What Is Payroll Tax Cut Proposal

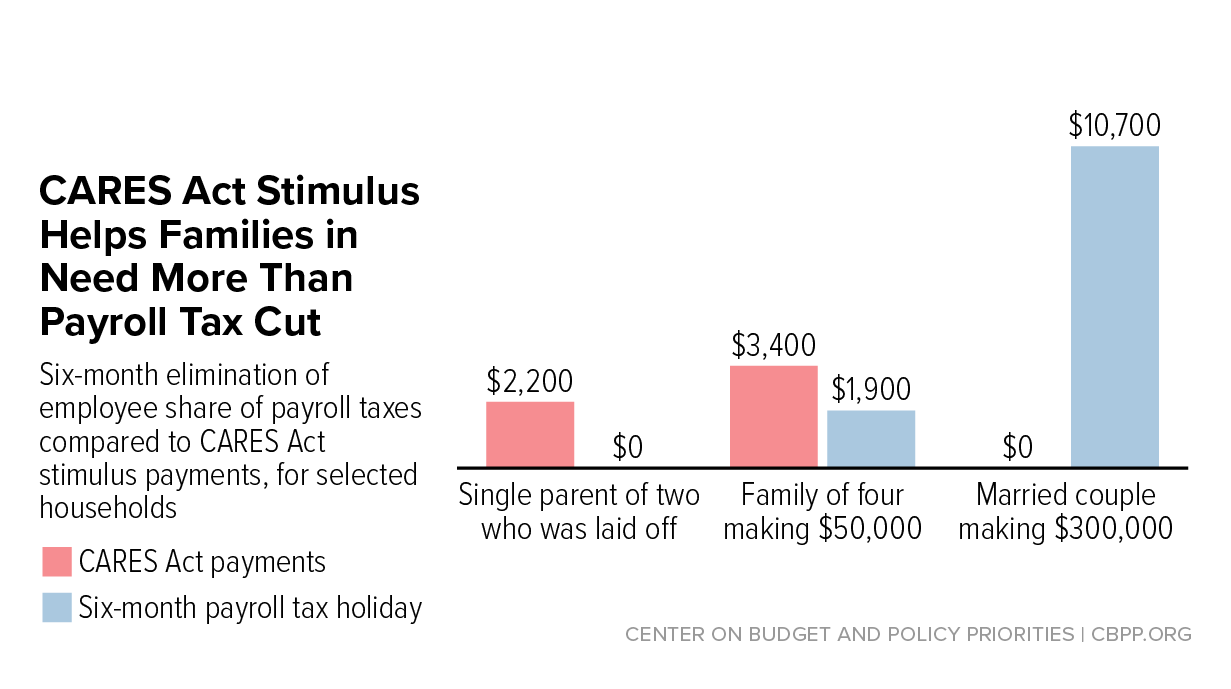

A payroll tax cut would do little to help workers without paid sick days or those who have lost shifts and tips senate finance committee ranking member ron wyden d ore said in a statement.

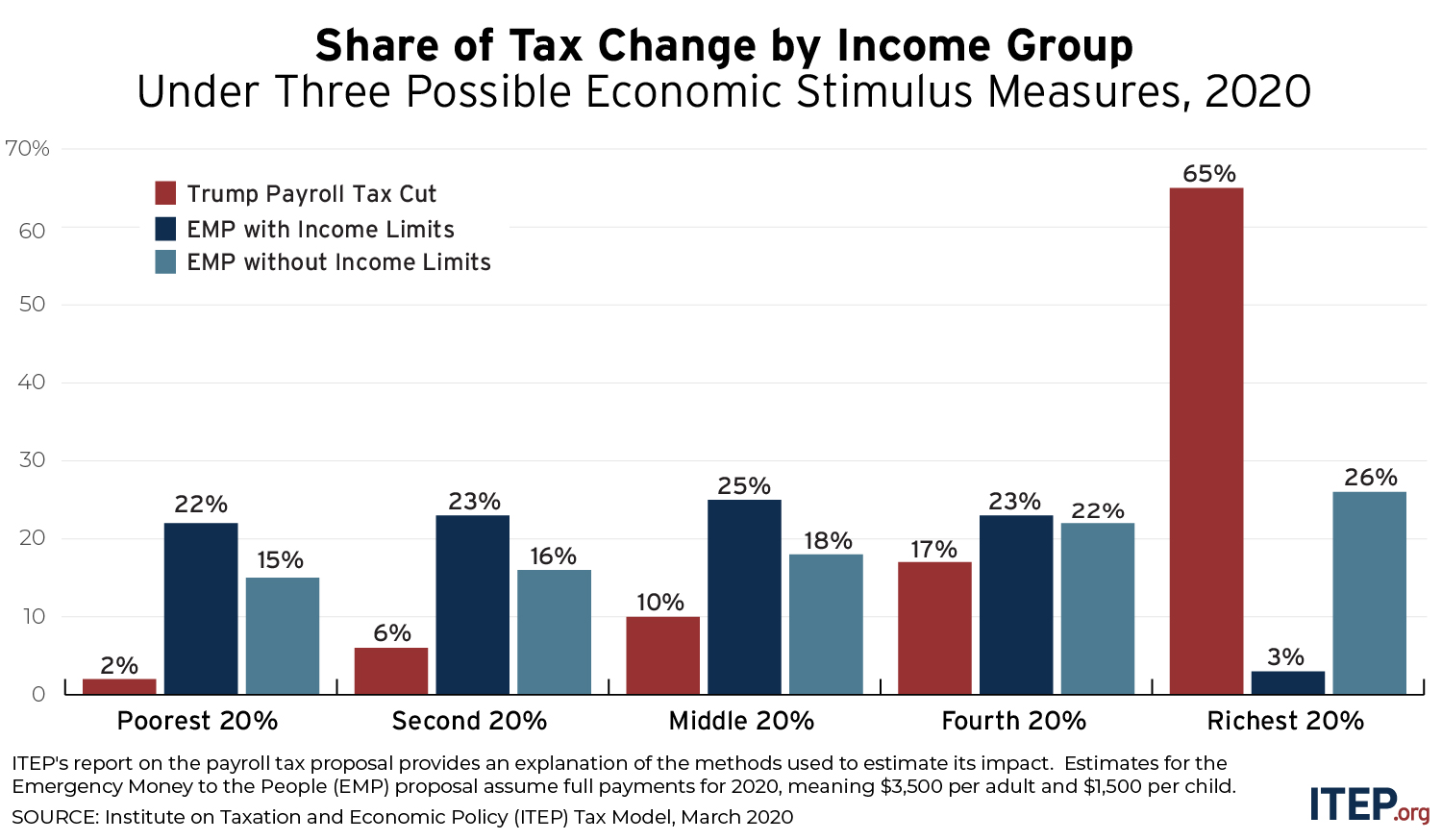

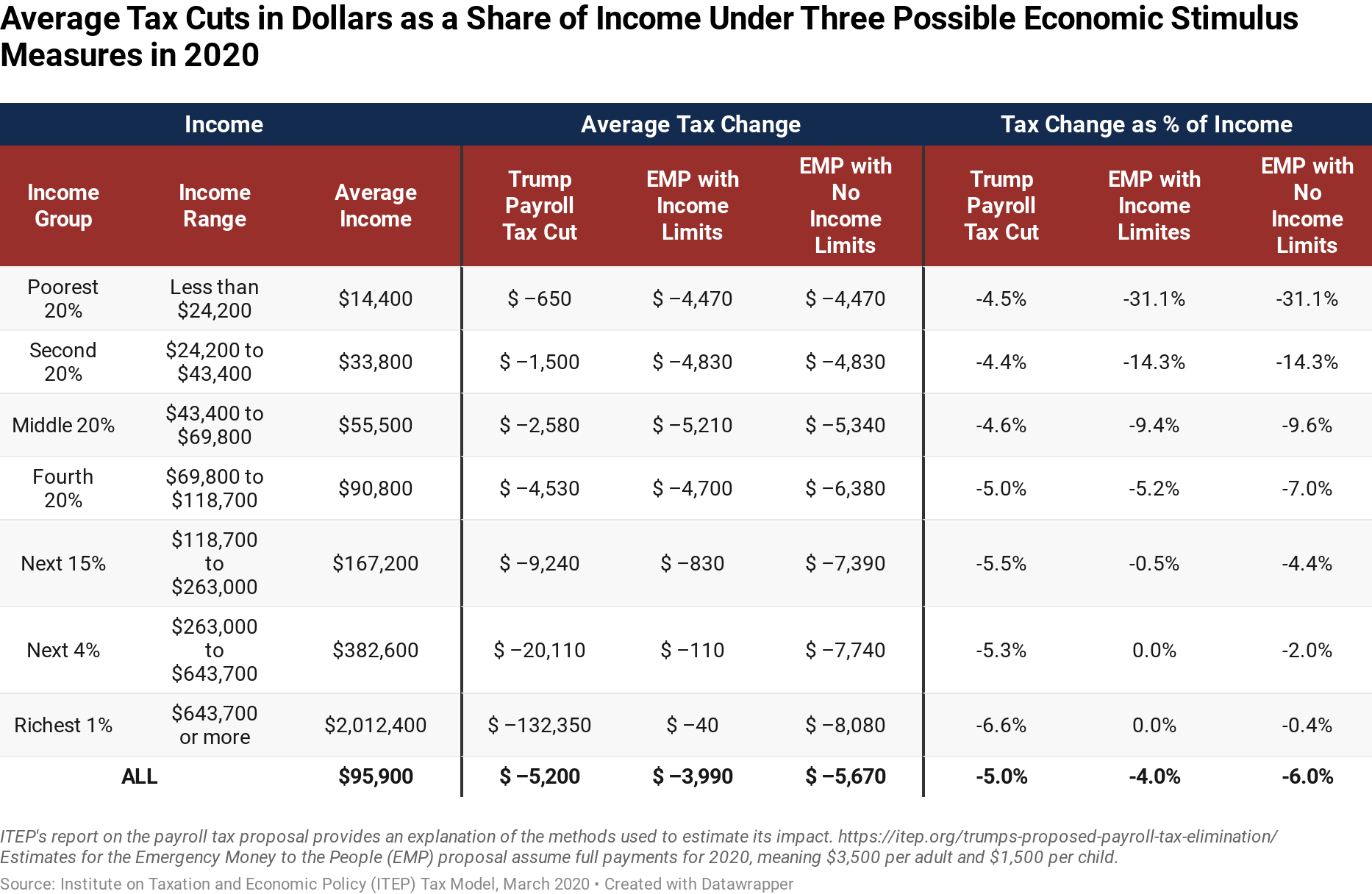

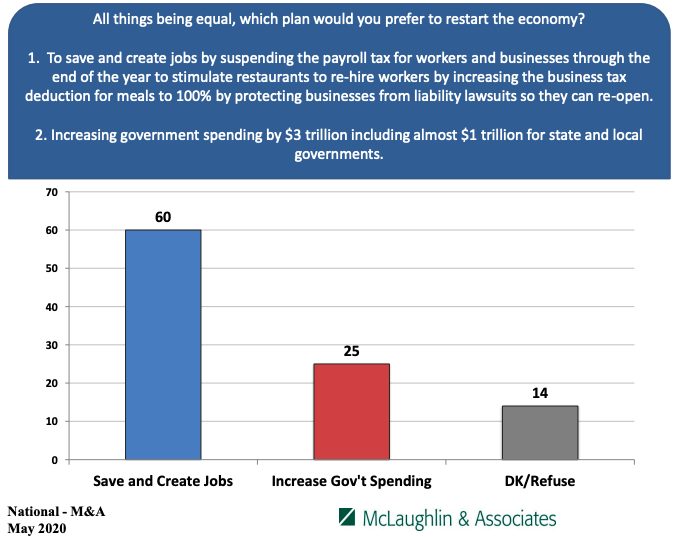

What is payroll tax cut proposal. Payroll tax cuts would also provide an incentive for employees to go back to work. Not many lawmakers have publicly backed trump s proposal for a payroll tax cut. Trump to fight coronavirus economic impact with payroll tax cut proposal and other programs individuals who work for themselves pay 12 4 percent toward social security and 2 9 percent for medicare.

As washington tries to figure out ways to mitigate the threats the coronavirus poses to the us economy president donald trump has said he might back a payroll tax cut for workers. President donald trump told lawmakers he wants a payroll tax cut at least through the election to give consumer spending a jolt as the coronavirus threatens to cripple growth. And speaker of the house rep.

For the bush administration s stimulus plan checks were sent to taxpayers. The question is is it the right time to do that gleckman said given the health risks the coronavirus poses. So what exactly is a payroll tax cut and how would it benefit americans.

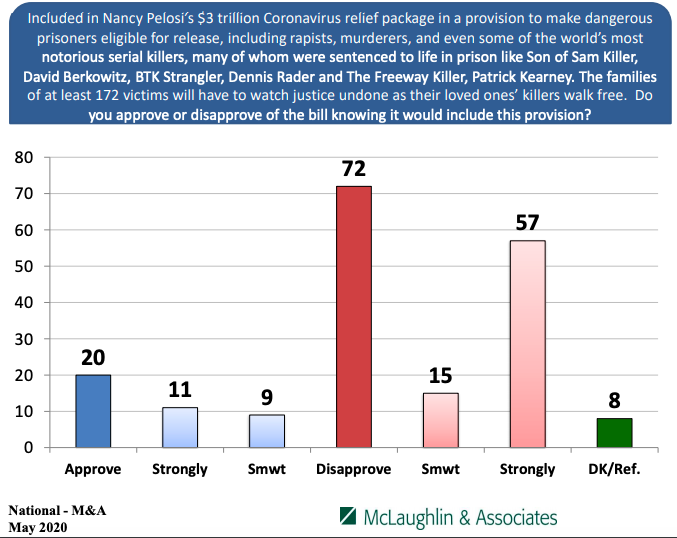

Nancy pelosi d calif speak to members of the press on august 7 2020. Payroll tax cut plan just a deferral won t achieve goal senate minority leader sen. In 2011 president barack obama cut payroll taxes by 2 which averaged around 1 000 extra per family that year.