What Is The Payroll Tax Rate In Virginia

Calculate your state income tax step by step 6.

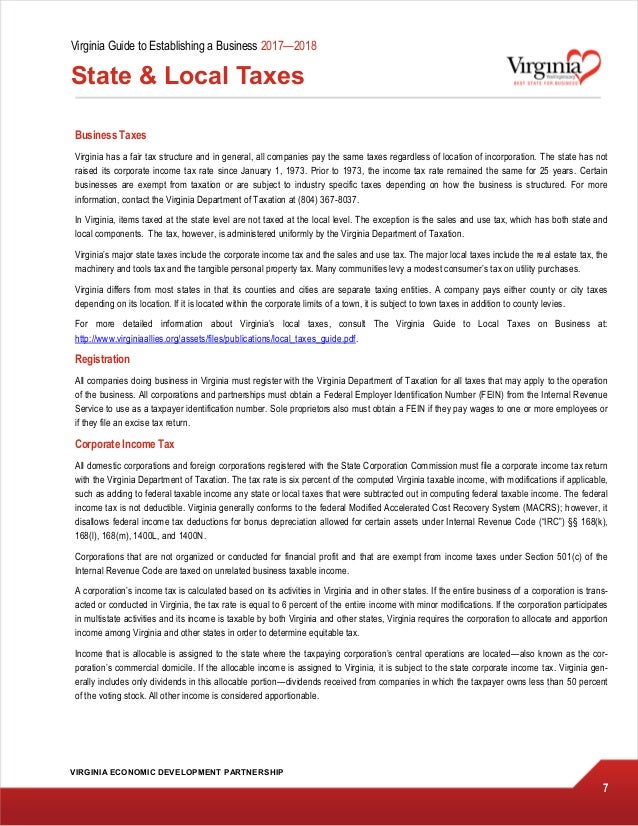

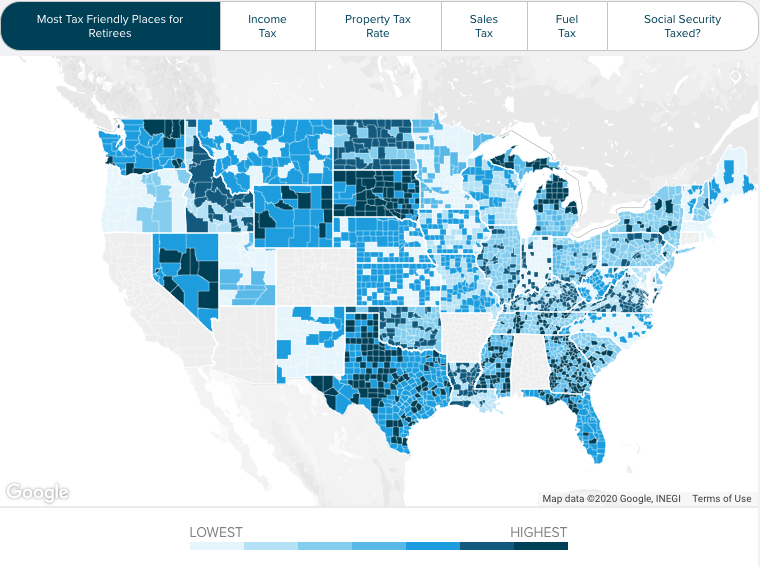

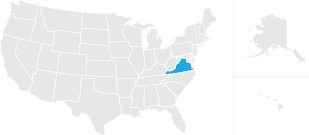

What is the payroll tax rate in virginia. 31 of the following calendar year or within 30 days after the final payment of wages by your company. The base statewide sales tax rate of 4 3 in virginia is combined with a statewide local rate of 1 meaning the effective floor for sales taxes in virginia is 5 3. Register with the virginia employment commission.

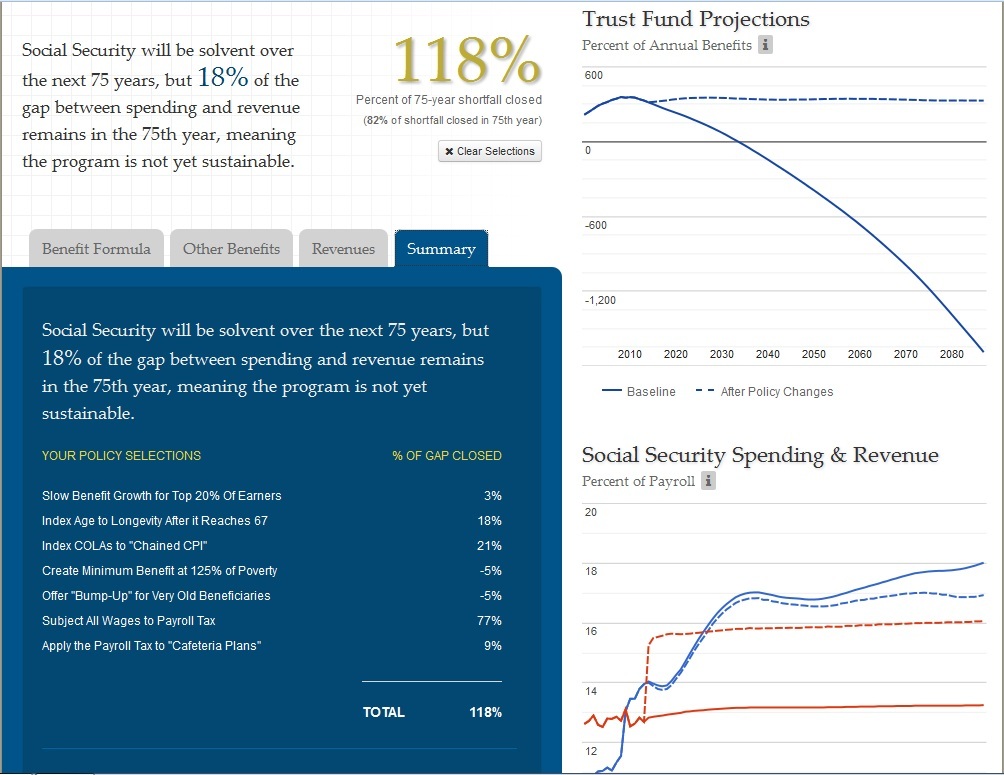

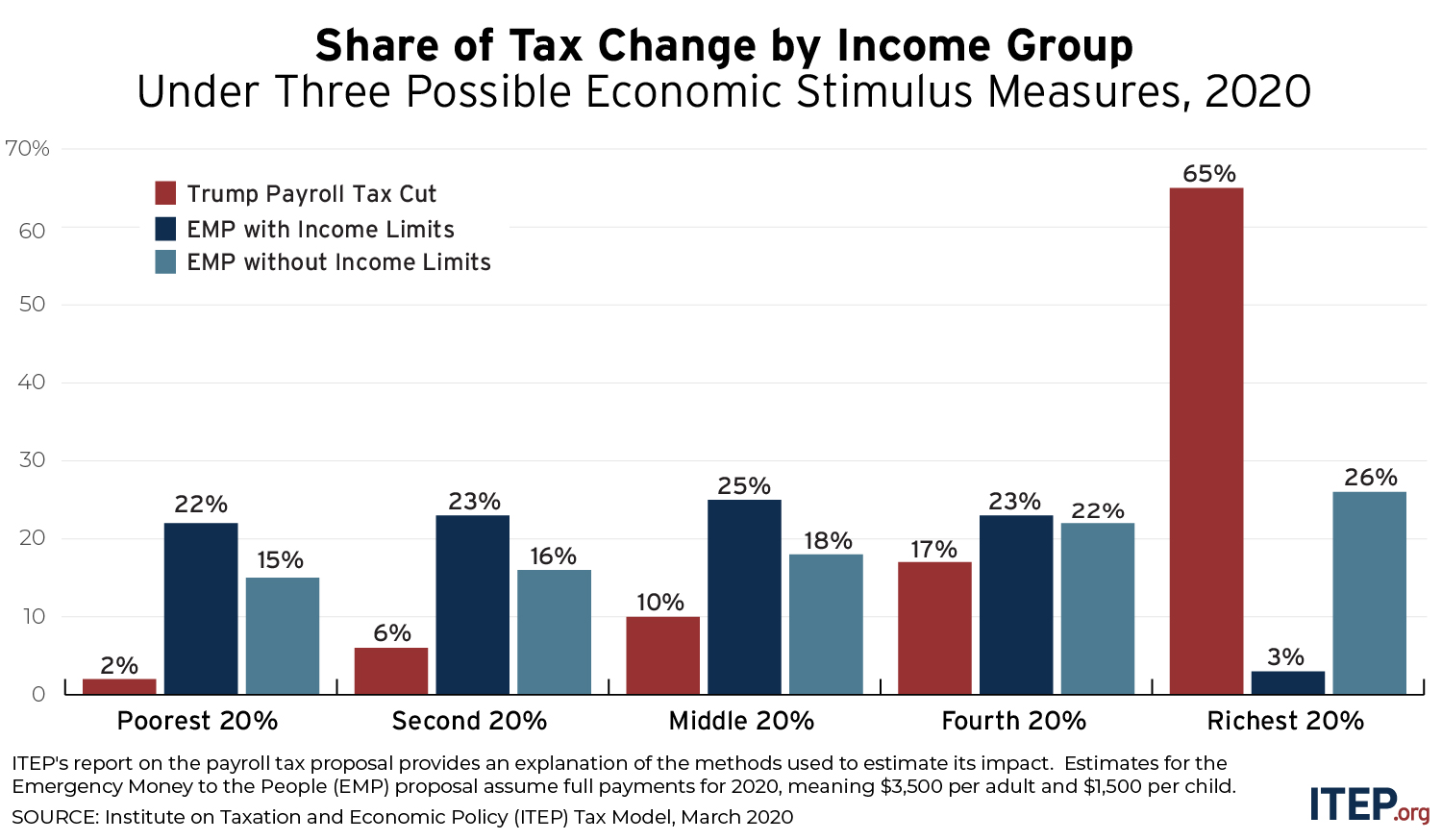

What are my state payroll tax obligations. Virginia has a progressive state income tax system with four tax brackets that range from 2 to 5 75. Overview of virginia taxes.

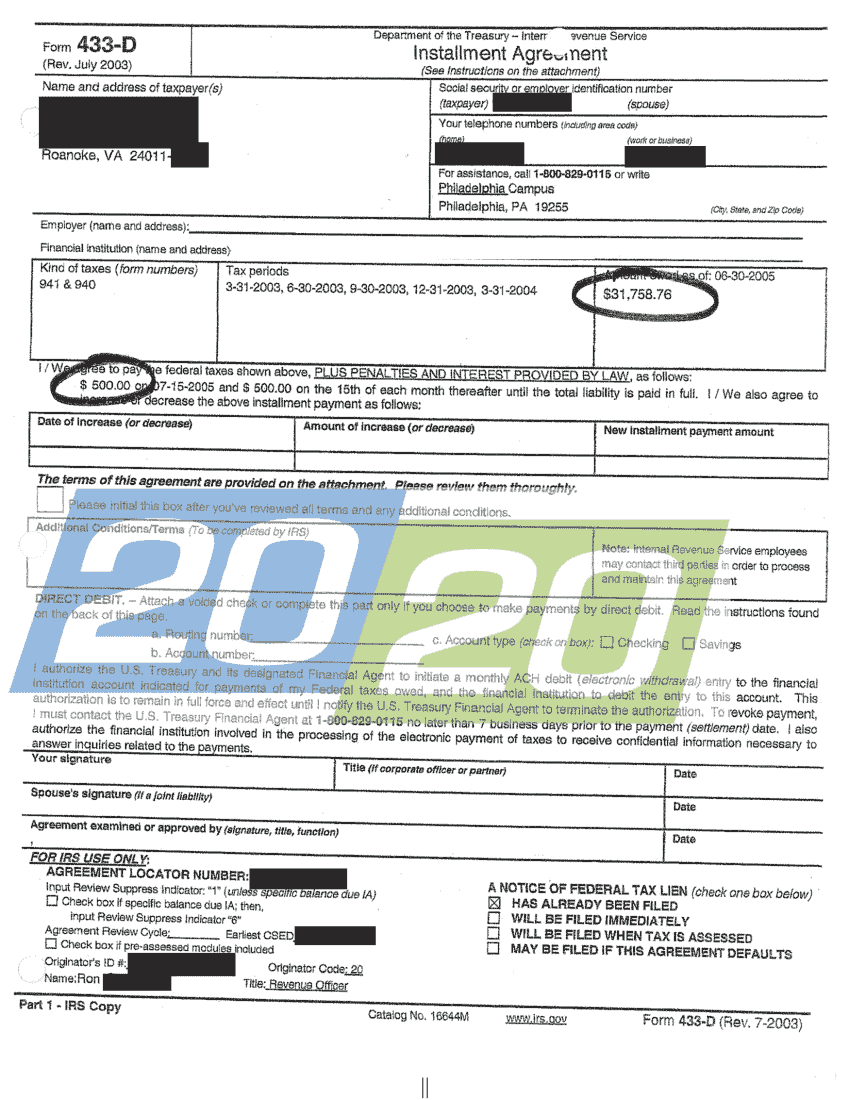

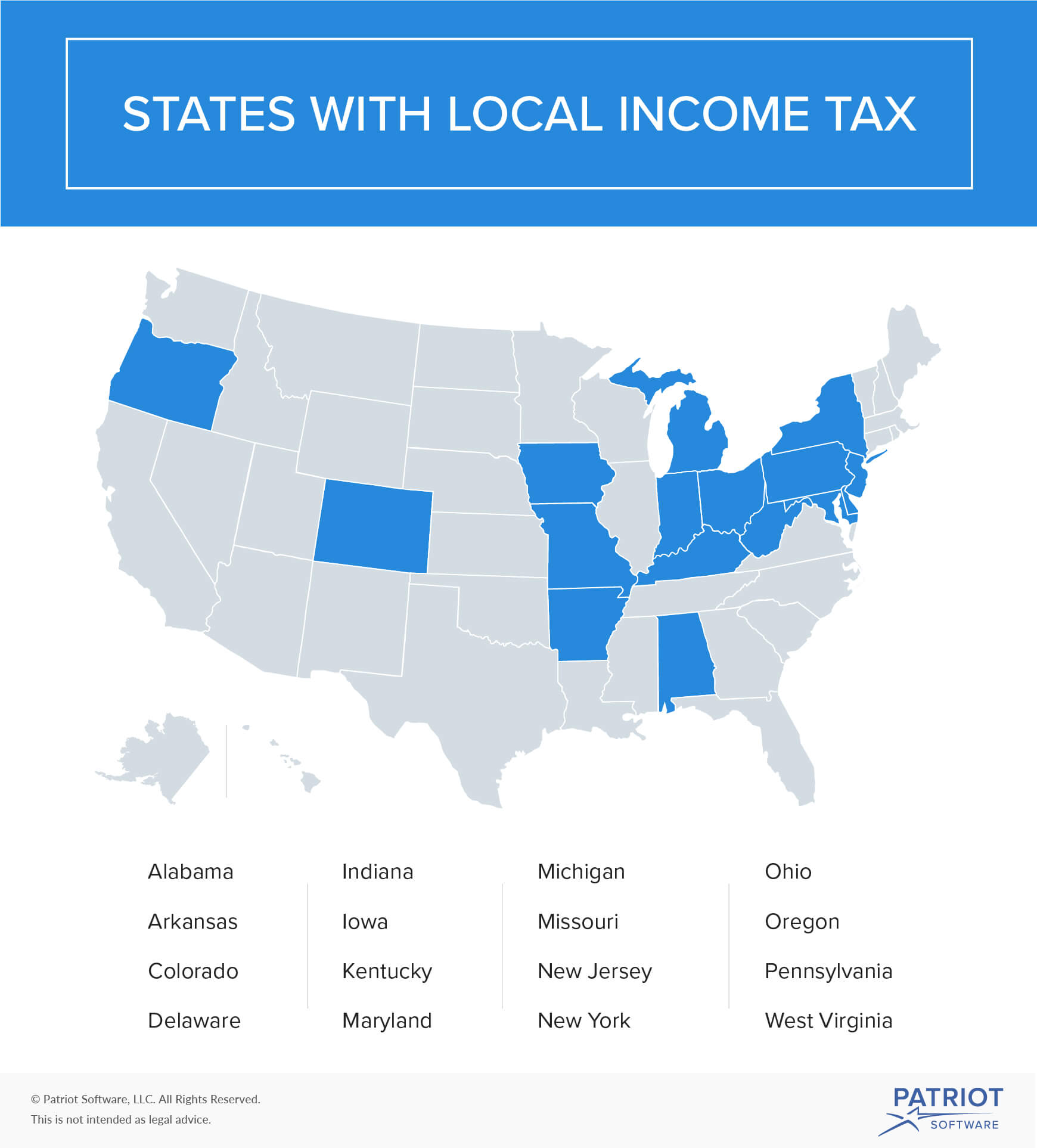

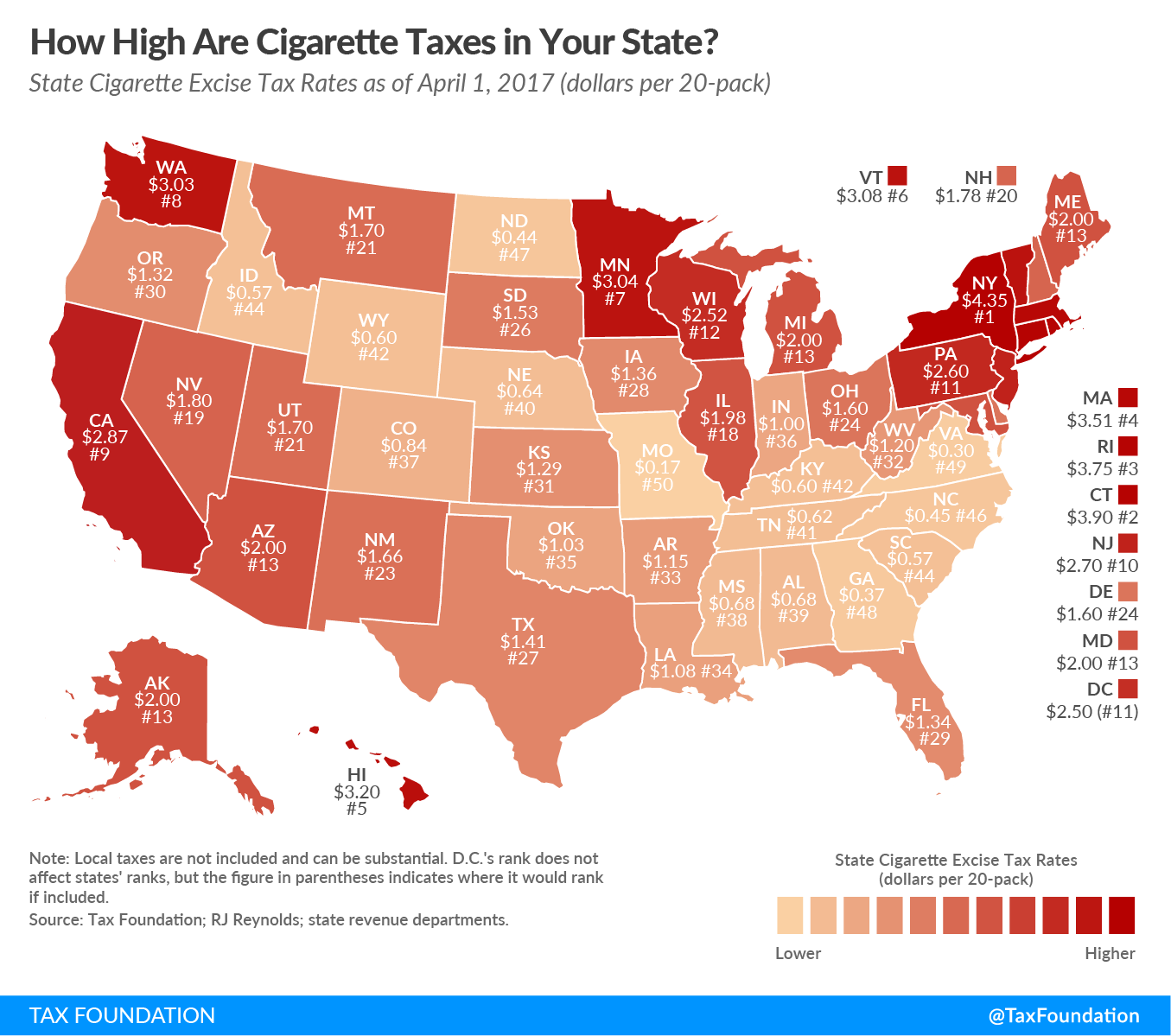

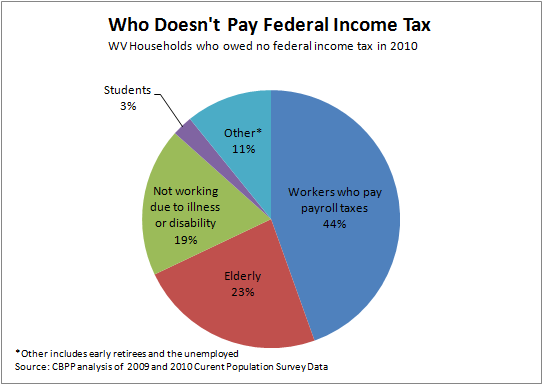

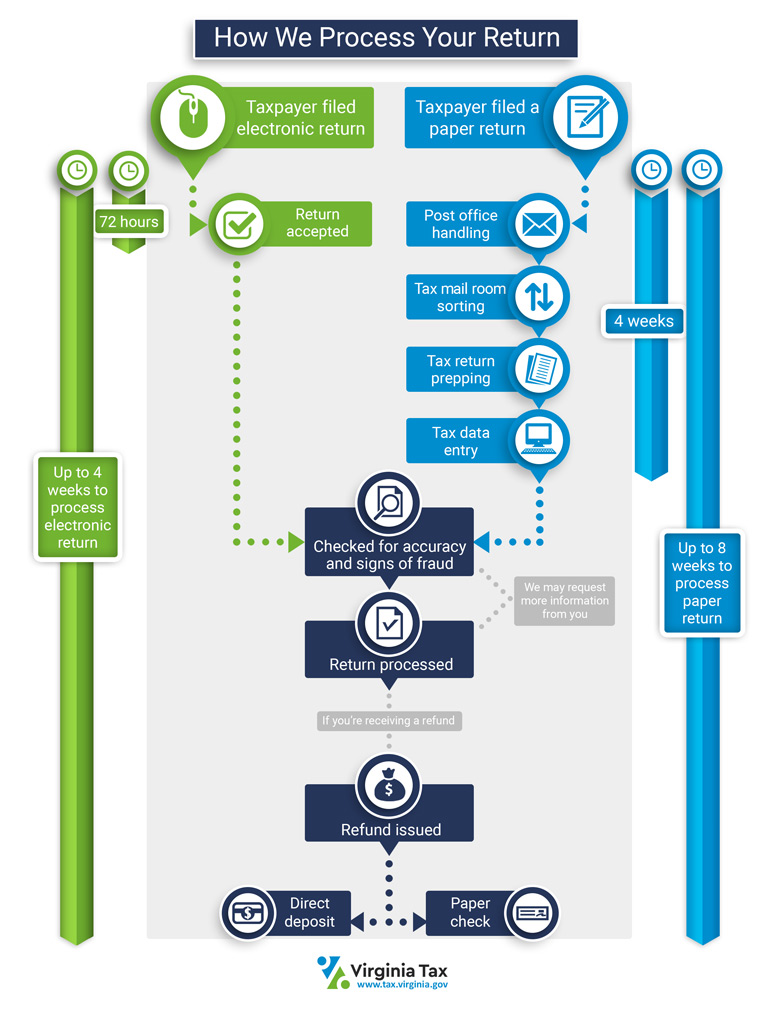

The fica tax rate is 15 3 of taxable wages. West virginia requires employers to withhold state income taxes from employee paychecks in addition to employer paid unemployment taxes you can find west virginia s tax rates here employees fill out wv it 104 employee s withholding exemption certificate to be used when calculating withholdings. All filers must file form va 6 employer s annual summary of virginia income tax withheld or form va 6h household employer s annual summary of virginia income tax withheld.

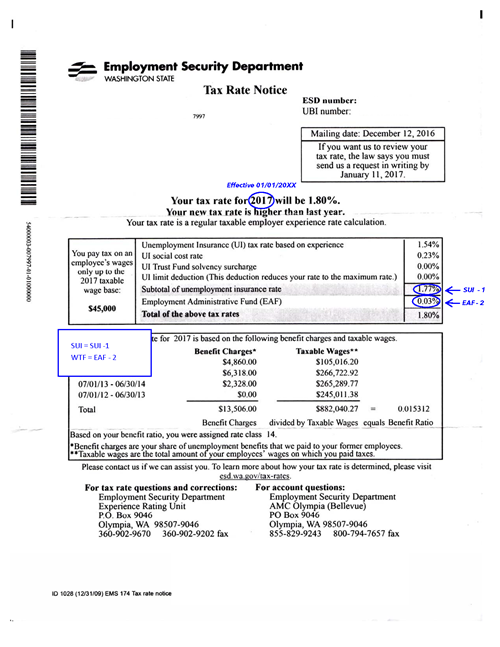

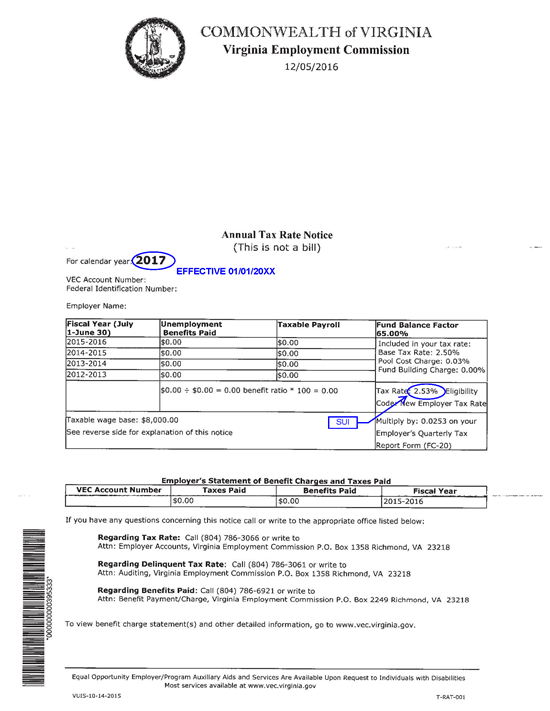

Virginia social security tax rate is 12 4 virginia medicare tax rate is 2 9. New employers generally have a rate between 0 11 6 21 includes 0 01 pool cost charge for suta with a wage base of 8 000. The va 6 and va 6h are due to virginia tax by jan.

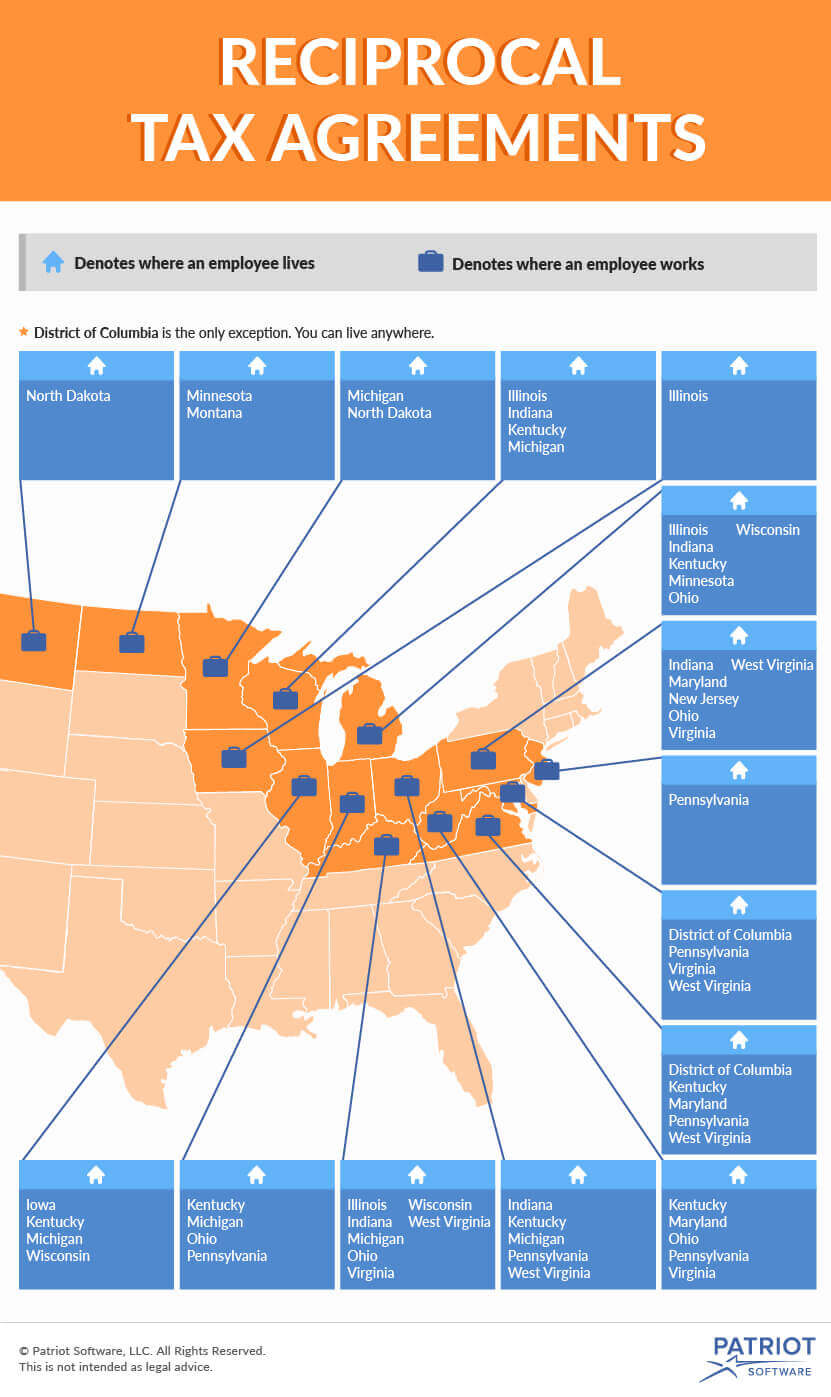

Since the highest rate applies to income over 17 000 most virginia taxpayers will find themselves paying the top rate at least partially. The virginia bonus tax percent calculator will tell you what your take home pay will be for your bonus based on the supplemental percentage rate method of withholding. West virginia has reciprocal agreements with kentucky.

The social security taxable wage base is the first 118 500 paid in wages to each employee during a calendar year. What are my state payroll tax obligations. If you want to simplify payroll tax calculations you can download ezpaycheck payroll software which can calculate federal tax state tax medicare tax social security tax and other taxes for you.

The medicare tax has no income limit. Virginia state payroll taxes. With four marginal tax brackets based upon taxable income payroll taxes in virginia are progressive.

Your unemployment tax rate can be found in the state unemployment insurance sui notice that you receive from the va employment commission. The bonus tax calculator is state by state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Since the top tax bracket begins at just 17 000 in taxable income per year most virginia taxpayers will pay the top rate.

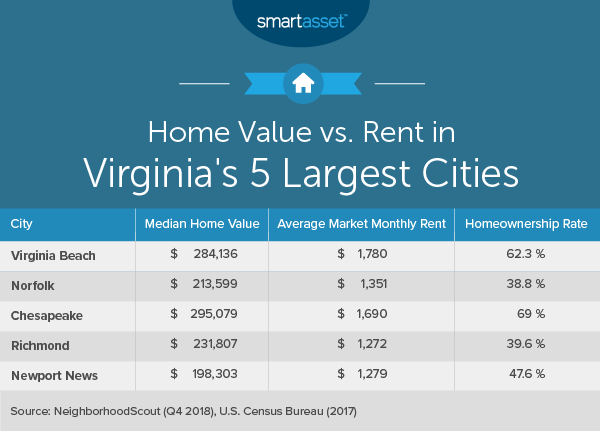

Virginia requires employers to withhold state income taxes from employee paychecks in addition to employer paid unemployment taxes you can find virginia s tax rates here employees fill out va 4 virginia employee s withholding allowance certificate to be used when calculating withholdings. In addition to that 5 3 rate localities in the northern virginia and hampton roads regions collect a 0 7 sales tax bringing the total in those areas to 6. The bracket you fall into will depend on your income level.

The fica tax is comprised of the social security tax and medicare tax.

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)

:max_bytes(150000):strip_icc()/Clipboard01-452705347a6e49ed8e82ca42d0a5cfa2.jpg)