What Is The Payroll Tax Rate In Nc

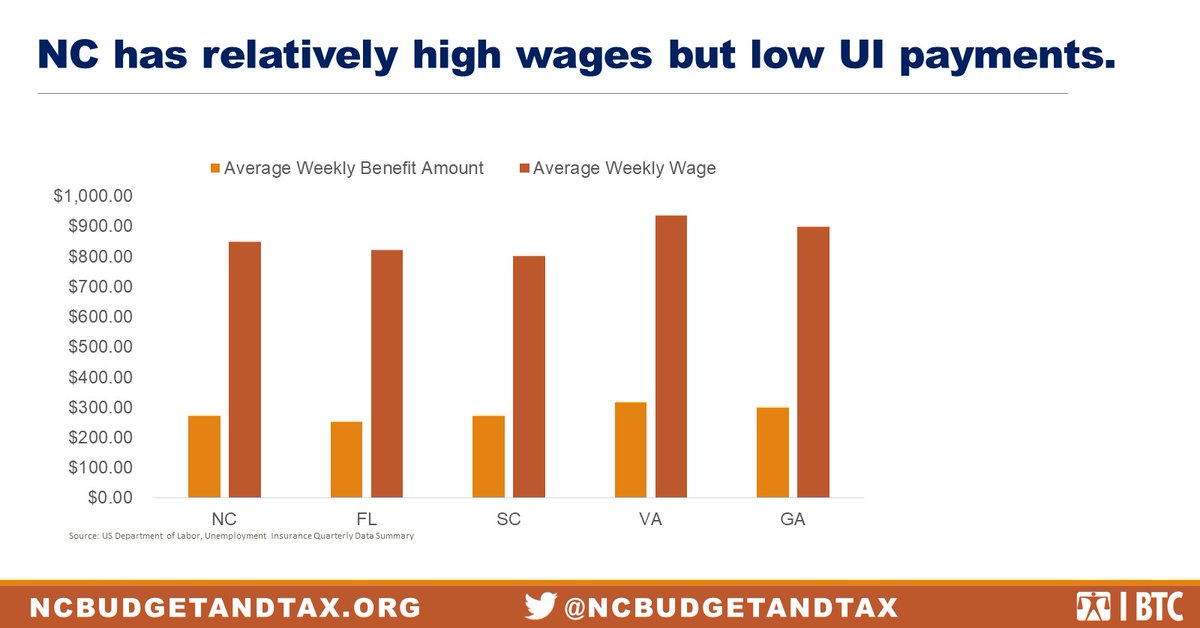

North carolina s ui tax rates are determined under an experience rating system.

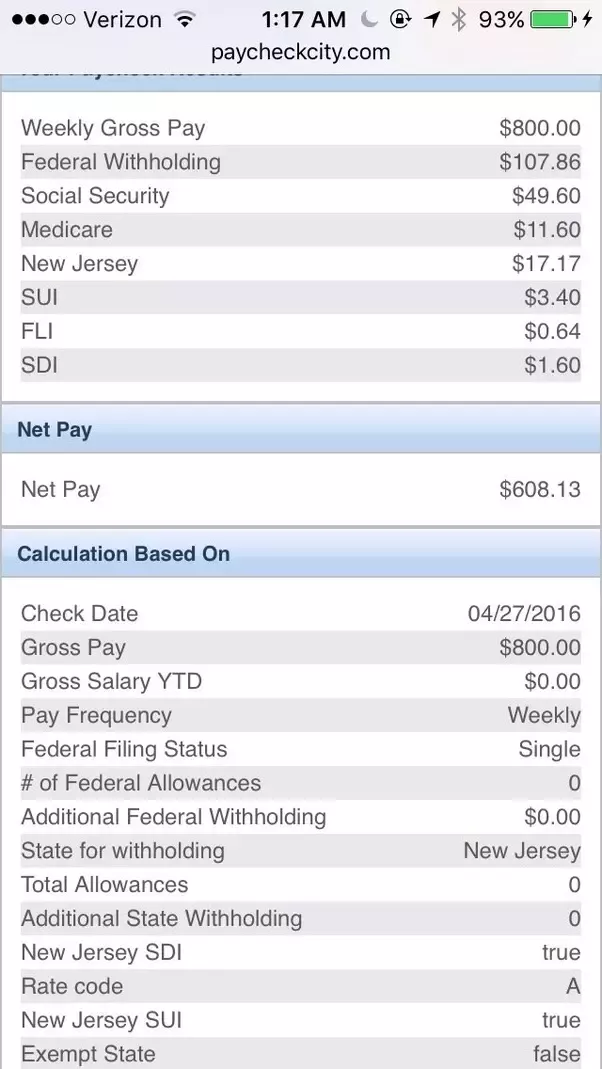

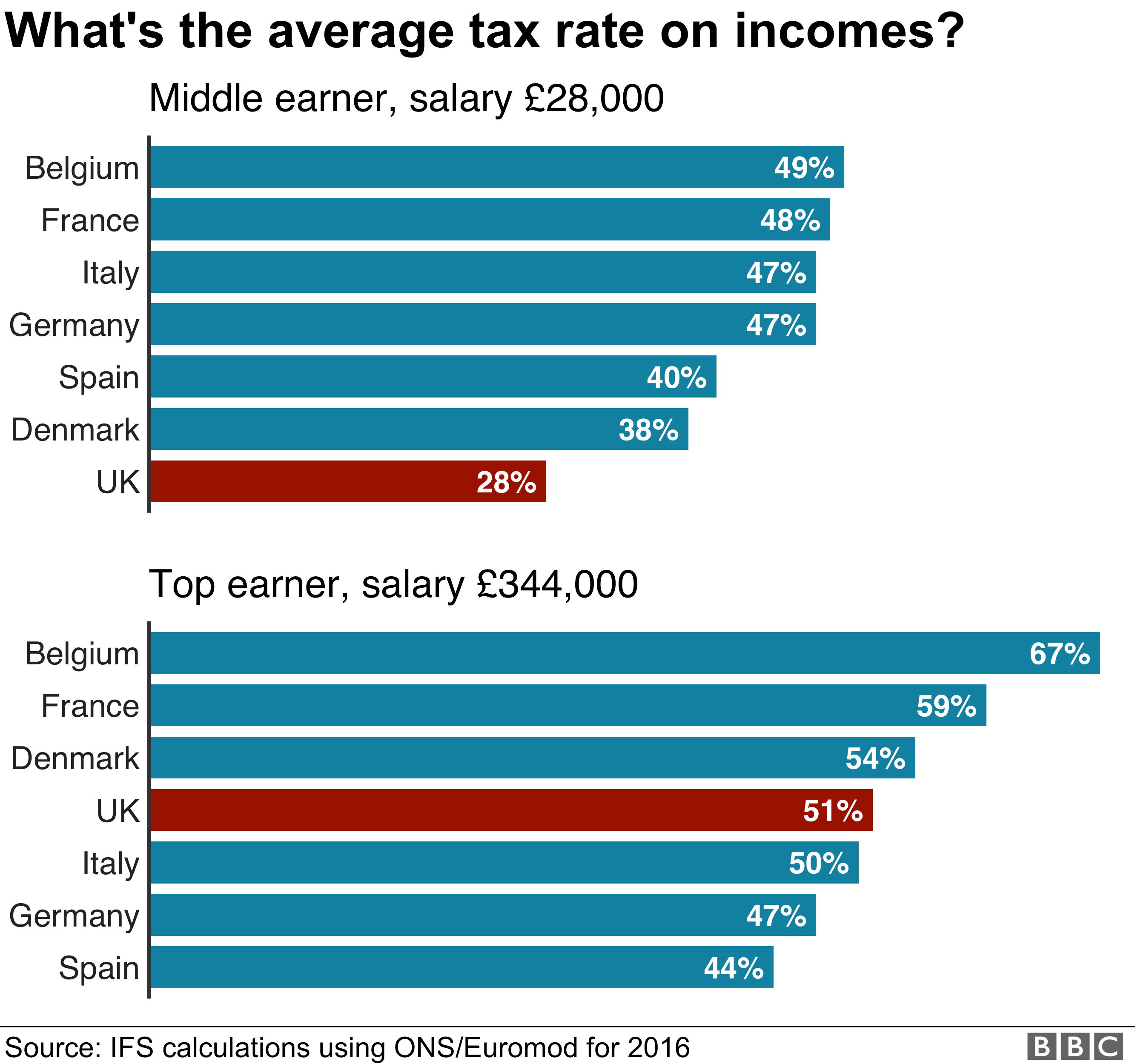

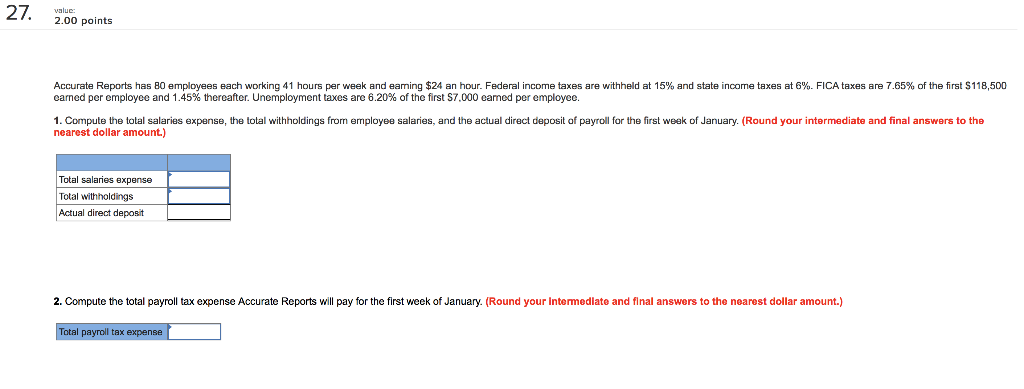

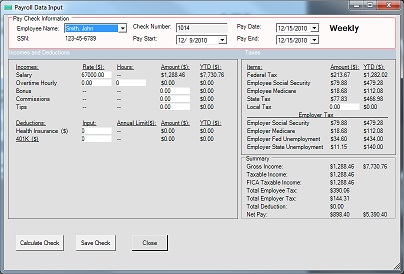

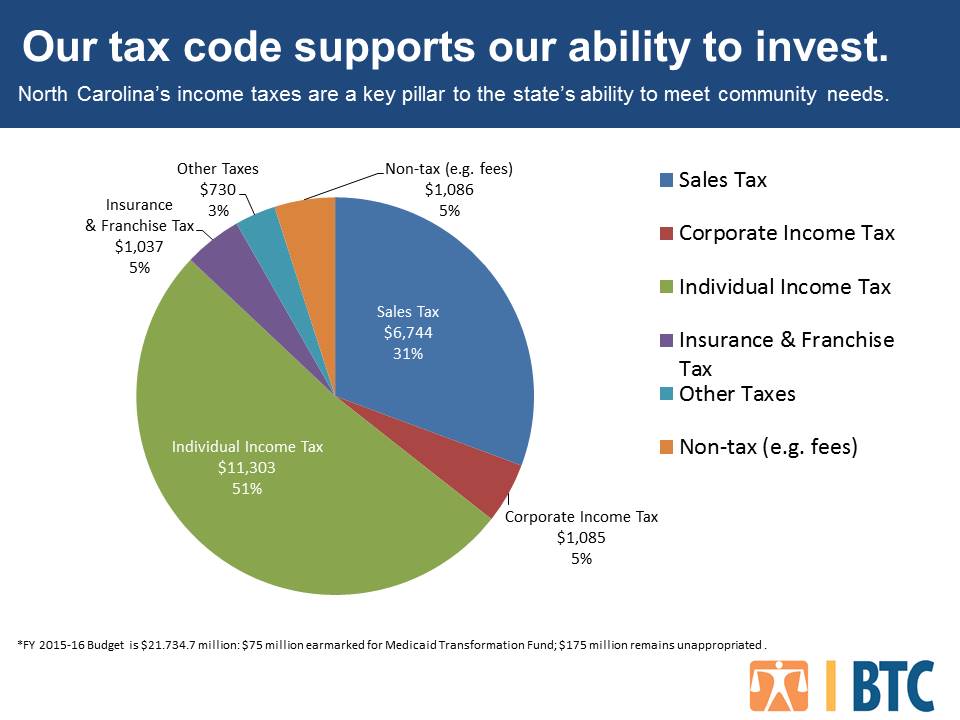

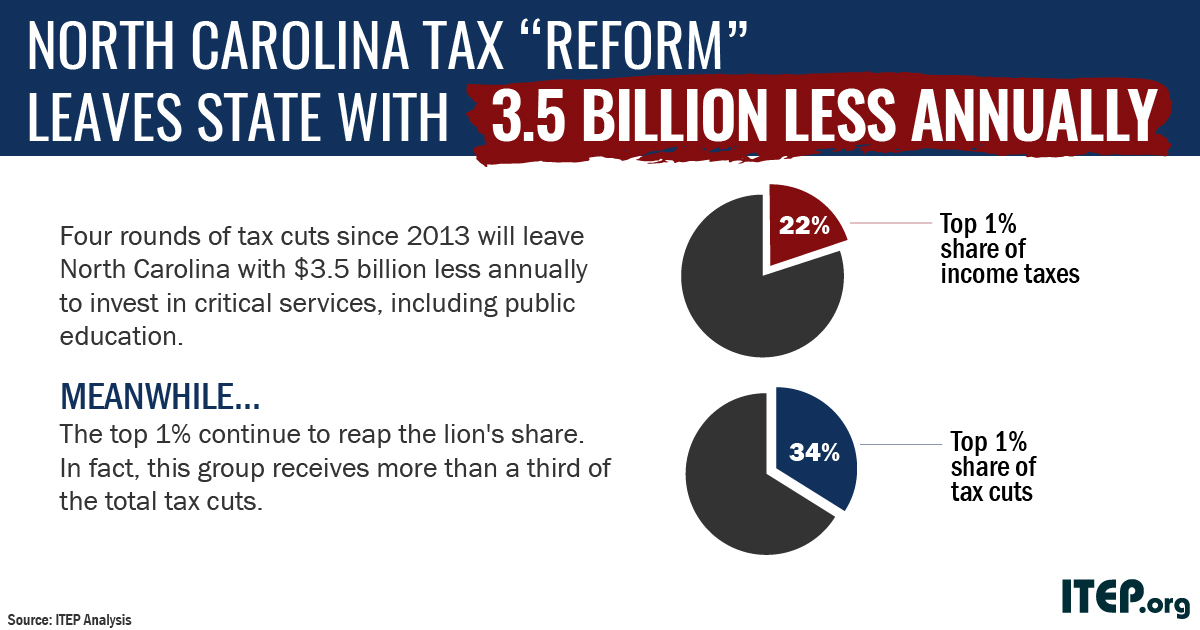

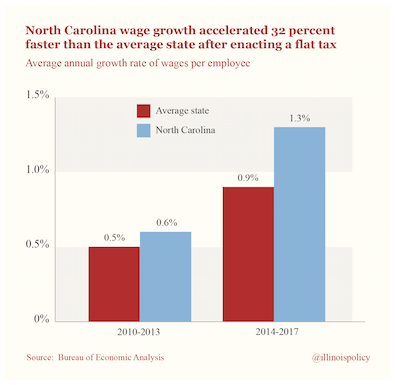

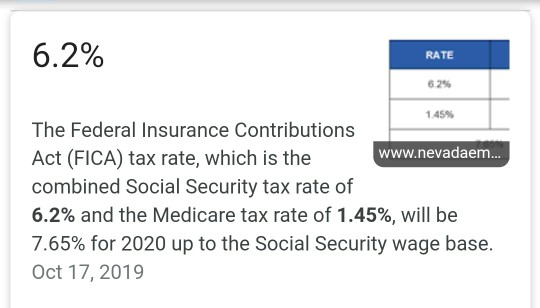

What is the payroll tax rate in nc. In 2013 the north carolina tax simplification and reduction act radically changed the way the state collected taxes. Federal payroll tax rates like income tax social security 6 2 each for both employer and employee and medicare 1 45 each are set by the irs. North carolina has not always had a flat income tax rate though.

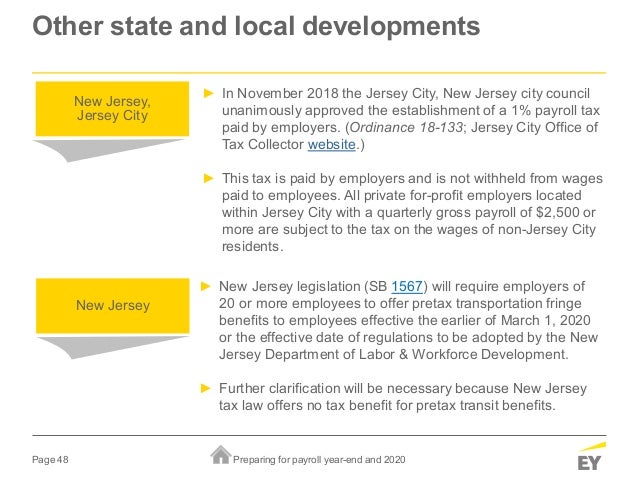

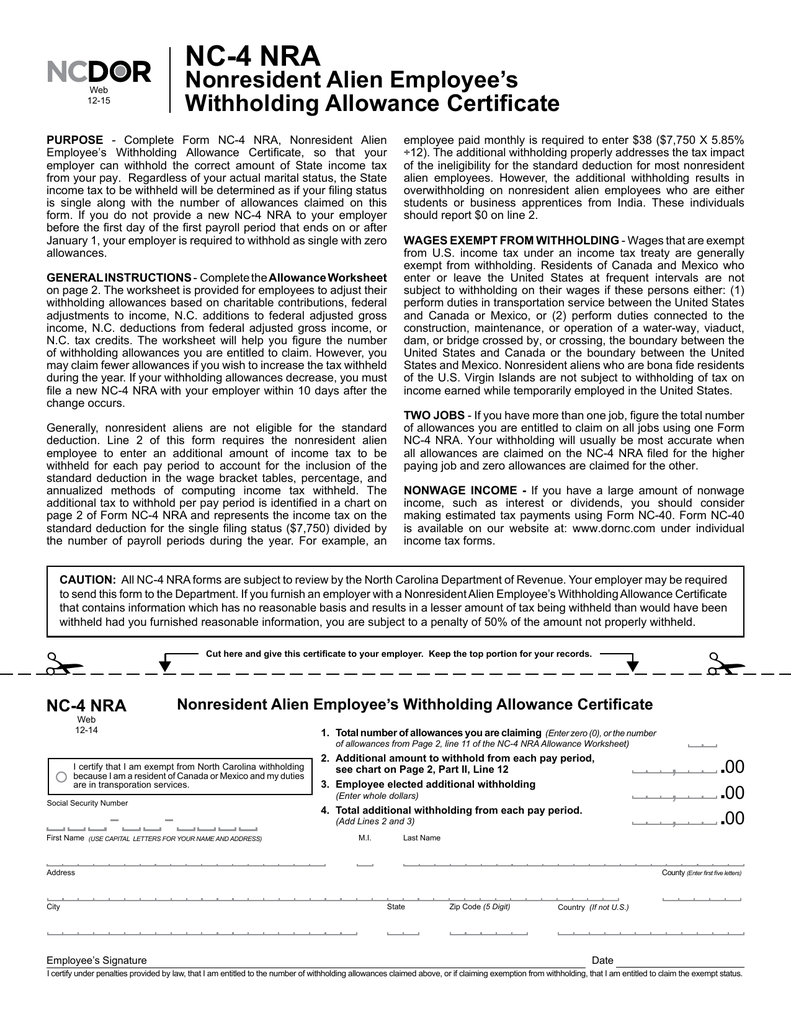

Employees fill out nc 4 north carolina employee s withholding allowance certificate to be used when calculating withholdings. North carolina s unemployment taxable wage base is to be 25 200 for 2020 up from 24 300 in 2019 a spokesman for the state department of commerce said nov. However each state specifies its own rates for income unemployment and other taxes.

What are my state payroll tax obligations. A contractor that qualifies for one of the exceptions to withholding is still subject to north carolina income tax on the compensation received for services performed in north carolina and must file the appropriate north carolina income tax return to report the compensation. Once an employer is eligible to receive a reduced tax rate the tax rate is determined annually based on experience.

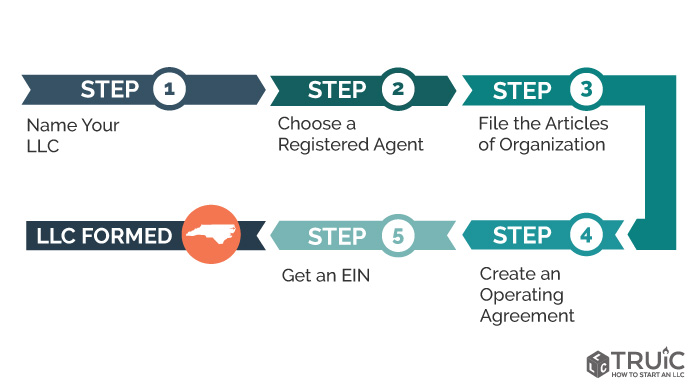

North carolina payroll tax and registration guide updated december 05 2016 for administrators and employees north carolina has state income tax and state unemployment insurance sui and requires employers who pay employees in nc to register with the nc department of revenue and the nc employment security commission. North carolina department of commerce division of employment security vendor payable name division of employment security mailing address p o. North carolina payroll calculators.

Below is a state by state map showing tax rates including supplemental taxes and workers compensation. Experience rating is affected by payroll tax paid timeliness of payments and unemployment insurance benefits charged against the employer s. The irs has stated that the new 941 should be used starting with second quarter of 2020 to report retained taxes under the covid 19 tax credits.

There is a flat income tax rate of 5 25 which means no matter who you are or how much you make this is the rate that will be deducted. Calculate your north carolina net pay or take home pay by entering your pay information w4. North carolina payroll taxes.

North carolina requires employers to withhold state income taxes from employee paychecks in addition to employer paid unemployment taxes you can find north carolina s tax rates here. North carolina payroll taxes are as easy as a walk along the outer banks.

/cdn.vox-cdn.com/uploads/chorus_asset/file/14724117/Undocumented_immigrant_tax_contributions2.jpg)