What Is The Payroll Tax Rate In Texas

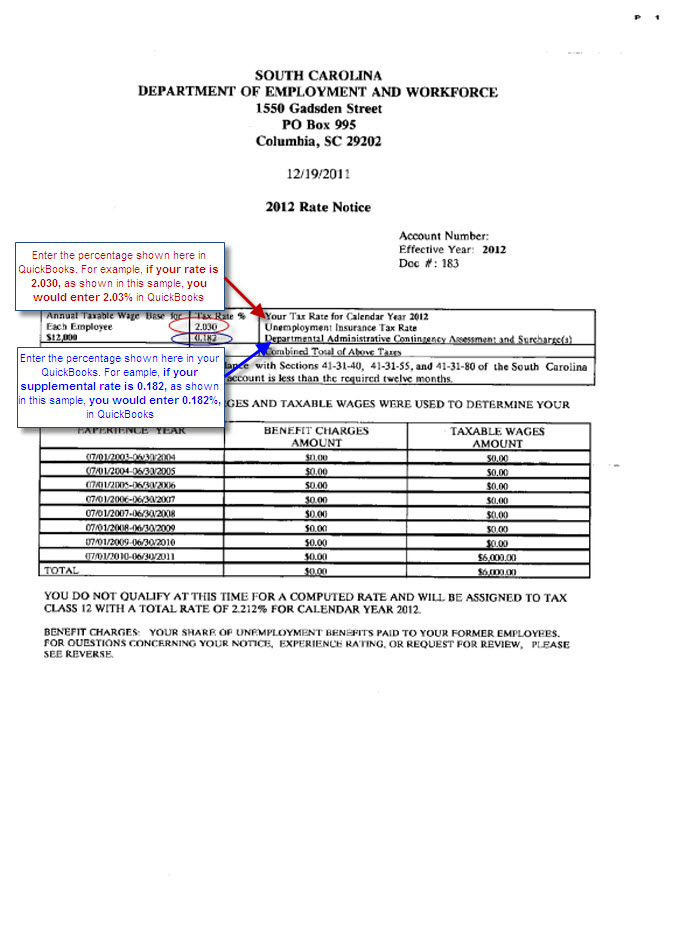

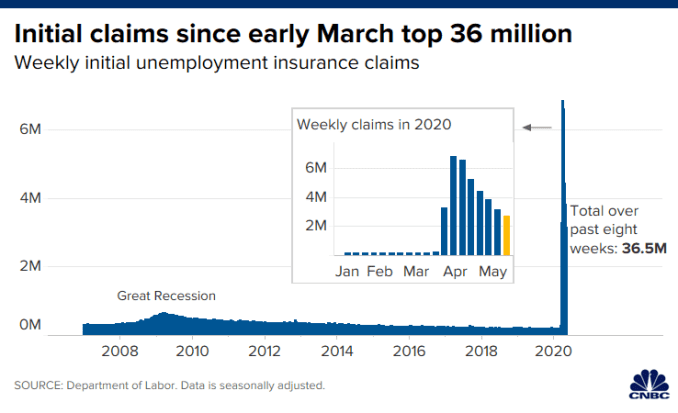

For 2010 the minimum rate was 72 percent and the maximum was 8 60 percent.

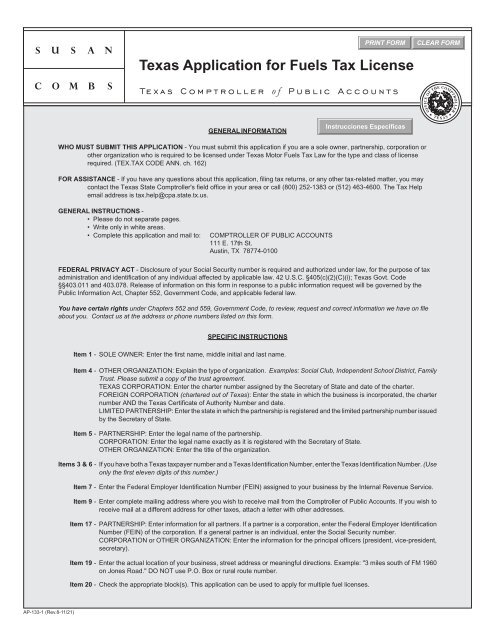

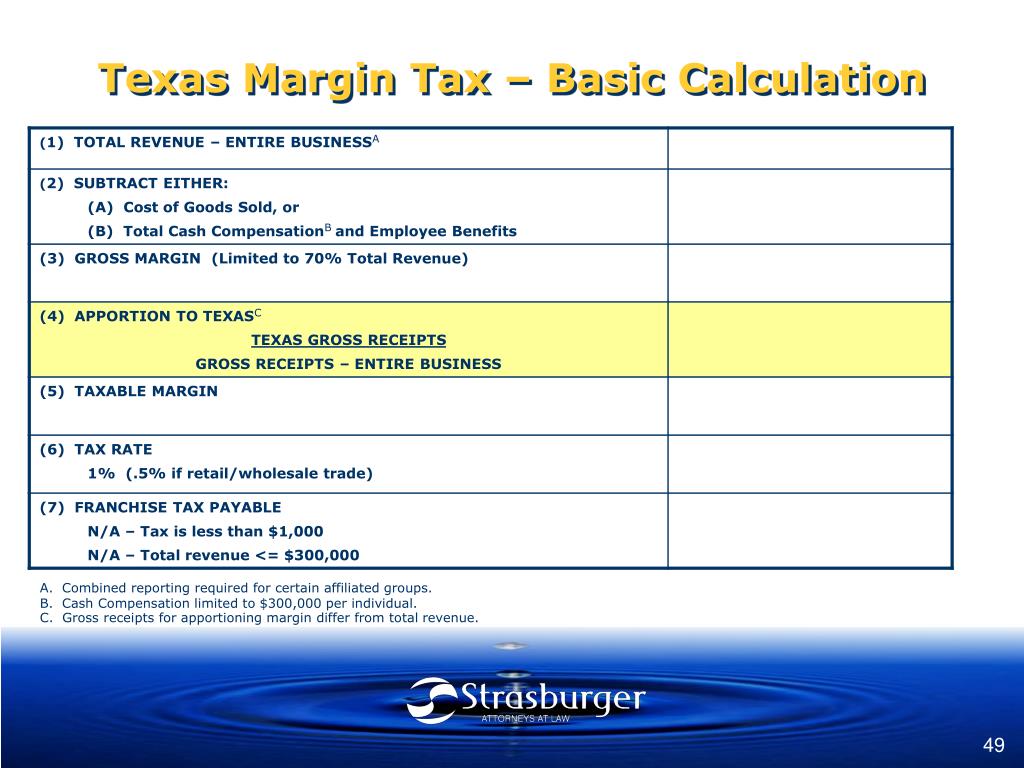

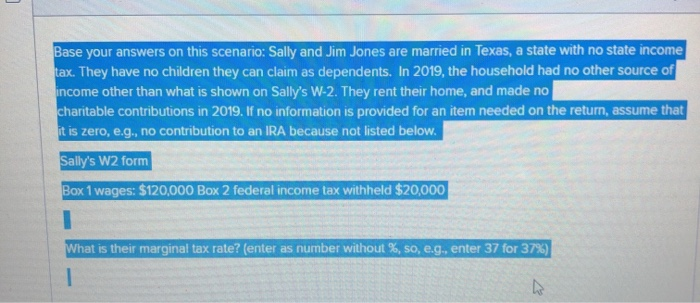

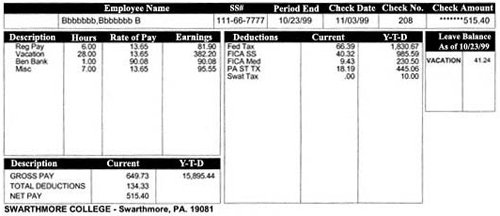

What is the payroll tax rate in texas. Most payroll earnings use the irs percentage method tables for income tax. However non regular earnings including but not limited to. This percentage will be the same for all employers in a given year.

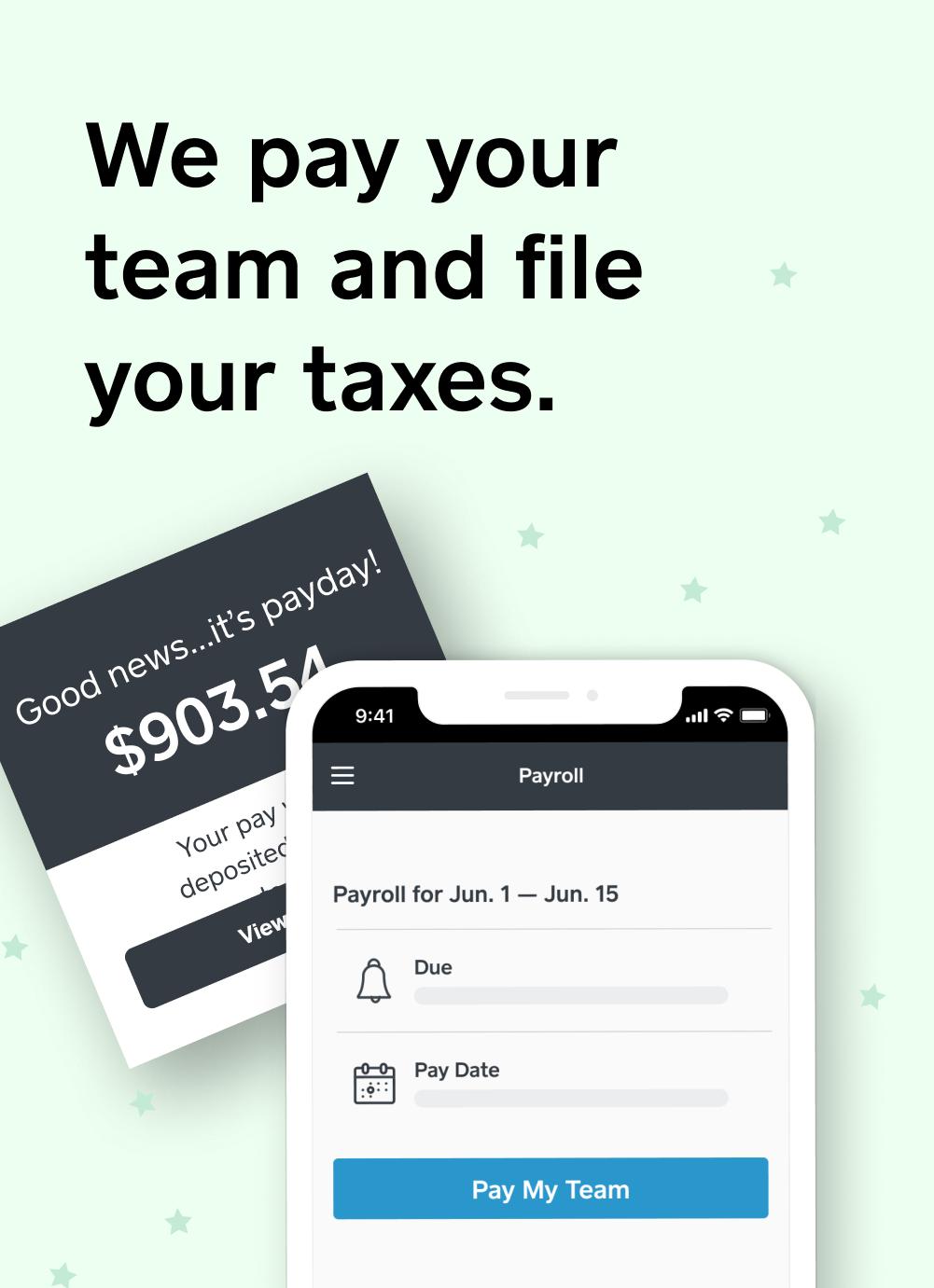

Payroll taxes in texas are relatively simple because there are no state or local income taxes. The employee tax rate for medicare is 1 45 and the employer tax rate for medicare tax is also 1 45 or 2 9 total. When you start a new job you.

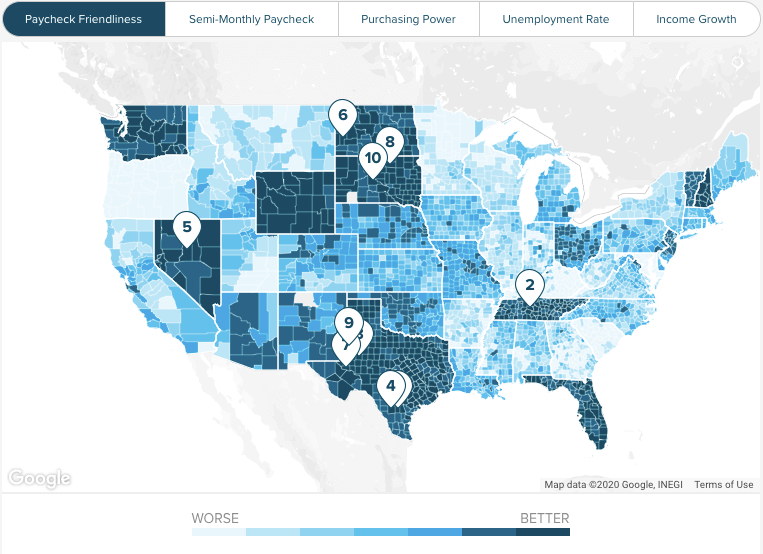

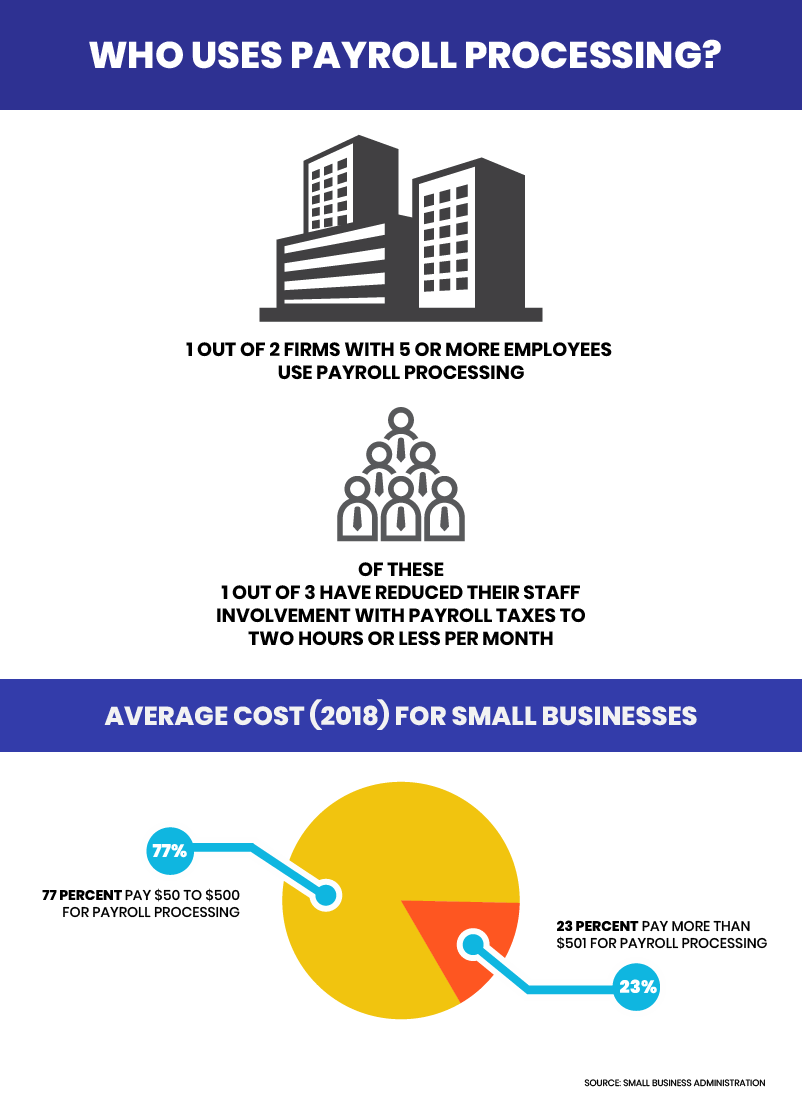

Related how to run a drama free family business 2 families spill their secrets hiring and growth. Below is a state by state map showing tax rates including supplemental taxes and workers compensation. Employees have different amounts of federal income tax withheld from their paycheck depending on their tax rate and their number of dependents.

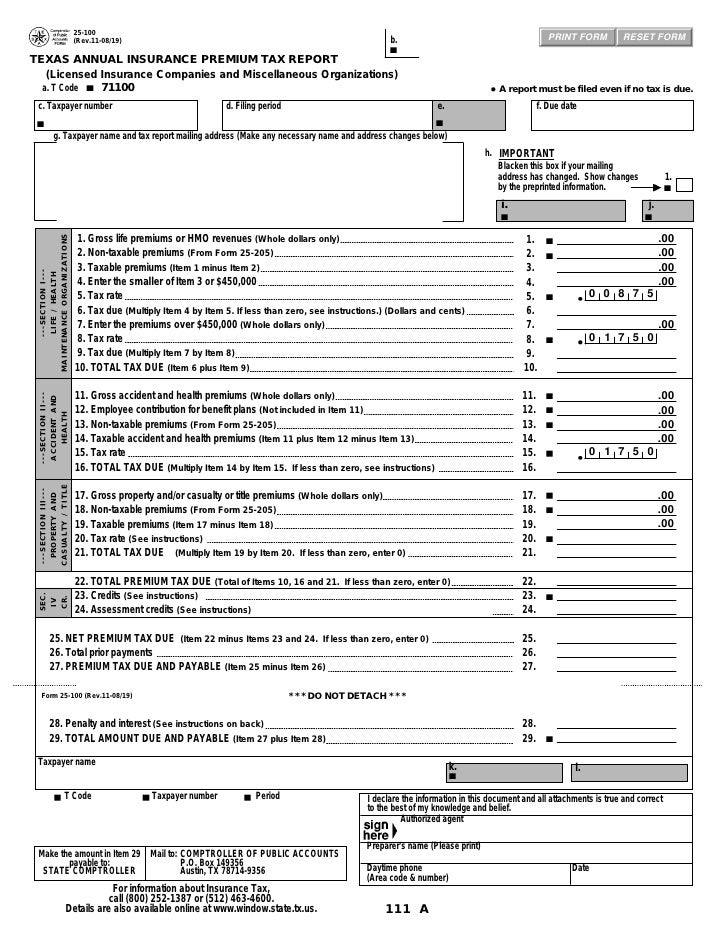

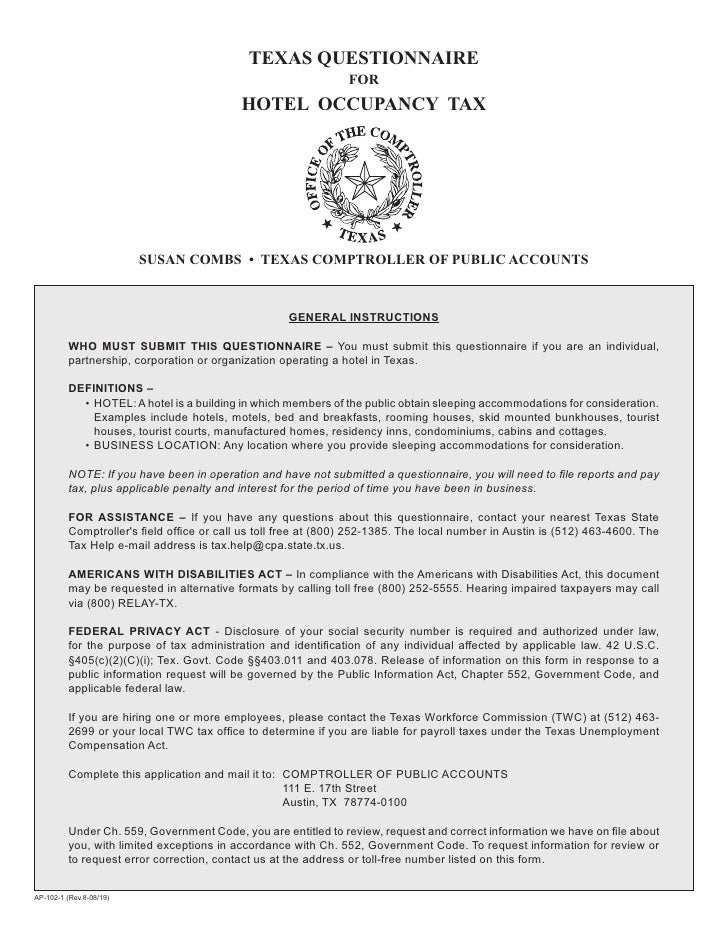

Though texas specific payroll taxes are a walk in the park with a cool autumn breeze and cotton candy setting sun you still have the nuisance that is federal payroll taxes. The interest tax is calculated according to commission rule. Texas is a good place to be self employed or own a business because the tax withholding won t be too much of a headache.

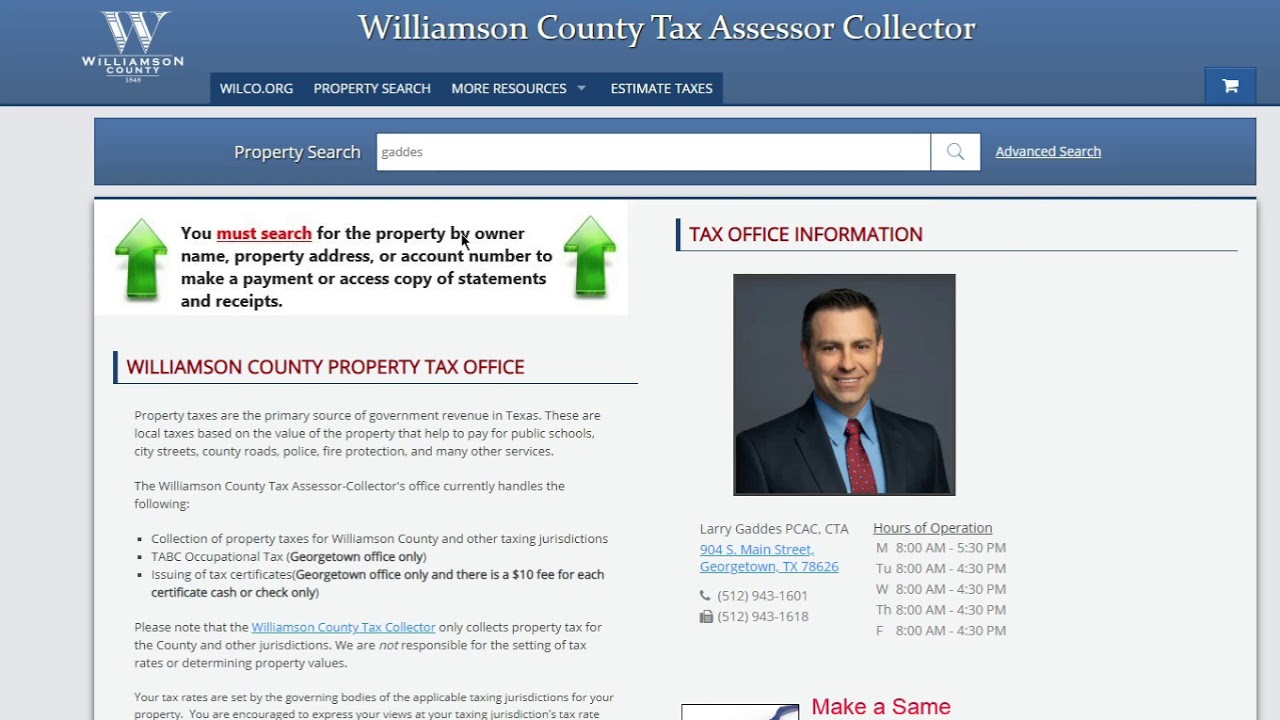

These taxes are imposed on. The main taxes employers have to pay in texas. However each state specifies its own rates for income unemployment and other taxes.

New hampshire and tennessee only tax income from interest and dividends washington d c and numerous cities. The interest tax rate for 2020 is 0 00 percent. There is no employer match for this tax.

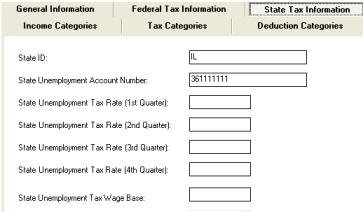

Federal payroll tax rates like income tax social security 6 2 each for both employer and employee and medicare 1 45 each are set by the irs. The texas workforce commission advises the employer of its suta tax rate for the year. In the united states payroll taxes are assessed by the federal government some of the fifty states alaska florida nevada south dakota texas washington and wyoming do not have state income tax.

New employers generally have a rate of 2 70 percent or the average industry tax rate whichever is greater. The suta wage base for 2010 was 9 000. The interest tax rate is used to pay interest on federal loans to texas if owed used to pay unemployment benefits.

Awards one time merits relocation and taxable moving payments use the supplemental wage flat rate of 22 percent. Calculate state unemployment tax. The additional medicare tax of 0 09 is withheld on income above 200 000 each.

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)

/https://static.texastribune.org/media/files/0b9158e22297f58df4322300b2ee0b0d/San%20Marcos%20COVID%20File%20EG%20TT%2016.jpg)

/https://static.texastribune.org/media/images/2015/08/19/31-Days-26-UnemploymentTax.jpg)

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

/US_states_by_GDP_per_capita_nominal-f89d1ca278a649a9b47e858ee41e7f09.png)