What Is The Payroll Tax Rate In Massachusetts

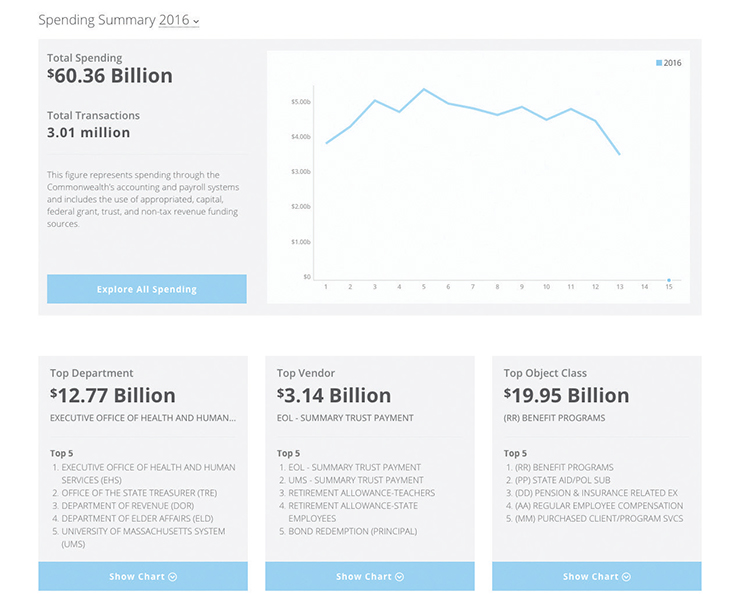

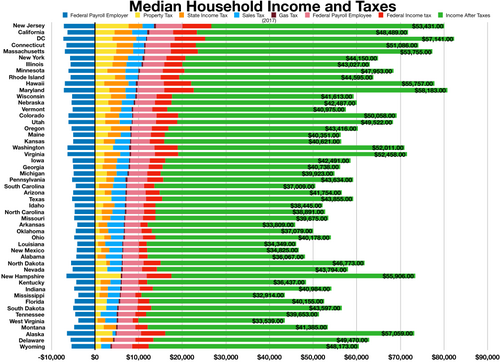

Below is a state by state map showing tax rates including supplemental taxes and workers compensation.

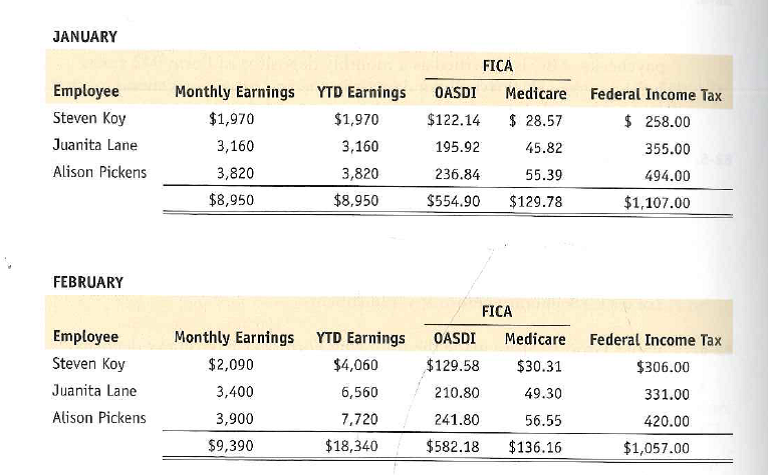

What is the payroll tax rate in massachusetts. In this massachusetts state tax calculator you can calculate the taxes with resident location as massachusetts and work location with all other 50 states. Overview of massachusetts taxes. No massachusetts cities charge their own local income tax.

Basically you can estimate massachusetts payroll taxes different combinations of residence work area scenarios. These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other financial data. Yes the personal income tax in massachusetts is a flat rate.

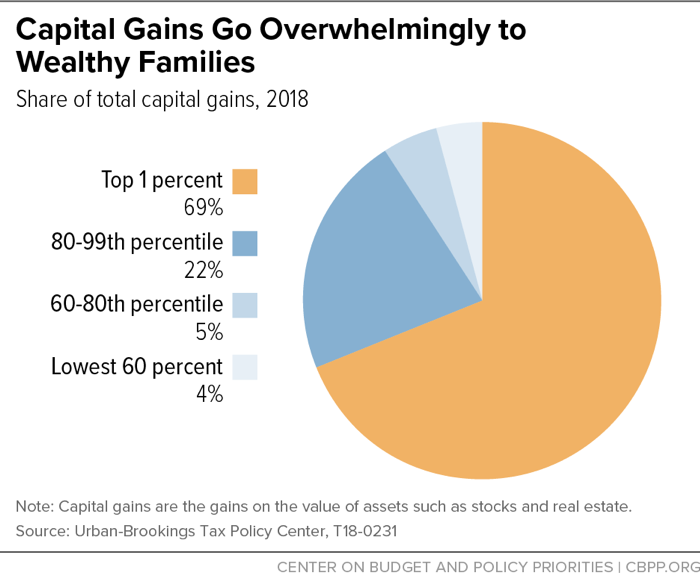

That goes for both earned income wages salary commissions and unearned income interest and dividends. This guide explains your responsibilities as an employer including collecting your employee s tax reporting information calculating withholding and filing and paying withholding taxes. Massachusetts is a flat tax state that charges a tax rate of 5 05.

Including federal and state tax rates withholding forms and payroll tools. Neither these calculators nor the providers. Massachusetts state does not have any reciprocity agreement with other states.

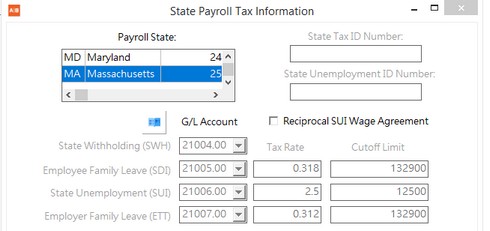

If you re an employer you need to withhold massachusetts income tax from your employees wages. Your free and reliable massachusetts payroll and tax resource. However each state specifies its own rates for income unemployment and other taxes.

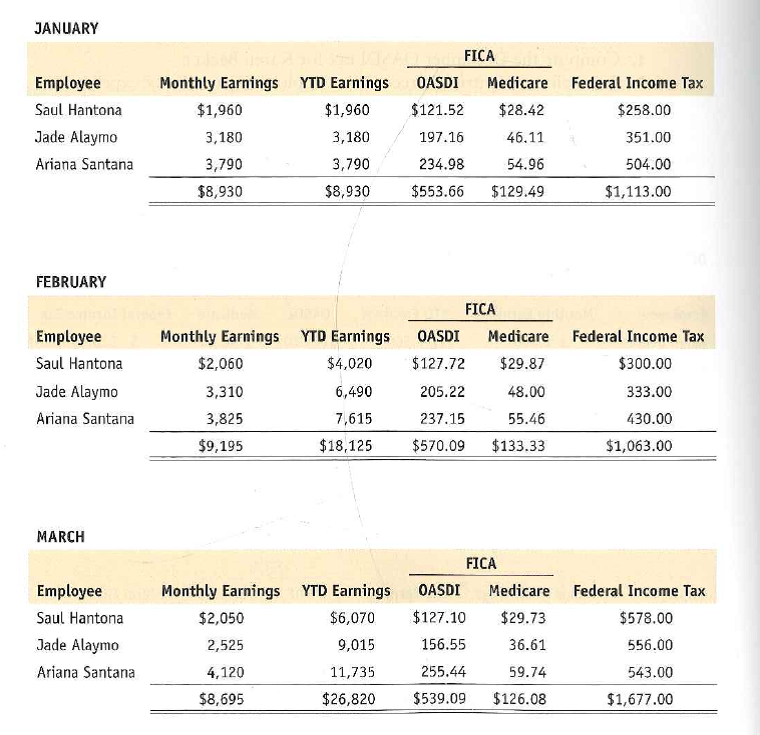

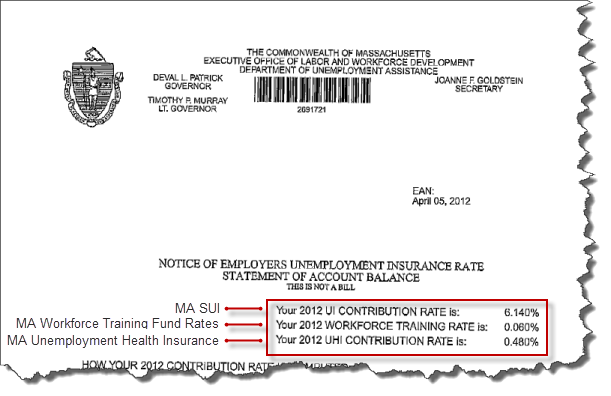

Federal payroll tax rates like income tax social security 6 2 each for both employer and employee and medicare 1 45 each are set by the irs. Massachusetts state unemployment insurance sui. Income taxes in massachusetts run at a flat rate of 5 for the 2020 tax year which means that regardless of whether your employee makes a hundred dollars or a hundred thousand the tax rate remains the same.

%20(DAS).jpg)