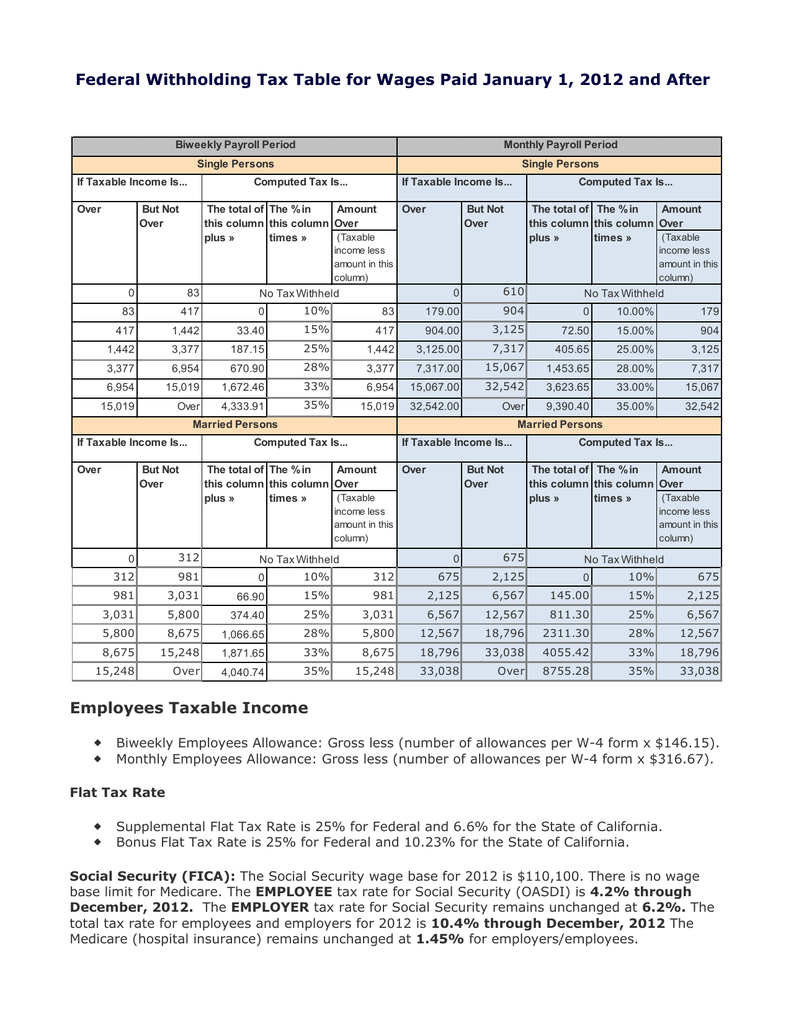

The employee tax rate for medicare is 1 45 and the employer tax rate for medicare tax is also 1 45 or 2 9 total. This tax rate varies and is based on the withholding allowance certificate form w 4 or de 4 that each employee fills out. The maximum tax is 1 229 09 per employee per year 122 909 x 010.

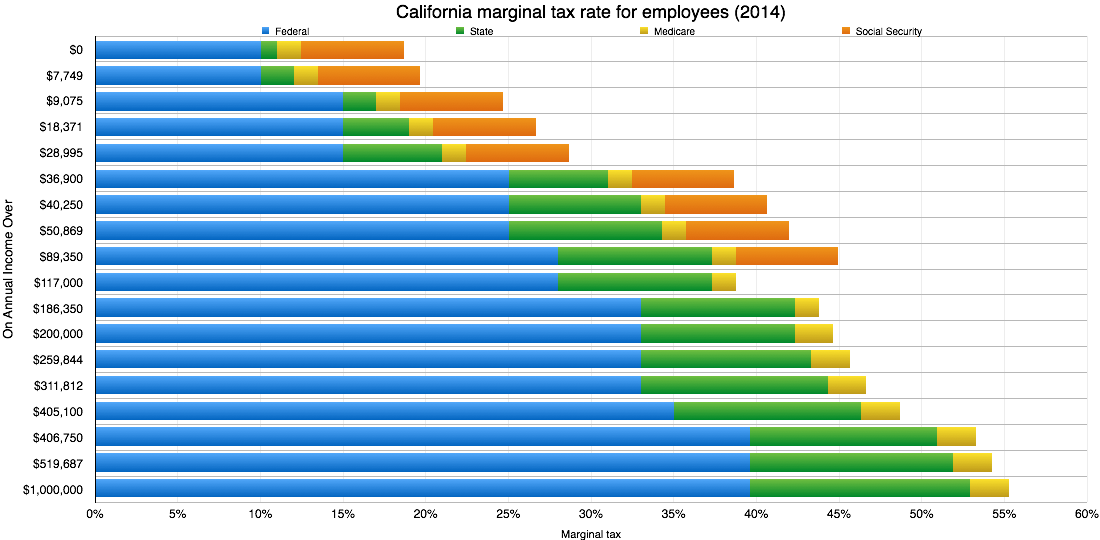

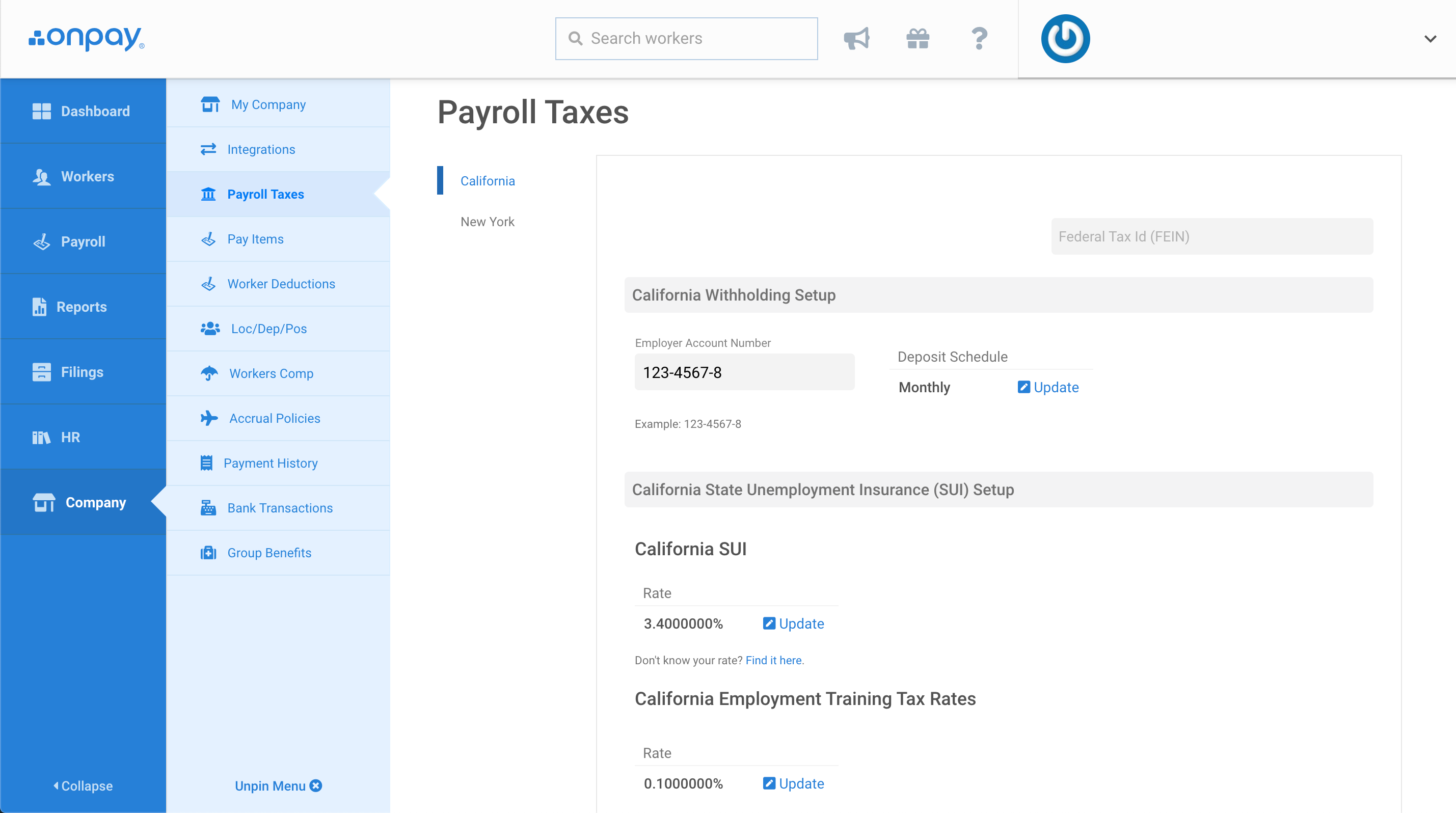

California state payroll taxes. Payroll taxes are complicated and time consuming. The additional medicare tax of 0 09 is withheld on income above 200 000 each.

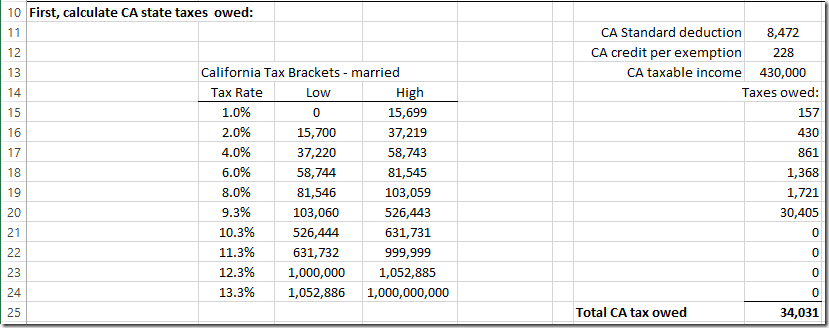

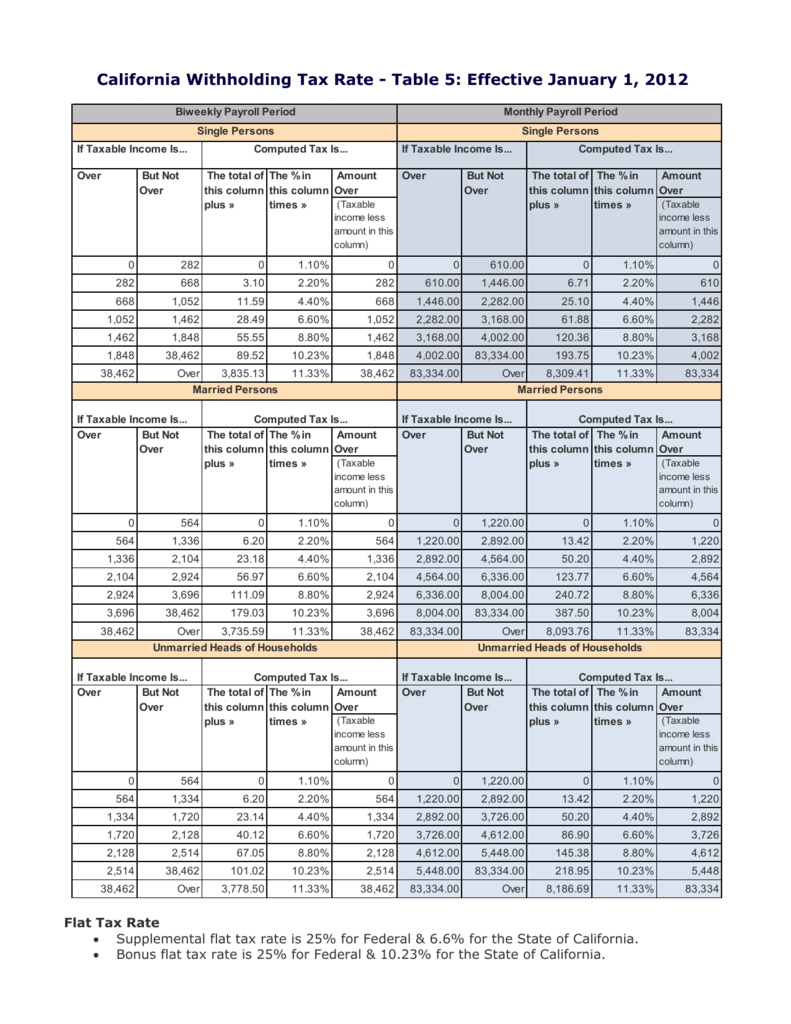

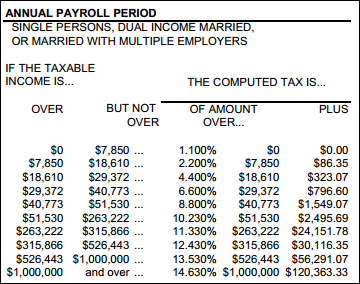

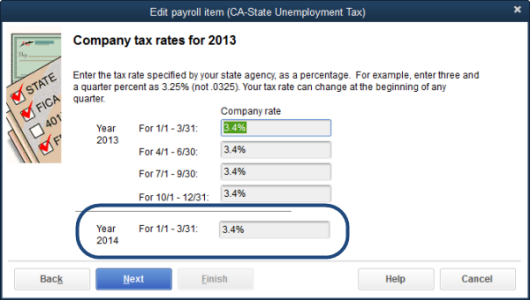

1 unemployment insurance ui tax 2 employment training tax ett 3 state disability insurance sdi tax and 4 california personal income tax pit. California personal income tax is the other california payroll tax that s paid by employees rather than employers but employers are again responsible for withholding it from their paychecks. It s a progressive income tax meaning the more money your employees make the higher the income tax.

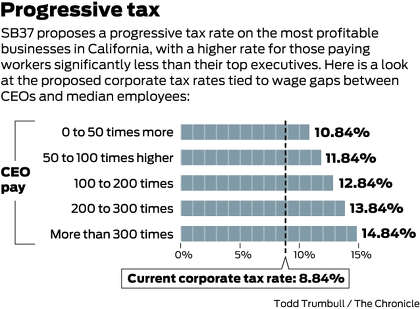

The state of california wins for the highest top marginal income tax in the country. This discounted futa rate can be used if. Payroll taxes are taxes imposed on employers or employees and are usually calculated as a percentage of the salaries that employers pay their staff.

Deductions from an employee s wages and taxes paid by the employer based on the employee s wages. The 2020 sdi tax rate is 1 00 percent 010 of sdi taxable wages per employee per year. There is no employer match for this tax.

Federal payroll tax rates like income tax social security 6 2 each for both employer and employee and medicare 1 45 each are set by the irs. Currently this rate of california personal income tax ranges from 1 to 12 3 of one s income plus a 1 surcharge on taxable incomes of 1 million or above. All ui taxes for 2020 have been paid in full by january 31 2021.

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)

3.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)

4.jpg)

/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)